Hello everyone,

The aim of this letter is to inform you about the current state of the cryptoasset market, but also about recent news in the field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Meta (formerly Facebook) recruits Microsoft and Apple employees to build its metaverse! The American giant doesn't hesitate to offer very attractive salaries to steal talent from the competition. Meta has not hesitated to double the salaries of certain strategic employees for the development of their new project. "Meta has hired around 100 Apple engineers in recent months"says Bloomberg. These American giants are vying for the IT skills of their engineers. The value of skills in this field is likely to rise sharply in the years ahead.

A hydroelectric plant in Costa Rica turns to Bitcoin (BTC) to keep running. There has been a production surplus in recent months, which has led the hydroelectric plant in question to close, due to a lack of demand from the state. Eduardo Kooper, the company's president, explains that he was " very skeptical "But the company is now profitable again thanks to this solution. As he points out, Bitcoin miners are looking for electricity " clean and inexpensive, with a stable Internet connection ". This type of agreement with power plants is likely to become more widespread.

Generally speaking, Bitcoin network miners tend to use more and more renewable energy simply because they need the cheapest electricity possible, and the cheapest electricity on the market necessarily comes from areas where it is in abundance and therefore close to hydroelectric dams like the one in Costa Rica.

The city of Rio de Janeiro in Brazil is to invest 1% of the treasury budget in cryptocurrencies. The city could also grant discounts for taxes paid in Bitcoin. Pedro Paulo, secretary of finance, explained at the event that Rio de Janeiro was studying the possibility accept BTC payments for property taxes. Residents opting for this means of payment will benefit from a discount. As we see more and more countries, cities and private companies turning to this new asset class, it's good news for the adoption of crypto-assets.

US banks join forces to create a stablecoin! (What is a stablecoin? Click here). At the center of all regulators' attention, this specific class of cryptocurrencies could be the sesame to mass adoption. Our money is already fully digitized in centralized files in our banks. In a context of increasing digitization of the economy and adoption of cryptocurrencies, stablecoin is an opportunity for major banks. Some of them have understood: the New York Community Bank (NYCB), the NBH Bankthe FirstBankthe Sterling National Bank and the Synovus Bank work together to develop USDF a new stablecoin backed by the US dollar.

American supermarket giant Walmart is getting into the metaverse too! At least, that's what seems to be emerging from trademarks that were quietly registered last month. Walmart is not alone. Since Facebook announced it was renaming itself Meta last October, major brands have rushed into this new sector. In December, Adidas sold 30,000 NFT of its collection " Into the Metaverse ". And competitor Nike had also shown an interest in the subject the same month. Disney also announced that he was working on his own virtual universeaccessible in its parks

Technical & Fundamental Analysis

To give you a better idea, here's the price of Bitcoin over the past two years in dollars.

The Bitcoin price at the time of writing is 42,800 $ (on 17/01/22).

The price correction has continued into the new year. This does not call into question the fundamental price growth and long-term bull market.

The BTC price has returned to test the support zone around 39 - 41 k $, and for the time being seems to be holding. This is an important zone, strongly defended by buyers. A rebound on this zone would be a good thing, but for the moment the price is not willing to go any lower.

For in-chain data (data captured by the analysis of BTC coin holders on the bitcoin blockchain), not much is happening. The market is currently floating

- Long-term cycle : Long-term holders continue to hold most coins, they are at maximum accumulation levels, they have also stopped their profit taking as the price must seem too low to them. Since the majority of bitcoin coins in circulation are held in the hands of long-term investors who only sell if the price rises sharply, but don't sell if the price falls, this still points to a bullish year for 2022.

- Medium-term cycle (3 months) : In terms of coin movements, the picture is very calm and neutral. The whales (big investors, institutions, private companies) sold off in October with a peak in December, this has eased now and we're slowly moving into a buying zone. The capital redeployment expected in January by the big institutions has not yet taken place.

- Short-term cycle (1 month): The selling trend is not over yet. Trading data indicate that both short- and long-term speculators have sold. We await the arrival of demand. Short-term chain signals show that the market is oversold relative to fundamental valuation.

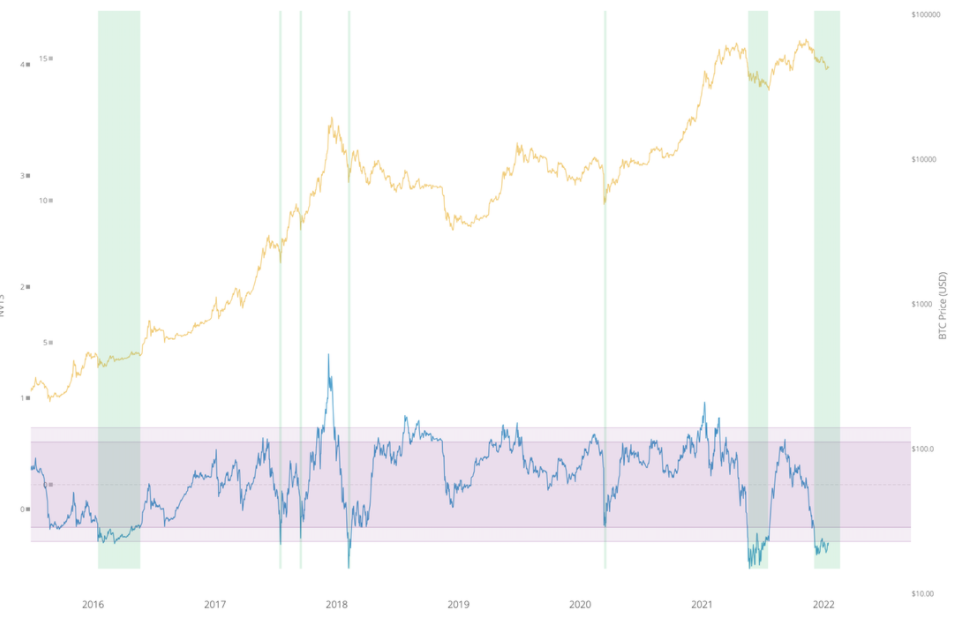

NVT Signal compares Bitcoin's market capitalization to the 90-day moving average of volume moved around the blockchain (in effect, investor activity). NVT is the closest equivalent to the PE ratio as seen in equities.

NVT Signal, which compares blockchain investment activity and Bitcoin valuation, continues to record the market as being in an oversold "buying zone". Structurally, we're in a zone similar to the 30,000 $ band seen between May and July 2021. It's really a waiting game before price discovery reacts.

A commentary on Ethereum (ETH) (the second largest crypto-asset) and Altcoins (all other crypto-assets apart from Bitcoin): ETH shows first signs of increasing blockchain demand. While BTC is trapped in a prolonged sideways regime, this is generally an area where Altcoins are operating and, indeed, they are starting to show strength. A mini Altcoin season is forming.

If you have any questions, comments or would like to find out more about our service, please do not hesitate to contact us: crypto.assets.manage@gmail.com

- Warning -

This is not investment advice. No one can predict the future.

You are solely responsible for your own investment decisions.

We are not responsible for any loss resulting from a decision taken on the basis of the information in this letter.