Hello everyone,

The aim of this letter is to inform you about the current situation of the crypto-asset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Hong Kong: Bitcoin (BTC) and Ethereum (ETH) spot ETFs approved. On Monday, Hong Kong's Securities and Futures Commission gave the go-ahead for the listing of several spot ETFs based on Bitcoin (BTC) and Ethereum (ETH).

-

Germany's largest federal bank launches cryptocurrency custody service. Landesbank Baden-Württemberg (LBBW), Germany's largest federal bank, has announced the launch of a new cryptocurrency custody service. Offered in collaboration with Bitpanda, it will reach out to corporate customers.

-

Pectra and EIP 3074: the update that will change the way we use Ethereum is confirmed. EIP 3074 has been confirmed for the next Ethereum update, called Pectra. This proposal will enable Ethereum addresses to take on certain functionalities hitherto reserved for smart contracts, with a view to making life easier for users of wallets such as MetaMask.

-

BlackRock: its tokenized fund is now tradable in USDC. Circle, the issuer of the stablecoin USDC, recently announced a new feature enabling holders of BUIDL, the fund tokenized by BlackRock, to exchange their tokens for USDC at any time via a new smart contract. This initiative once again highlights how traditional financial players, such as BlackRock, are integrating with distributed network applications like Ethereum.

-

ETF Bitcoin spot: trading volume soars to $200 billion. The cumulative volume of Bitcoin spot ETFs has passed the $200 billion mark less than 3 months after their approval by the Securities and Exchange Commission (SEC). Does this growth demonstrate growing investor interest in this new asset class?

-

Layer 2: capitalization could reach $1 trillion by 2030, according to VanEck. VanEck, the asset manager, recently published an in-depth report on Ethereum layers 2, predicting a valuation of $1 trillion in capitalization by 2030. The document also sets out various key data for an in-depth understanding of the market and its outlook.

Fundamental Analysis

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 61,183 $ (on 18/04/24).

Halfway through the bull market

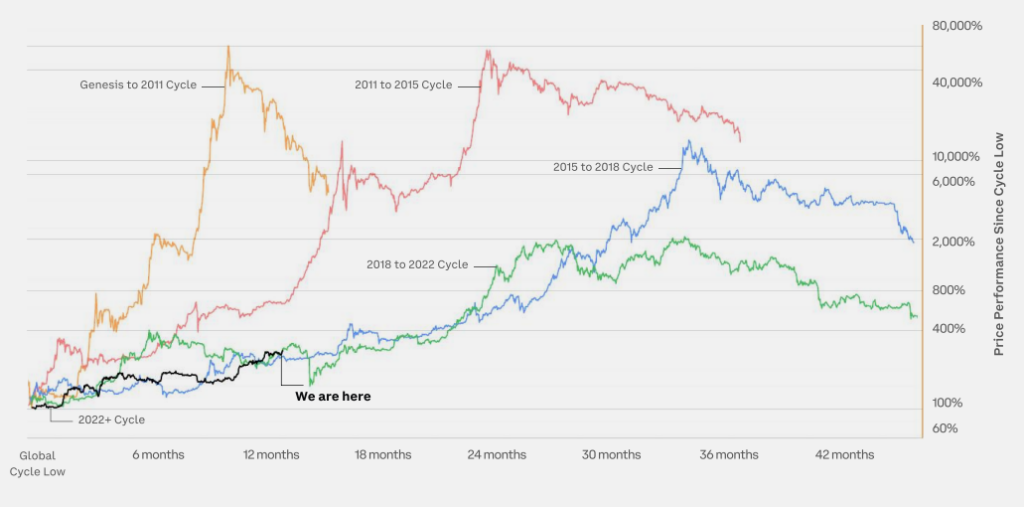

The diagram below illustrates how far we've already come in this bull market, signalling that we're about halfway through the cycle. Historically, towards the end of the cycle, performance and prices tend to rise exponentially, or at least at a faster pace than at the beginning of the cycle.

A look at the last two cycles, 2015-18 and 2018-22, shows a similarity: there's none of the euphoric surge seen in 2018. I think this cycle will do the same, while being relatively more moderate than previous cycles.

Although we can anticipate an acceleration towards the end of the cycle, it should be more moderate and less euphoric, partly due to the influence of institutional investors, notably via ETFs, which could dampen excessive euphoria.

Source: Glassnode

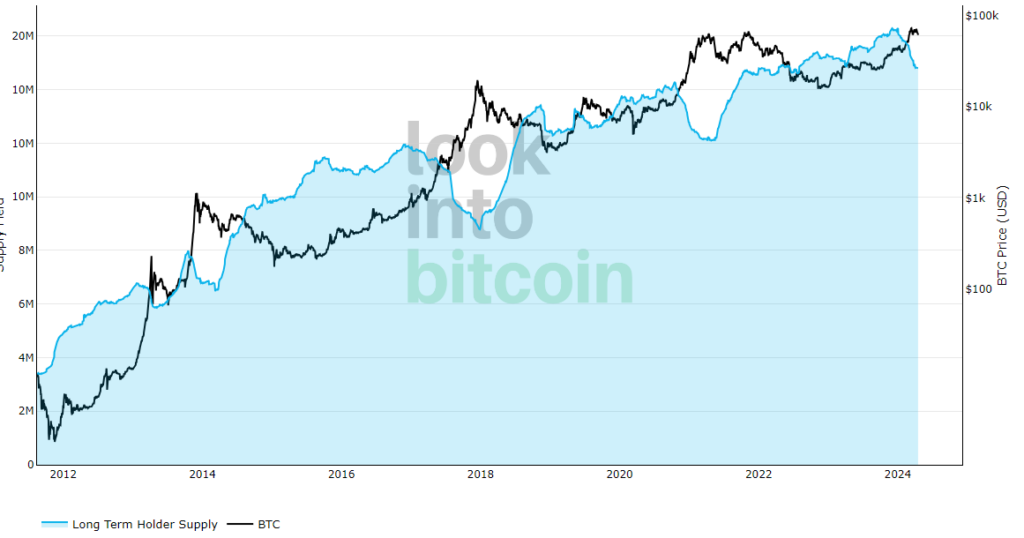

As I mentioned in my previous letter, the transfer of wealth from long-term to short-term holders has begun and is currently at the halfway point of this cycle.

This evolution can be seen in the troughs observed on the blue curve below. Historically, market peaks coincide with the peak of the troughs on this blue curve, which represents the quantity of tokens held by long-term investors.

At the same time, we can also understand the strong correlation between the Bitcoin price and the number of these long-term token holders, which has been steadily increasing since Bitcoin's inception.

Source : Look Into Bitcoin

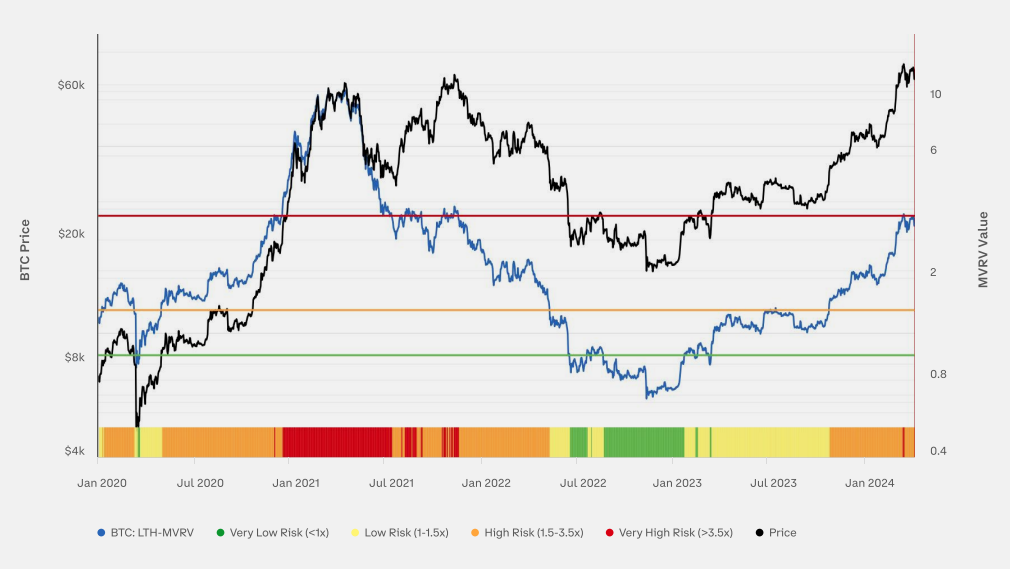

Another interesting indicator is MVRV, which represents the ratio between market value (MV) and realized value (RV), thus expressing the relationship between the current price and the realized price of assets.

Realized value is the average price at which each coin was last traded on the blockchain. MVRV can be seen as a measure of the «unrealized or latent profit» contained in the circulating supply.

As illustrated below (blue line), this ratio is currently around 3 to 3.5. During the last bull market, this ratio peaked at 10 before reversing. We're probably halfway through the current cycle, and it's possible that this ratio could go as high as 5 to 6.

Source: Glassnode

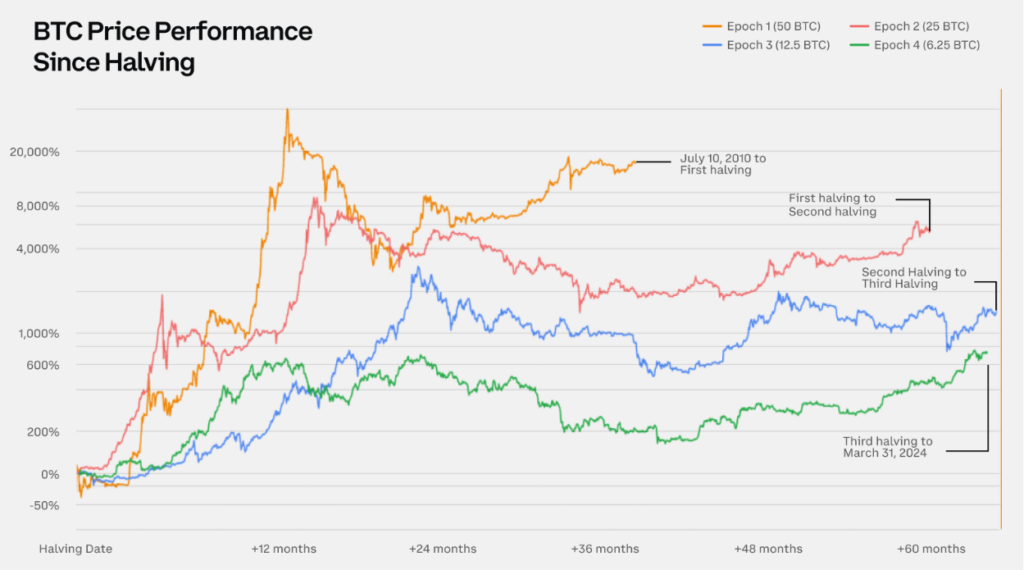

BTC's performance after the Halving

After each halving, over the following 12 months, BTC performance was high. As a reminder, halving occurs every 210,000 blocks on the Bitcoin blockchain (approximately every four years). It simply halves the production of new bitcoins with each new block (every 10 minutes).

Between 2009 and 2012: 50 new BTC per block

Between 2012 and 2016: 25 new BTC per block

Between 2016 and 2020: 12.5 new BTC per block

Between 2020 and 2024: 6.25 new BTC per block

Then, from 2024 to 2028: 3.125 new BTC per block

Etc, ............

This phenomenon will continue until 2140

Halving reinforces Bitcoin's scarcity, which, combined with the classic law of supply and demand, where falling supply meets rising demand, can have a significant impact on Bitcoin's value. Bitcoin's performance history shows that periods of halving have often been followed by substantial price rises.

Source: Glassnode

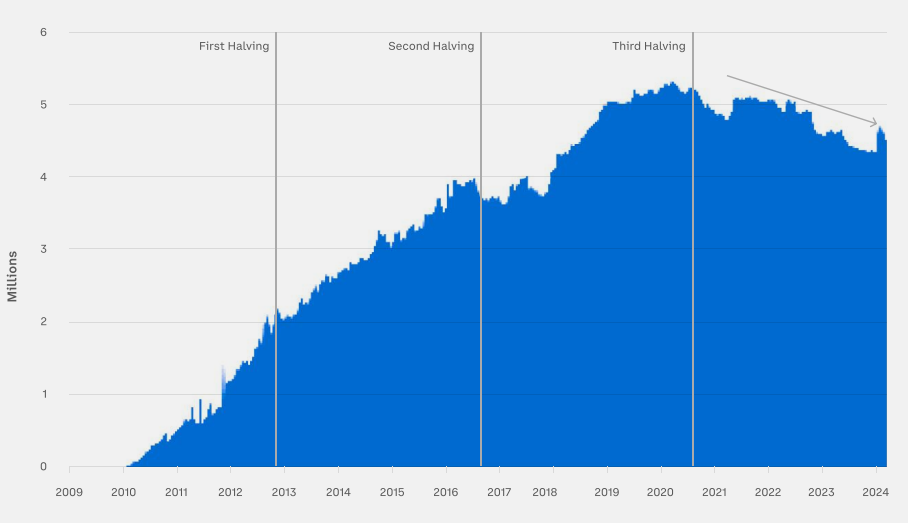

Available BTC for Trading

To assess the supply of BTC available for trading, Glassnode has calculated the current circulating supply of 19.68 million BTC and subtracted the illiquid supply, comprising Bitcoins largely unavailable for trading due to lost wallets, very long-term holdings or locks for various reasons. For this reason, we can call this chart: BTC available for trading.

One difference between this cycle and previous ones is the reduction in the amount of BTC available for short-term trading. This suggests, once again, that there is less and less BTC available on the market for new buyers.

Source: Glassnode

Our service

We offer a portfolio management service specialized in digital assets. We provide complete human support from A to Z in this universe, customizing your portfolio allocation according to your risk profile and situation.

With our turnkey management approach, you can take advantage of industry developments without worrying about digital asset selection, in-depth token research, volatility, arbitrage and more. Simply consult your monthly reports and invest regularly, taking a long-term perspective (4 years and more).

We don't engage in algorithmic trading on a day-to-day basis, preferring only long-term investments in projects we know and understand. Our monthly portfolio arbitrages are accompanied by in-depth asset analysis, with a particular focus on tokenomics.

Discover our website: https://crypto-assets-management.com/

If you have any questions, comments or would like to find out more about our services, please contact us by e-mail at tristan.g@crypto-assets-management.com or schedule a phone call lasting a few minutes by following this link.

Discovery Pack

Investment of less than €20,000

- No entry fees

- Management fee: 2 % / year

- Performance fees: 20 % excl. tax on capital gains (High Water Mark method)

- Exit fee: 3 %

- Minimum subscription: €5,000

- Commitment period : None

Premium Pack

Investment over €20,000

- No entry fees

- Management fee: 2 % / year

- Performance fees: 20 % of performance above the benchmark index*.

- Exit fees: None

- Minimum subscription: €20,000

- Commitment period : None

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of information provided by a third party.ions in this letter.