The aim of this letter on : Bitcoin the purest liquidity barometer? is to inform you about the current state of the crypto-asset market, as well as recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Bitcoin exceeds $80,000 for the first time in history. What could stop Bitcoin? With Donald Trump recently re-elected President of the United States, the BTC price is breaking records daily, crushing its previous historic ATH. Today (10/11/24), Bitcoin even surpassed the historic $80,000 threshold.

-

MicroStrategy goes ahead and buys over $2 billion worth of Bitcoins (BTC). In line with the business strategy it has been following for several years now, MicroStrategy continues to acquire a large number of Bitcoins (BTC), making the company headed by Michael Saylor the one with the largest BTC reserves in the world.

-

BlackRock's Bitcoin ETF surpasses the gold ETF launched in 2005. Thanks to significant inflows this week, the amount of assets under management in BlackRock's Bitcoin ETF has surpassed that of the gold ETF. Let's take a look at the amounts involved.

-

Donald Trump's victory: what can we expect for the crypto ecosystem? It's now certain: Donald Trump will be inaugurated as the 47th President of the United States on January 20. For the crypto ecosystem, this news is a sign of many changes to come. Let's take a look at how the cryptocurrency market could evolve over the next few years.

-

J.P. Morgan to offer instant dollar-to-euro conversion using blockchain. Thanks to its private blockchain and native token, US bank J.P Morgan will soon be enabling its institutional customers to perform currency conversions between euros and dollars instantly.

Fundamental Analysis

Source : https://www.coingecko.com/fr

Letter N°43: Bitcoin the purest liquidity barometer? Fat apps and fee switches

The Bitcoin price at the time of writing is 93,500 $ (11/20/24).

Bitcoin, the purest liquidity barometer?

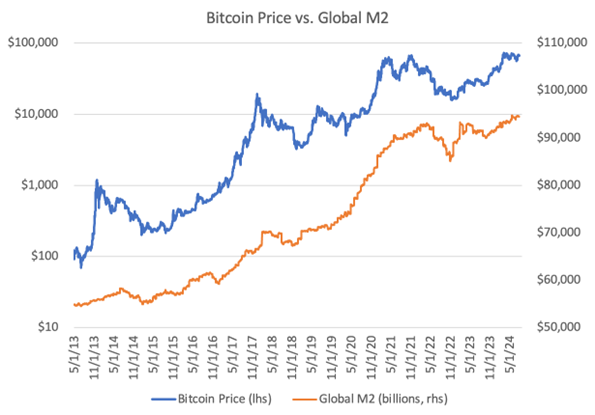

Over the years, Bitcoin is one of the assets that has shown a strong correlation with global liquidity. When global liquidity increases, Bitcoin tends to prosper. Conversely, when liquidity contracts, Bitcoin tends to suffer.

There are many ways to measure global liquidity, but for this letter we'll use global M2, a broad measure of the money supply that includes physical money, current accounts, savings deposits, money market securities and other forms of readily available cash.

The correlation is striking: the price of Bitcoin is heavily influenced by global liquidity and therefore by the policies of central banks. Here are the two curves below:

Similarly, comparing year-on-year percentage changes in Bitcoin and global liquidity also highlights how the two seem to move in tandem, with the Bitcoin price increasing when liquidity increases and decreasing when liquidity decreases.

In general, risky assets are closely linked to liquidity conditions. When liquidity is abundant, investors tend to seek higher returns by moving into assets perceived as riskier. Conversely, when liquidity is tight, they prefer to turn to what they perceive as safer investments. This is why equities often perform well in times of increasing liquidity.

At this stage of its adoption cycle, Bitcoin is still mainly perceived as a risky asset by the majority of institutional investors. As such, it potentially presents the most direct correlation with global liquidity, unlike safe-haven assets such as gold or bonds.

Bitcoin also has a high overall correlation and the highest correlation with M2 liquidity over rolling 12-month periods compared with other asset classes. It also stands out for its directional alignment with global liquidity. Although its high volatility can sometimes cause short-term deviations from liquidity indicators such as global M2, analysis of directional consistency reveals a reliable relationship over the long term.

Indeed, Bitcoin follows the global liquidity trend in 83 % of 12-month periods and 74 % of 6-month periods, indicating a strong directional correlation to other assets. This reinforces its predictability in the face of changing liquidity conditions.

Source : Ycharts

Bitcoin is a useful macroeconomic indicator for investors due to its high correlation with global liquidity, more consistent than that of other assets such as stocks, gold or bonds.

The "Fat App" thesis

Uniswap launches Unichain, a dedicated Layer 2 blockchain, consolidating the "Fat App" thesis where major applications verticalize their technology stack to capture more economic value. This move enables Uniswap to transform its UNI token into a direct value-generating asset via staking for validators.

Unichain could lead to a migration of DeFi liquidity from the Ethereum core network, while maintaining links with it via UNI staking on Ethereum. This model highlights a new dynamic for applications able to control their own block space, maximizing their economic influence. The trend towards dedicated application chains is gaining ground in the cryptosphere, illustrating a re-evaluation of the economic structures between applications and underlying blockchains.

Uniswap could initiate a trend where large applications create their own Layer 2s to increase the value capture of their tokens across the entire value chain. Other projects have incorporated this possibility into their long-term roadmap, notably AAVE, but also SKY (formerly MakerDAO).

Fees Switch activation

Digital tokens are redefining the mechanisms of value creation and accumulation, becoming an alternative to traditional equity. Several protocols are implementing innovative proposals to enhance the value of their tokens, often via mechanisms such as staking, redemptions, or revenue redistribution. Here's an overview of recent major initiatives:

- Uniswap UNI: revenue-sharing with UNI holders via a staking mechanism linked to governance. The aim is to use trading fees to reward active participants. Proposal under discussion.

- Compound Staking for COMP holders, with rewards from borrowing costs and improved governance through weighted voting based on shareholdings. Proposal under discussion.

- Aave AAVE: Proposes an update to redistribute revenues from lending and borrowing activities to AAVE stakers and strengthen protocol security via a security module. Proposal under review.

- Arbitrum DeFi: Provides for ARB staking with potential rewards from fees generated by sequencing and MEV, as well as a liquid token (stARB) that can be used in DeFi. Proposal under discussion.

- Gnosis GNO: Launched a $30 million buyback program to reduce GNO's offering and increase its value. Proposal adopted, program underway.

These strategies aim to align the interests of token holders with those of the protocols, while strengthening the commitment and economic sustainability of DeFi ecosystems.

Only protocols that have reached a certain maturity and break-even point can activate this new revenue redistribution model. It's much easier to calculate the value and projected value of application-backed tokens than that of tokens in Level 1 (L1) blockchains.

Our service

At Crypto Assets Management, we offer discretionary management of digital asset portfolios, customized to your profile. Our strategy is based on analysis and management of Bitcoin cycles (historically 4 years)with a focus on long termmonthly arbitrages, and with a particular focus on tokenomics.

Discover our website: https://crypto-assets-management.com/

Discovery Pack

Investment of less than €20,000

- Entry fee: 1.5 %

- Management fee: 2.5 % / year

- Performance fees: 20 % excl. tax on capital gains (High Water Mark method)

- Exit fee: 3 %

- Minimum subscription: €5,000

- Commitment period : None

Premium Pack

Investment over €20,000

- Entry fee: 1.5 %

- Management fee: 2.5 % / year

- Performance fees: 20 % of performance above the benchmark index*.

- Exit fee: 1.5 if withdrawn before 3 years

- Minimum subscription: €20,000

- Commitment period : None

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of the information in this letter.