Hello everyone,

The aim of this letter is to inform you about the current situation of the crypto-asset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

According to Coinbase, «billions» will flow into the crypto ecosystem thanks to ETFs - Why? Will we see millions of dollars flowing into the ecosystem by the end of the year? That's the prediction of exchange Coinbase, which is betting big on the approval of Bitcoin ETFs in the United States. What does it predict?

-

BlackRock files Ethereum spot ETF application with SEC. BlackRock, the world's largest asset manager, is officially entering the competition for Ethereum cash ETFs after filing a Form S-1 with the US Securities and Exchange Commission (SEC).

-

Commerzbank: Germany's 2nd-largest bank obtains cryptocurrency license. This week, Commerzbank was granted a license to offer cryptocurrency custody services. It thus becomes the first German bank of this scale to obtain this type of authorization.

-

«Central bank digital currencies (CBDCs) can replace cash,» says IMF head. Are we heading for a cashless world? That's the conviction of Kristalina Georgieva, Managing Director of the International Monetary Fund (IMF), who took a swipe at «private» currencies. What do we think?

-

PayPal touts blockchain as a revolution in payment methods. In a blog post about payment technologies, PayPal extolled the revolutions brought to the sector by blockchain. The company also discussed its own work in this area.

-

eID: the digital identity proposed by the European Union that nobody wants. The European Union's eIDAS regulation, which aims to revolutionize online interactions through the introduction of a digital identity, is closer than ever. However, this innovation raises privacy concerns, questioning the balance between efficiency and individual freedom. Are decentralized identity projects in danger?

-

Crypto money laundering? Completely has-been for the FBI! The party's over. Only a few years ago, it was still possible to use cryptocurrency to launder dirty money and turn your loot into bitcoins or je-ne-sais-quoi other. But the authorities are no longer hesitating to follow the blockchain trail to find and dismantle networks that thought they were safe behind wallets. offshore. American justice doesn't mess around with fraudsters, and cryptocurrency is definitely no longer a cloak of invisibility for crooks.

Fundamental Analysis

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 37,310 $ (11/20/23).

Halfway between capitulation and euphoria:

We're probably halfway between the phase of capitulation we experienced from May 2022 to March 2023 and the phase of euphoria we should experience from December 2024 to May 2025.

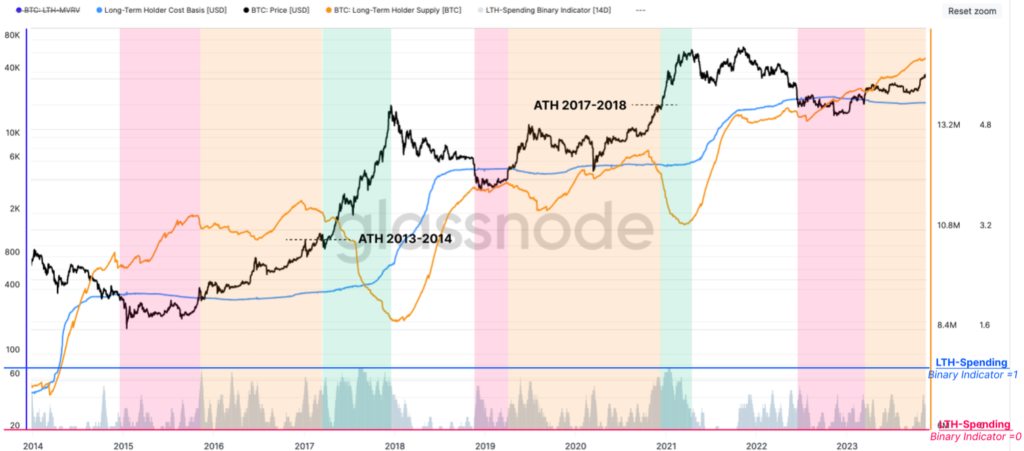

We can clearly see the rhythm of these cycles on the Glassnode indicator below.

This Binary Spend Indicator (SBI) indicates whether sales by long-term holders (LTHs) are of sufficient intensity to decrease the total supply of LTHs. This currently indicates that very little spending is being done by long-term holders, adding further evidence of the decrease in Bitcoin coins in circulation.

Source: Glassnode

All cohorts of investors accumulate together:

A distinct change has occurred since the end of October this year: investors of all portfolio sizes ( 10k BTC) have substantially accumulated their holdings.

We can see these accumulations by investor cohort on the chart below. The blue areas correspond to buying zones.

Source: Glassnode

Long-term adoption increases Bitcoin token distribution:

As adoption continues, the number of smaller holders, also known as «Shrimp» (meaning those with less than 1 BTC), is gradually increasing. Other designations are also listed in the legend to the chart below.

Contrary to what you might think, dilution, or the distribution of tokens, increases over time. The influx of new participants generates more energy (in the form of monthly income, for example) which they can spend on acquiring new tokens.

Consistent investors, also known as «whales», who are usually the first to arrive, see the value of their tokens appreciate. However, they tend to reduce their total token holdings as they are forced to diversify their portfolio at a certain stage.

The major trend to observe is clearly the decline in the number of miners as token holders. The industry has become so large that their influence has diminished compared to the early days of the Bitcoin network.

Source: Glassnode

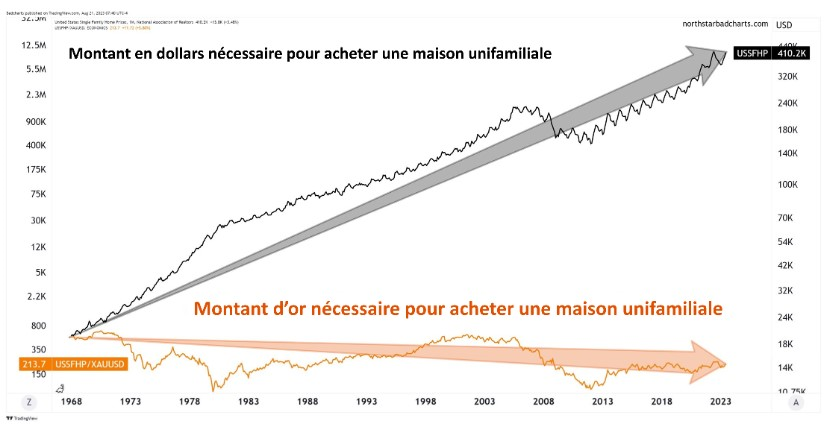

Gold reveals the mirage of fiat money (euros, dollars, etc.):

The cost of homes has risen for those who use government paper money. However, if we evaluate this cost in terms of real money, i.e. gold, the price of a house is actually slightly lower than it was several decades ago. This is what would happen if we were to envisage a situation where inflation was non-existent for a period exceeding 50 years.

Gold highlights the fragility of fiat money while preserving purchasing power. While the average cost of a home in the U.S. has risen from 73,000 $ to 514,000 $ between 1979 and today, the amount of gold needed to purchase a home (268 ounces) has remained constant over the same period!

Here is a visual representation of the situation below, this graph is very important to understand:

Source : Or.fr

Price rises are the result of almost exclusively the fact that we examine prices through a filter that distorts reality: fiat currencies (the euro, the dollar...).

It's as if we were constantly wearing sunglasses, day and night, throughout the summer and winter seasons: the average luminosity perceived throughout the year becomes artificial and does not reflect reality.

Our service

We offer a portfolio management service specialized in digital assets. We provide complete human support from A to Z in this universe, customizing your portfolio allocation according to your risk profile and situation.

With our turnkey management approach, you can take advantage of industry developments without worrying about digital asset selection, in-depth token research, volatility, arbitrage and more. Simply consult your monthly reports and invest regularly, taking a long-term perspective (4 years and more).

We don't engage in algorithmic trading on a day-to-day basis, preferring only long-term investments in projects we know and understand. Our monthly portfolio arbitrages are accompanied by in-depth asset analysis, with a particular focus on tokenomics.

Discover our website: https://crypto-assets-management.com/

If you have any questions, comments or would like to find out more about our services, please contact us by e-mail at tristan.g@crypto-assets-management.com or schedule a phone call lasting a few minutes by following this link.

Discovery Pack

Investment of less than €20,000

- No entry fees

- Management fee: 2 % excl. tax / year

- Performance fees: 20 % excl. tax on capital gains (High Water Mark method)

- Exit fee: 3 % excl. tax

- Minimum subscription: None

- Commitment period : None

Premium Pack

Investment over €20,000

- No entry fees

- Management fee: 2 % excl. tax / year

- Performance fee: 20 % excl. tax of performance in excess of the benchmark index*.

- Exit fees: None

- Minimum subscription: €20,000

- Commitment period : None

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of information provided by a third party. in this letter.