Hello everyone,

The aim of this letter is to inform you about the current situation of the crypto-asset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Over a million ETH withdrawn from staking: what do the on-chain data say? One week after the Shapella update, over one million ETH have been withdrawn from staking. While this may seem a substantial figure, the information provided by the on-chain analysis shows that staking is more popular than ever.

-

Twitter partners with eToro to make buying cryptocurrencies easier for its users. It's a partnership that's bound to get people talking. Trading giant Twitter has teamed up with trading platform eToro, to make cryptocurrency and stock trading more accessible to users of the social network. Could this be the start of a revolution for Twitter?

-

How are cryptocurrencies used by investors? In its latest study, CoinGecko looks at the different uses of cryptocurrencies among investors in the ecosystem. Investment, payments, speculation, DeFi, light on the statistics of these different pillars.

-

Bitcoin: London Stock Exchange Group to provide derivatives services. Through its subsidiary SCH SA, London Stock Exchange Group will provide clearing services for the GFO-X Bitcoin index. In this way, BTC is gaining a foothold in traditional finance.

-

A stablecoin indexed to inflation? That's what Base, Coinbase's layer 2, wants.. In an article suggesting ideas for application developers, Base, Coinbase's layer 2, showed particular interest in the concept of inflation-indexed stablecoin. Nevertheless, the emergence of flatcoins raises a number of issues.

-

Ledger completes Series C with a new €100 million round of financing. Ledger announced today that it has raised a further 100 million euros, bringing its Series C funding to 456 million euros. These funds will enable the brand to bring its many projects to fruition, such as the new generation of hardware wallets embodied by the Ledger Stax.

-

Flybondi is now issuing all its tickets in NFT - what does this mean for passengers?. Argentine airline Flybondi is integrating Web3 into its ticketing process by issuing its electronic tickets in the form of non-fungible tokens (NFT). Using the Algorand (ALGO) blockchain, this initiative enables travelers to transfer or sell their «NFTickets» completely independently.

-

Alyra: Paul's feedback on blockchain developer training. Are you interested in blockchain development and considering taking a training course? Here's Paul's feedback to give you an idea of what you can expect from a training course organized by the Alyra school, which specializes in training future professionals in the sector.

-

Banking crisis: uncertainty remains «exceptionally high» according to IMF head. The head of the International Monetary Fund (IMF) returned to the crisis that has shaken the banking sector in recent weeks. She asserts that uncertainty remains high, despite potential signs of easing. An update on the financial institutions that shook last week.

Fundamental Analysis

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 29,333$ (04/19/23).

The Ethereum staking rush?

The latest Ethereum update, which enabled the double upgrade named «Shapella and Shanghai», was successfully completed in April. One week after the update, which enabled the unlocking of stashed Ethers and their rewards on the Beacon Chain, we can see that few investors have requested the withdrawal of their Ethers.

Many feared mass withdrawals, but this scenario did not materialize. In our previous letters, we explained why we thought there would be few withdrawals. In fact, most indicators seem to show that investor confidence in Ethereum has been boosted by the latest update.

Looking at withdrawals in more detail, it is interesting to note that the average number of ETH stored per validator fell from 34 to 32.5. This is not insignificant, as 32 is the minimum number of ETH required to run a validator. This suggests that, in reality, current withdrawals could correspond to rewards received since the deployment of the Beacon Chain smart contract:

Source: Glassnode

We should also take a look at new entries. Here, the trend has accelerated We've seen an increase in deposits over the past few days.

Source: Glassnode

More than 18.9 million ETH are currently staked on the Beacon Chain's smart contract, representing more than $38.9 billion. 15.6 % of total capitalization.

The post-bear rebound phase?

As we can see on the long-term chart below, the last three down cycles ended with a strong rebound. This has at least exceeded the 60 % high of the previous cycle before the next halving. We therefore have good reason to believe that by the time of the next halving (April 2024), the price will be well over 40,000 $.

We don't expect a strong bull market of the kind seen at the end of 2014, the end of 2017 or the beginning of 2021 until 2024. Within these large cycles, there are interesting small cycles to study, which we'll look at in future letters.

A potential Alt Season?

Prices have risen sharply since the start of the year. This rise has been driven (as after every bear market exit) by Bitcoin. Bitcoin's dominance increases both at the start of bull markets and during well-established bear markets. Conversely, the Altcoins (in the top 50) saw their dominance increase during well-established bull markets, and often just before major bearish corrections.

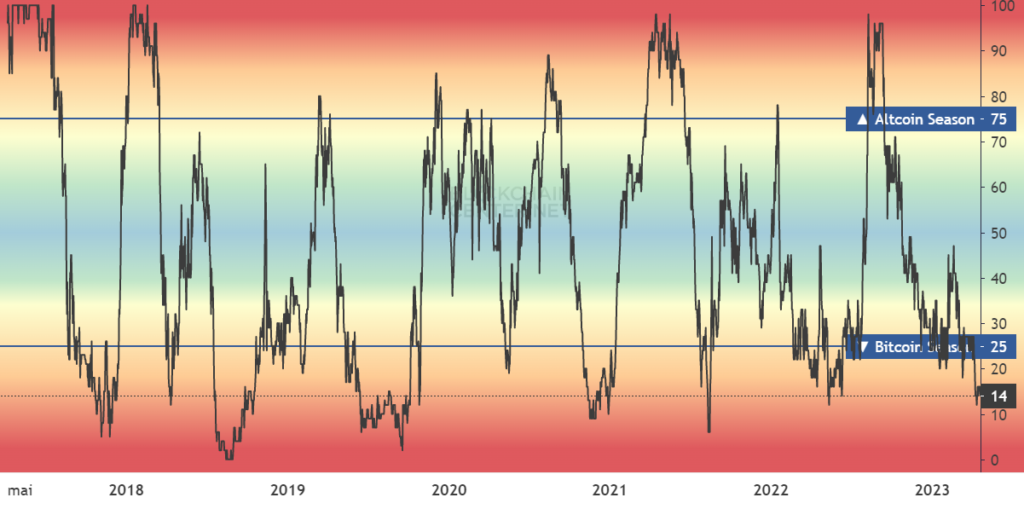

You can see it below in an Alt Season indicator.

Source

This graph shows that we are approaching an optimal period for switching allocations to Altcoins.

-

2022 was the worst year for bonds in over 100 years.

The enormous measures adopted by governments to deal with the Covid-19 pandemic, the war in Ukraine and the massive energy crisis, derailed inflation. To put out the fire, central banks had to apply the brakes very aggressively and raise their key interest rates sharply. They then provoked a bond crash during the rate hike, in order to (or rather, to try to) beat inflation. Their ultra-flexible policy of negative interest rates beforehand sowed the seeds of this situation.

With bond prices inversely correlated to rising interest rates, bonds suffered their worst year in over a century.

Source: Econopolis, Bloomberg

The recent bankruptcies of some banks (such as SVB, Credit Suisse and others) are not insignificant, and are partly linked to these unsustainable rate hikes.

Many banks are now sitting on very large latent losses following the fall in their bond prices. As long as few customers request withdrawals, these losses remain latent. If too many customers wish to withdraw their funds, forcing the banks to sell their bonds at a loss, a house of cards collapses for the most fragile banks. This is a very dangerous situation, especially as most French life insurance policies are invested in this type of bond.

As we explained in previous letters, the digital asset ecosystem is a much less interest-rate-sensitive market than the bond and equity markets.

Our service

We offer a discretionary management service for portfolios specializing in digital assets. We provide comprehensive human accompaniment in this universe, adapting your portfolio allocation to your risk profile and situation.

Our turnkey management allows you to profit from the evolution of this sector without worrying about which digital assets to put in your portfolio, nor about in-depth token research, volatility, arbitrages, etc... All you have to do is read your monthly reports and invest regularly with a long-term horizon (4 years and more).

We don't do algorithmic trading or daily trading, we invest for the long term in projects we know and understand. We make monthly arbitrages in the portfolios and study in depth the assets (especially their tokenomics) that we put in the portfolio.

Discover our website: https://crypto-assets-management.com/

If you have any questions or comments, or if you would like to find out more about our service, please do not hesitate to contact us at this e-mail address: tristan.g@crypto-assets-management.com or make a telephone appointment with us via this link.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of information provided by a third party. in this letter.