Hello everyone,

The aim of this letter is to inform you about the current situation of the crypto-asset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Bitcoin's capitalization now exceeds $1,000 billion. Bitcoin has crossed a symbolic threshold: its market capitalization now exceeds $1,000 billion. This makes it the 10th most capitalized asset in the world.

-

25 % Ethers are now stored on the Ethereum blockchain - A figure that continues to rise. The Ethereum blockchain reaches a significant milestone with 25% of Ethers in circulation, or 30 million ETH, now placed in staking.

-

MicroStrategy now holds $9.5 billion worth of Bitcoin (BTC) . While the Bitcoin price confirms its upward trend, topping the $50,000 mark, MicroStrategy's latent profit on BTC continues to grow. It now stands at $3.5 billion.

-

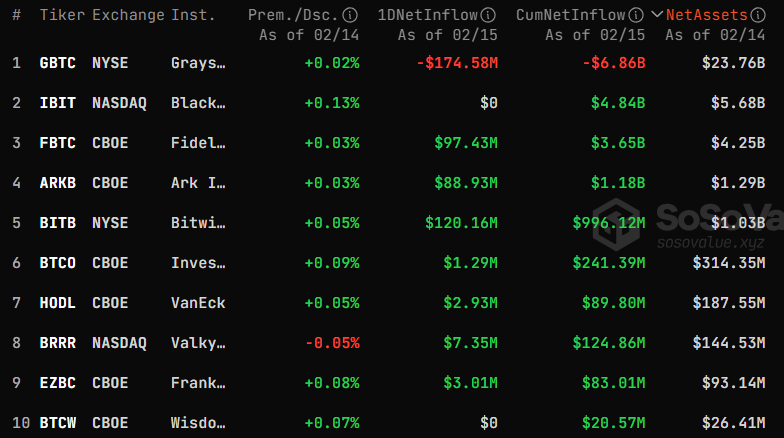

Bitcoin spot ETFs: they now hold 3.5 % of BTC in circulation. Over $32 billion worth of BTC is currently held in Bitcoin spot ETFs in the U.S., representing 3.48 % of the total BTC supply. Despite a reduction in outflows on Grayscale's GBTC, other ETFs continue to gain in popularity, with increasingly consistent positive net flows. Meanwhile, BlackRock and Fidelity continue to stand out from their competitors.

-

Dencun: official date for Ethereum (ETH) update now known. Now that Dencun has been successfully deployed on the various Ethereum (ETH) testnets, the mainnet update is the next big step. Expected on March 13, it will, among other things, activate the famous Proto-Danksharding and its data blobs.

-

Ethereum: Franklin Templeton applies for an ETH spot ETF. After seeing its Bitcoin spot ETF approved by the SEC last month, the asset manager has this time applied for ETH. The fund is also expected to generate additional revenues from Ethereum staking.

Fundamental Analysis

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 52,663 $ (on 15/01/24).

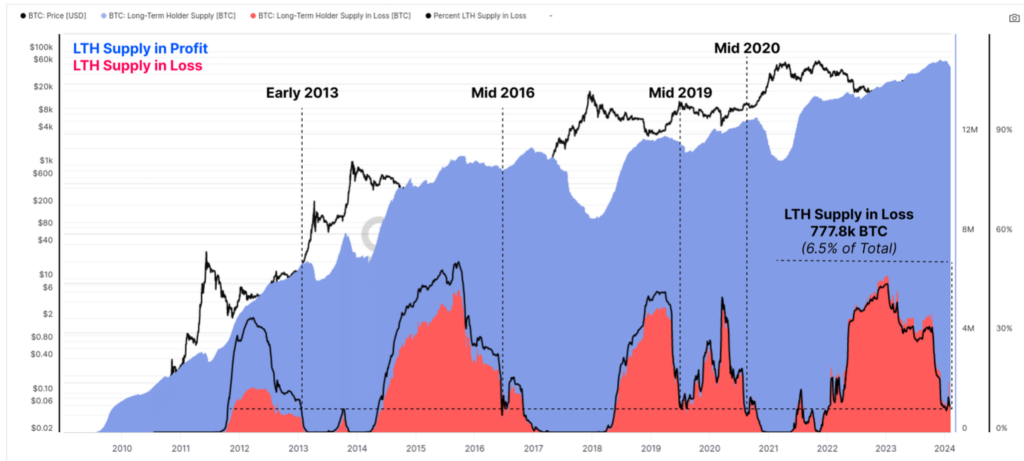

Long-term holders, soon all in profit.

We can see that the total volume of losing long-term holders is shrinking drastically (in red). This suggests that we are about to enter a phase where long-term holders will be sellers, probably in the second half of 2024 and early 2025.

When we see the appearance of these small dips (below in blue), and when we see the peak of the dip, it's because the price of bitcoin is considered overvalued by long-term holders. This cohort of long-term investors isn't usually very wrong.

Source: Glassnode

The power of institutional capital :

Spot bitcoin ETFs have been a big hit with institutions in 30 years, BlackRock and Fidelity make the best starts against 5533 other ETFs. At the time of writing, these investment vehicles have $36.77 billion in assets under management. And totals 3.62 % of Bitcoin's total capitalization.

It's a great sign of adoption and regulation that has taken place in recent weeks. Of course, there are also risks involved, not least that of the «centralization» of Bitcoin in institutions.

As I wrote in my last few letters, institutional capital is pouring into Bitcoin ETFs. Americans will even end up owning exposure to Bitcoin, via their retirement funds, without even knowing it.

Bitcoin ETFs absorb ten times more BTC than miners can produce! The Bitcoins produced each day are around 900 / day, the Bitcoins absorbed by Bitcoin ETFs are around 9000 / day. The difference is staggering, and Bitcoins will become increasingly scarce with this buying pressure.

Source : https://sosovalue.xyz/

When will a spot Ethereum ETF be launched?

Now that spot ETFs on Bitcoin have been approved by the Securities and Exchange Commission (SEC), the cryptocurrency ecosystem is now awaiting those on ETH. Below are the dates of the applications made by asset managers. It's best to consider only the final «deadline» date. I don't think the SEC will validate a spot ETF before the final deadline on May 23, 2024.

Source: Bloomberg Intelligence, SEC.gov

There is a growing force and influence on the part of banks and asset managers to ask to manage the digital assets of interested customers and investors. This is only to be expected. Investors want exposure to this new asset class, so institutions are adapting, and those that resist will lose market share.

US banks, left behind in their key role in Bitcoin ETFs, are pushing the SEC to change its guidelines for holding digital assets.

A coalition of commercial banks has sent a letter to the SEC asking it to exclude ETFs from the broad spectrum of crypto-currencies. They want a share of the market.

Un upheaval in the international payments system?

Currently, 20 % of the world's oil is traded using currencies other than the US dollar. This represents a significant change from the beginning of the century. This transformation of the global financial landscape raises important questions, calling into question the dollar's «imperial privilege» mainly due to the extraterritoriality of US law on dollar transactions.

I believe that the share of dollar-denominated oil purchases and sales will continue to decline, with major consequences for the global economy. This raises the question of what will become of the dollar reserves accumulated by importing countries to pay their energy bills, estimated at 7,400 billion dollars.

Various options are open to countries holding these dollar reserves:

- Purchasing American goods and services

- Acquisition of assets in the U.S.

- Converting dollars into other currencies

What is fairly certain in the very long term is the disappearance of the dollar's function as a standard and store of value. And I stress the very long term. For the time being, the dollar remains an important standard of value. These large-scale movements take a long time.

There are already new international payment systems based on bilateral agreements between countries, as in the case of China and Russia.

In conclusion: it's better to invest in Asian and emerging markets than in Europe.

Our service

We offer a portfolio management service specialized in digital assets. We provide complete human support from A to Z in this universe, customizing your portfolio allocation according to your risk profile and situation.

With our turnkey management approach, you can take advantage of industry developments without worrying about digital asset selection, in-depth token research, volatility, arbitrage and more. Simply consult your monthly reports and invest regularly, taking a long-term perspective (4 years and more).

We don't engage in algorithmic trading on a day-to-day basis, preferring only long-term investments in projects we know and understand. Our monthly portfolio arbitrages are accompanied by in-depth asset analysis, with a particular focus on tokenomics.

Discover our website: https://crypto-assets-management.com/

If you have any questions, comments or would like to find out more about our services, please contact us by e-mail at tristan.g@crypto-assets-management.com or schedule a phone call lasting a few minutes by following this link.

Discovery Pack

Investment of less than €20,000

- No entry fees

- Management fee: 2 % / year

- Performance fees: 20 % excl. tax on capital gains (High Water Mark method)

- Exit fee: 3 %

- Minimum subscription: €5,000

- Commitment period : None

Premium Pack

Investment over €20,000

- No entry fees

- Management fee: 2 % / year

- Performance fees: 20 % of performance above the benchmark index*.

- Exit fees: None

- Minimum subscription: €20,000

- Commitment period : None

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of information provided by a third party. in