The aim of this letter on a potential two-phase bull market? is to inform you about the current state of the crypto-asset market, as well as recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Goldman Sachs acquires $420 million in Bitcoin spot ETFs. Goldman Sachs has taken a major step towards Bitcoin adoption by investing $420 million in Bitcoin spot ETFs. This initiative shows that Bitcoin continues to gain ground, even within the most established financial institutions, reinforcing its widespread adoption.

-

Coinbase prepares to launch a competitor to Wrapped Bitcoin (WBTC) - What's at stake with such a token? While BitGo struggles to maintain Wrapped Bitcoin (WBTC), Coinbase is preparing to launch a competitor, cbBTC. This move could reinforce Coinbase's dominance in the Bitcoin ecosystem, raising concerns about market balance.

-

BlackRock now owns more cryptocurrencies than Grayscale. BlackRock surpasses Grayscale in terms of cryptocurrency holdings, becoming the largest asset manager in the sector. Marking a turning point in the cryptocurrency investment landscape, consolidating BlackRock's dominant position in global markets.

-

Paying in USDC via the iPhone: soon a reality? Under heavy pressure from European Union regulators, Apple had no choice but to allow third-party players to exploit tap-to-pay. Circle, the company behind USDC, will enable iPhone users to use this technology to make purchases with its stablecoin.

-

Swiss and Norwegian central banks reportedly hold 3,400 Bitcoins via MicroStrategy shares. MicroStrategy's Q2 2024 results reveal that the Swiss and Norwegian central banks have purchased MSTR shares, gaining indirect exposure to Bitcoin. Could this move signal a strategic shift towards crypto-currencies, or is it simply a traditional investment strategy?

Fundamental Analysis

Source : https://www.coingecko.com/fr

Letter N°40: A bull market in two phases?; Political pivot on crypto in the US.

The Bitcoin price at the time of writing is 64,539 $ (on 20/08/24).

A two-phase bull market?

The realized profit/loss ratio for long-term holders is an indicator we can use to analyze the cyclical behavior of this cohort. Although this measure is down significantly from its peak, it still remains at a high level. This suggests that long-term investors are slowing down their profit-taking.

Interestingly, at the all-time high (ATH) in March 2024, this measure reached a level comparable to previous market peaks. During the 2013 and 2021 cycles, the measure had fallen to similar levels before rising again, leading to a two-phase bull market. However, in 2017-2018, this decline persisted against the backdrop of a bear market, marked by dominant losses.

The question is whether we are currently in a cycle similar to those of 2013 and 2021, i.e. a two-phase bull market, or rather to that of 2017-2018, a one-phase market. Given the buying strength of long-term holders and the fact that prices have not significantly exceeded the highs of the previous cycle, it seems more likely that we are in a two-phase cycle, like those of 2013 and 2021.

Source: Glassnode

On the chart below, we can see the bull market in two phases from 2021, with two distinct «waves» in red on the far left. For the current cycle, a first «wave» has been completed, and we are now at an equilibrium point. The market will have to choose between a sharp decline, resulting in a bear market similar to that of 2017-2018, or a second bullish wave, as in the previous cycle. Personally, I'm leaning towards the second bullish option.

The political pivot on crypto in the US

In the space of a few weeks, a major political pivot on crypto has taken place in the United States. Two of the three presidential candidates, as well as several senators and members of the House of Representatives, have expressed their support for the crypto ecosystem. This sudden change means that the United States has regained the upper hand in this new technology, with the ambition of dominating this ecosystem in the future.

In a speech at a major Bitcoin event in Nashville, USA, presidential candidate Donald Trump outlined a dozen key points about Bitcoin:

1. Bitcoin is a «marvel of technology»

2 . Bitcoin could overtake gold

3. Trump's «America First» approach

4. Make America the world leader in cryptography

5. Crypto-friendly policies and the end of «Operation Choke Point 2.0»

6. A new Presidential Advisory Council on Cryptography

7. Regulatory clarity for Stablecoins

8. Bitcoin is no threat to the US dollar

These key points show that the subject of crypto is now unavoidable for politicians. It's more advantageous for them to support this ecosystem rather than oppose it, given the large number of people using this technology.

A return to HODLing

In recent months, a certain uncertainty and indecision has been perceptible among investors in digital assets. However, by examining investors' response to these unstable market conditions, a trend towards HODLing seems to be emerging.

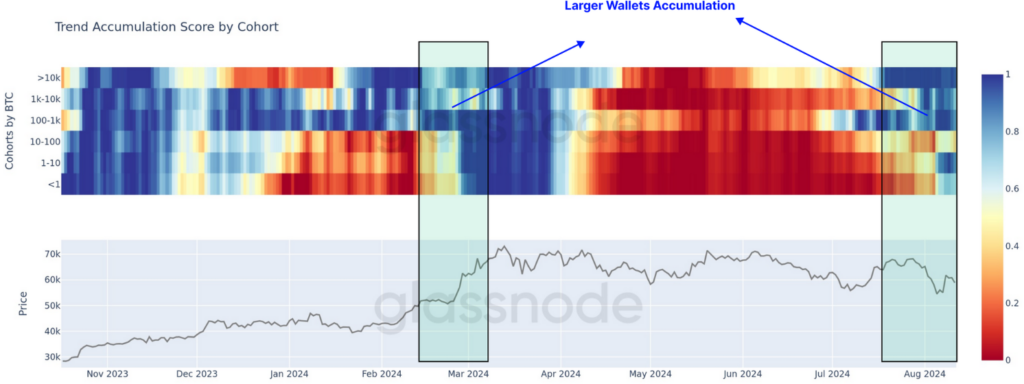

Since Bitcoin's ATH was established in March, the market has gone through a long period of distribution, involving portfolios of all sizes. In recent weeks, we've seen the first signs of a reversal in this trend, particularly among the largest portfolios, often associated with ETFs. These large portfolios now seem to be adopting an accumulation strategy.

This probably suggests that we are in a two-phase bullish cycle, as this type of behavior is not typical of a single-phase cycle.

Our service

We offer a portfolio management service specializing in digital assets. We provide complete human support from A to Z in this universe. Our aim is to personalize your portfolio allocation according to your risk profile and situation.

With our turnkey management, you can take advantage of the sector's evolution without worrying about: the choice of digital assets, in-depth research, volatility, arbitrages and so on. Simply consult your monthly reports and invest regularly over the long term (4 years or more).

We don't engage in algorithmic trading on a daily basis. We only favor long-term investments in projects we know and understand. Our monthly portfolio arbitrages are accompanied by in-depth asset analysis, with a particular focus on tokenomics.

Discover our website: https://crypto-assets-management.com/

If you have any questions, or would like to find out more about our services, please do not hesitate to contact us: tristan.g@crypto-assets-management.com. You can also schedule a phone call lasting a few minutes by following these steps this link.

Discovery Pack

Investment of less than €20,000

- Entry fee: 1.5 %

- Management fee: 2.5 % / year

- Performance fees: 20 % excl. tax on capital gains (High Water Mark method)

- Exit fee: 3 %

- Minimum subscription: €5,000

- Commitment period : None

Premium Pack

Investment over €20,000

- Entry fee: 1.5 %

- Management fee: 2.5 % / year

- Performance fees: 20 % of performance above the benchmark index*.

- Exit fee: 1.5 if withdrawn before 3 years

- Minimum subscription: €20,000

- Commitment period : None

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of information provided by a third party.ions in this letter.