Hello everyone,

The aim of this letter is to inform you about the current situation of the crypto-asset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

ETF Bitcoin spot: State of Wisconsin buys $164 million worth. The State of Wisconsin Investment Board (SWIB) has invested around $164 million in Bitcoin spot ETFs, including BlackRock's iShares Bitcoin Trust (IBIT) and Grayscale's GBTC. A positive sign that could encourage other major institutions to follow suit?

-

CME Group plans to compete with Coinbase and Binance by launching a Bitcoin spot market. The CME Group, the world's largest stock exchange, is planning to integrate Bitcoin spot trading, according to a report in the Financial Times. This initiative could transform traditional investors' access to BTC and compete with the major exchange platforms.

-

RWA tokenization: Chainlink and DTCC unveil a pilot project to be tested by major banks. Chainlink (LINK) and the Depository Trust & Clearing Corporation (DTCC) have unveiled a new pilot system called Smart NAV. Tested by major financial players such as BNY Mellon, Franklin Templeton and JP Morgan, what does it involve?

-

JPMorgan: America's No. 1 bank now invests in Bitcoin ETFs (BTC). JPMorgan, America's largest bank, recently unveiled its exposure to Bitcoin spot ETFs, financial products that track the price of Bitcoin. This news caused quite a stir in the cryptocurrency world, raising questions about the growing involvement of traditional financial institutions in this sector.

-

MakerDAO unveils PureDai, a new fully decentralized stablecoin. MakerDAO, the organization behind the DAI stablecoin, is reportedly developing PureDai, another fully decentralized stablecoin. Why is this?

-

Ethereum (ETH): Vitalik Buterin presents the EIP-7702 - Why is this a major breakthrough?. In a bid to effectively develop account abstraction on Ethereum (ETH), Vitalik Buterin has introduced EIP-7702. What new features would this proposal introduce?

Fundamental Analysis

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 66,315 $ (on 16/05/24).

The Halving Clock:

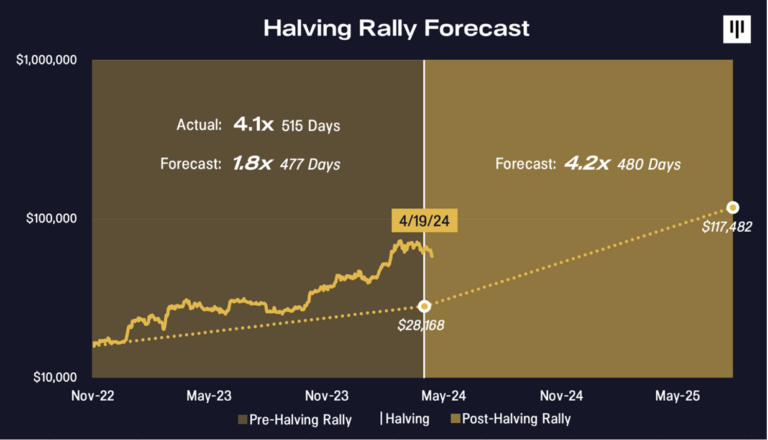

By analyzing the impact of halvings and the stock-to-flow ratio, investment fund Pantera Capital anticipates a maximum Bitcoin price of around 117,000 $ in mid-2025 for this bull cycle. We agree with their hypothesis.

It's a complex exercise, and one that many analysts, investors and investment funds engage in. Of course, this should not be taken for granted, as no one can predict the future. However, studying theoretical objectives can help us to better understand a cycle.

Source : Pantera Capital

Bitcoin even surpassed their expectations, thanks in particular to the acceptance of Bitcoin cash ETFs in the United States at the beginning of 2024. This was a huge success. Since then, Bitcoin has outperformed most other cryptos.

Source: Pantera Capital.

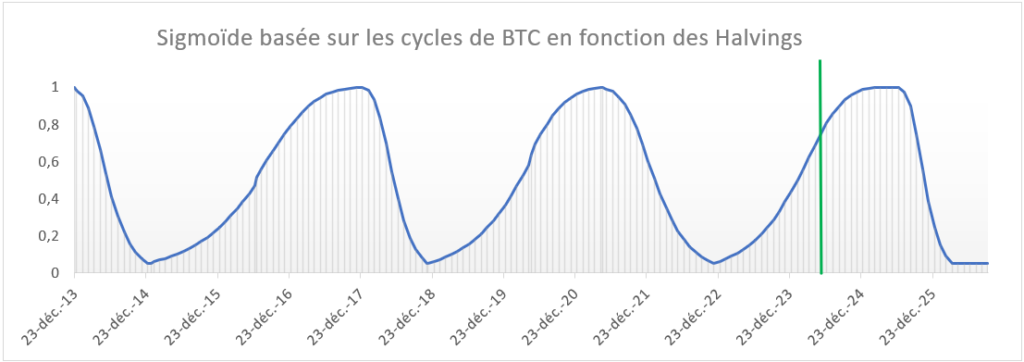

It's interesting to make price projections, but it's just as relevant to estimate time ranges. Sometimes, we can identify the best selling periods using a «countdown» based on previous historical cycles.

Below is one of our internal indicators, which we call the «Halving Clock»:

This indicator, based solely on a countdown of previous cycles, has worked very well so far. When it approaches 0, it indicates that we are approaching the lowest point of the cycle, and conversely, when it approaches 1, it indicates that we are approaching the highest point of the cycle.

This indicator does not take into account Bitcoin's current price. It only takes into account the average duration of previous cycles. It anticipates a high point between April and July 2025, without forecasting a price.

Are spot Ethereum ETFs (ETHs) potentially accepted?

As this letter was being written, an important piece of news came to light: a potential turnaround in the SEC's approval of cash ETFs.

The probability of acceptance of spot Ethereum ETFs is rising sharply.

This is according to two well-known ETF analysts at Bloomberg, even though the SEC was expected to reject the applications.

«James Seyffart and I are increasing our chances of approval of the Ether spot ETF to 75% (up from 25% initially), after hearing rumors this afternoon that the SEC may do a 180° turn on this (increasingly political) issue, which has everyone rushing in now (like us, everyone had assumed they would be denied).»

Eric Balchunas, Senior Analyst ETF, Bloomberg

So, it's likely that new applications for spot Ether ETFs will be filed in the next few days. Here is the current list of the various entities that have applied for spot Ethereum ETFs:

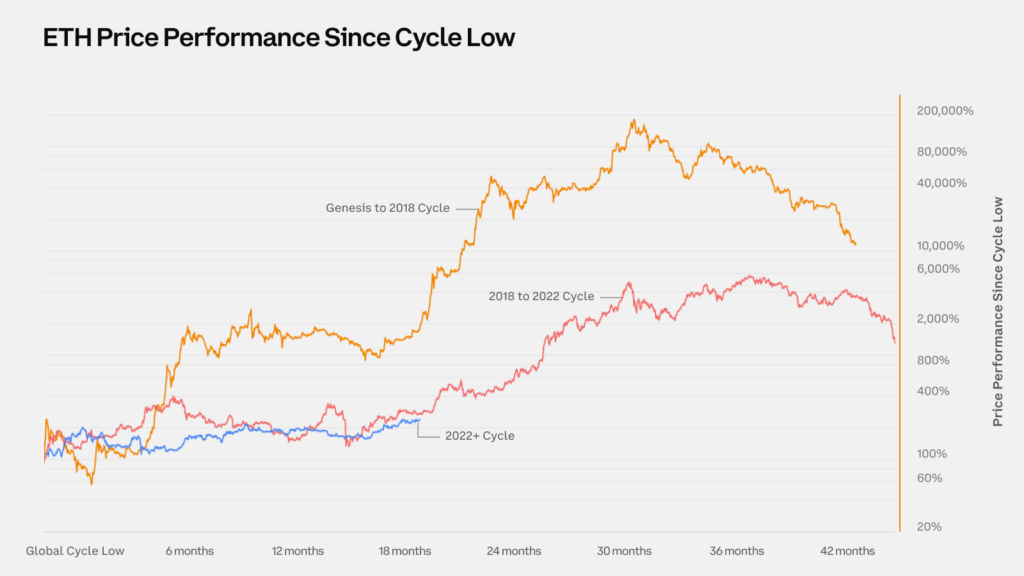

Before this information was announced, we were writing an article on Ethereum (ETH), whose performance is currently lagging behind that of BTC and its own previous cycles. We think there's plenty of scope for catching up. ETH tends to perform better in the second half of cycles, as is often the case for the Altcoin market as a whole.

The potential acceptance of a spot ETF for ETH could also boost this dynamic.

Source: Glassnode

Our service

We offer a portfolio management service specialized in digital assets. We provide complete human support from A to Z in this universe, customizing your portfolio allocation according to your risk profile and situation.

With our turnkey management approach, you can take advantage of industry developments without worrying about digital asset selection, in-depth token research, volatility, arbitrage and more. Simply consult your monthly reports and invest regularly, taking a long-term perspective (4 years and more).

We don't engage in algorithmic trading on a day-to-day basis, preferring only long-term investments in projects we know and understand. Our monthly portfolio arbitrages are accompanied by in-depth asset analysis, with a particular focus on tokenomics.

Discover our website: https://crypto-assets-management.com/

If you have any questions, comments or would like to find out more about our services, please contact us by e-mail at tristan.g@crypto-assets-management.com or schedule a phone call lasting a few minutes by following this link.

Discovery Pack

Investment of less than €20,000

- No entry fees

- Management fee: 2 % / year

- Performance fees: 20 % excl. tax on capital gains (High Water Mark method)

- Exit fee: 3 %

- Minimum subscription: €5,000

- Commitment period : None

Premium Pack

Investment over €20,000

- No entry fees

- Management fee: 2 % / year

- Performance fees: 20 % of performance above the benchmark index*.

- Exit fees: None

- Minimum subscription: €20,000

- Commitment period : None

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of information provided by a third party.ions in this letter.