Hello everyone,

The aim of this letter is to inform you about the current state of the cryptoasset market, but also about recent news in the field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Visa promotes the adoption of crypto-assets by merchants and banks. The company has now launched its crypto-asset advisory services. These new services are dedicated to financial institutions, individuals and other businesses. With the launch of these advisory services, the company is not only issuing optimistic forecasts for crypto-assets, it is also contributing to its realization by helping other organizations take the decisive step towards crypto adoption.

Swiss bank BBVA adds Ether (ETH) to its cryptocurrency custody and trading service following strong demand from customers looking to diversify. The bank aims to further develop its digital asset portfolio in the coming months. From now on, it will offer its customers transactions in Bitcoin (BTC), but also in Ether (ETH). Banks are moving timidly towards digital assets, but those who make the right shift may well be tomorrow's winners.

Nike enters the metaverse with the acquisition of RTFKTa start-up specializing in the creation of virtual sneakers in the form of non-fungible tokens (NFT). These are unique digital tokens that cannot be copied. Why buy virtual sneakers, you may ask? Quite simply, to acquire an image and visibility in the metavers that are attracting more and more users. For example, big companies (like Nike) pay a lot of money for a few seconds of visibility on TF1, even though they're just 2-dimensional images of a pair of shoes.

The government of Zimbabwe is considering the adoption of cryptocurrencies as legal tender. El Salvador has given ideas to many other nations, particularly those hit by high inflation. Zimbabwe is one such country. In 2009, the country issued a 100,000 billion zimbabwe dollar bill which at the time represented 30 US dollars. This bill shows the limits of FIAT currencies (a fiat currency is a currency decreed by a State which entrusts its management to a Central Bank). Zimbabwe scrutinizes a Bitcoin that has been showing interest in recent months as a bulwark against inflation. It remains to be seen what conclusions the government will draw from this first phase of consultation.

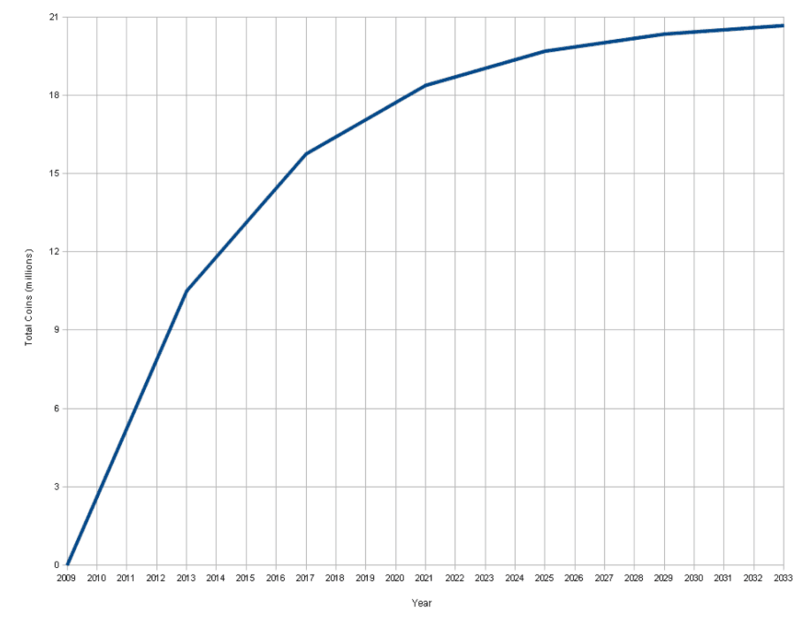

The milestone of 90 % bitcoins issued and in circulation was recently reached. If we refer to the data published by Blockchain.comAs you can see, more than 18.89 million bitcoins have been mined out of the 21 million that will eventually exist. Bitcoin, a bulwark against inflation? For its supporters, Bitcoin's main advantage is its limited supply. Unlike fiat currencies, no more can be produced.

Below is a graph showing the number of bitcoins issued by the network. 21 million is the maximum and cannot be modified.

Number of bitcoin issued by the network.

Technical & Fundamental Analysis

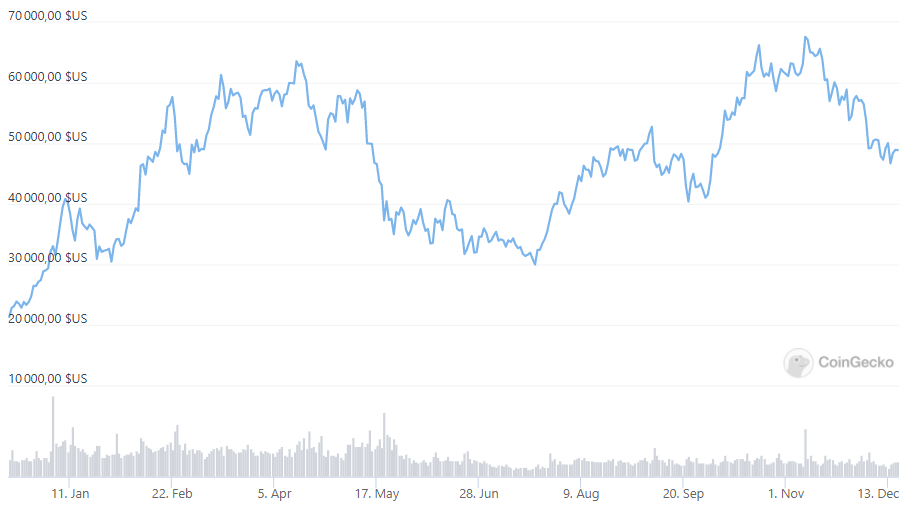

Bitcoin price over the past 1 year in dollars.

The Bitcoin price at the time of writing is 47,000 $ (12/15/21).

The price correction has intensified in recent days. This does not call into question the fundamental growth of the price and the long-term bull market. As you can see above, BTC has risen from 30,000 $ to 69,000 $ in 4 months, so it's only natural that the BTC price is looking to retest these new support zones at 43,000 $. This price correction pushes back our hopes of breaking through the 70,000 $ barrier by a few months, perhaps in the second quarter of 2022.

- Long-term cycle : Despite the recent fall in prices, there's no sign of a bear market. Structurally, we are still in a long-term bullish region. Long-term holders are still accumulating heavily in discounted BTC in recent weeks.

- Medium-term cycle : We expect prices to recover in the weeks of December, with consolidation lasting several weeks. We expect prices to return to previous highs in the first half of 2022.

- Short-term cycle : HODLers (very long-term holders of bitcoin) have risen. They've bought the decline of recent weeks. According to the Supply Shock valuation model on the bitcoin blockchain, BTC is currently trading at a discount of 6,000 $. We think we're close to a low point for this correction.

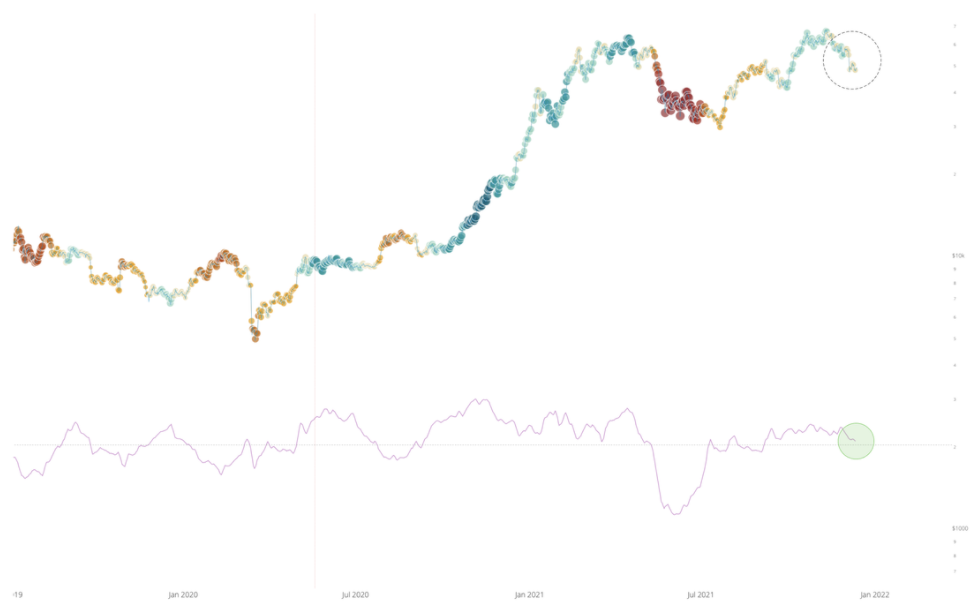

While the price has retreated from the highs of a month ago, the net flow of coins moving to HODLers, remains in the bullish region. The heat map below shows that it has softened over the past month, but there hasn't yet been enough selling to justify a deeper bearish phase. We're keeping a close eye on this zone, but so far there's no sign of a bear market. We remain bullish for the long term.

Long-term buy/sell map. Green = buy, red = sell.

We're still noticing that Ethereum's (ETH) fundamentals are getting stronger by the day. We believe that ETH could outperform BTC over the coming weeks, as it remains undervalued.

What's more, the long-term trend of BTC versus ETH indicates a higher upside potential for ETH.

If you have any questions, comments or would like to find out more about our service, please do not hesitate to contact us: crypto.assets.manage@gmail.com

- Warning -

This is not investment advice. No one can predict the future.

You are solely responsible for your own investment decisions.

We are not responsible for any loss resulting from a decision taken on the basis of the information in this letter.