Hello everyone,

The aim of this letter is to inform you about the current situation of the cryptoasset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Sam Bankman-Fried has been arrested and is expected to be extradited to the United States. Charges against Sam Bankman-Fried include wire and securities fraud, conspiracy to commit wire and securities fraud, and money laundering.

In a statement, the Prime Minister of the Bahamas, Philip Davis, said: « The Bahamas and the United States have a common interest in holding accountable all individuals associated with FTX who may have betrayed the public trust and broken the law." . Follow the FTX situation in real time.

-

Cryptocurrency buyers have quadrupled since 2020. Conducted by JP Morgan, a study reveals that the number of cryptocurrency buyers in the US has increased fourfold since the Covid-19 crisis. The financial group estimates that the number of people who have invested in this type of asset has risen from 3% to 13% of the US population.

-

European Union to limit cash payments to 10,000 euros. The European Union decided late last week to limit cash payments to 10,000 euros, in order to combat money laundering and the financing of terrorism. Cryptocurrency transactions in excess of 1,000 euros will also be more closely monitored. As a reminder, cash payments are already limited to 1,000 euros in France.

-

Without Merge, one million ETH would have been created with Ethereum PoW. The data shows us that if blockchain had remained at proof of work, over a million additional ETH would have been created.

In a PoW model, this would mean approximately 1.28 billion dollars of money supply would have been createds. Projecting the data on an annual basis, this would equate to 3.06 % of inflation for 3.7 million new ETH.

But thanks to a switch to PoS consensus, this is not the case. With the current state of the Ethereum blockchain, the network would even be deflationary on a daily basis, i.e. -0.47 % per year, and neutral on a 30-day basis. (Source: https://ultrasound.money/).

-

Binance audit: the Bitcoin (BTC) held by the platform is over-collateralized. Further proof of Binance's solidity? The platform has just completed an audit of its reserves, and the report reveals that Binance's Bitcoin (BTC) reserves are slightly larger than previously announced. This is reassuring for users who feared another FTX scenario. View the reserves of certain exchange platforms live on Nansen : https://portfolio.nansen.ai/entities.

-

Ledger Stax: Ian Rogers compares the cryptocurrency ecosystem to the early days of the Web. Ian Rogers, Ledger's Chief Experience Officer, looks back at the genesis of the brand's new hardware wallet: the Stax. In doing so, he draws a parallel between the current development of the cryptocurrency ecosystem and the beginnings of the Web.

«In the 90s, people were saying “everyone will never have broadband!” Ten years later, the same people were saying, “Everyone will never have a smartphone!” Yet today, humanity collectively uses over 6.5 billion Internet-connected smartphones to live their daily lives.»

Ian Rogers, Ledger's Chief Experience Officer

Fundamental Analysis

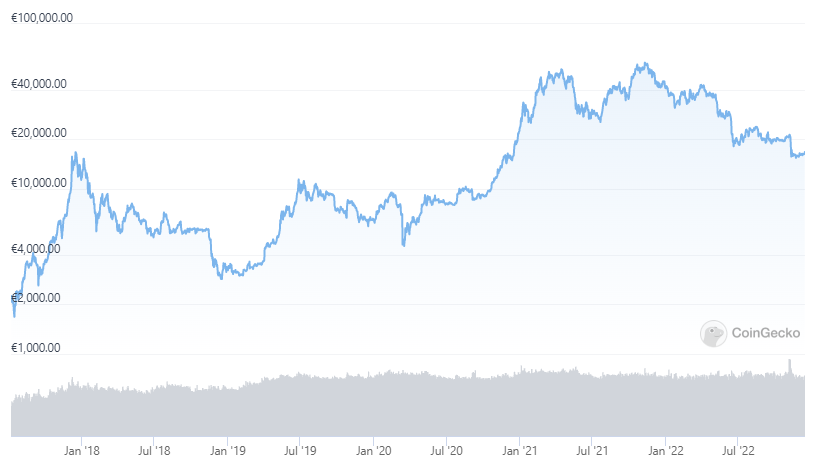

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 17,950 $ (on 14/12/22).

We are approaching the end of 2022. This year has been one of the most difficult and brutal for the ecosystem, but also for financial markets at large. With central bank monetary policies performing 180-degree reversals in response to inflation, and after decades of extremely flexible and easy credit conditions, the tightening caused severe and rapid declines in most asset classes.

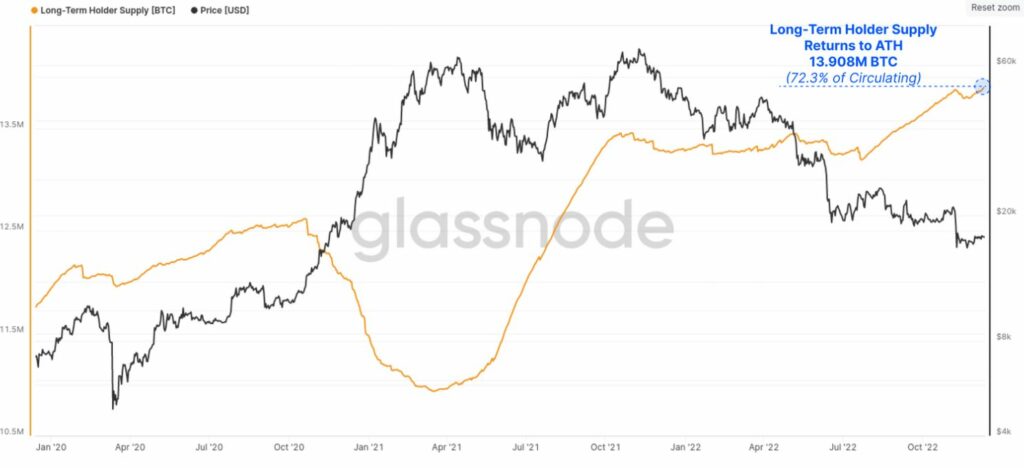

We are currently at thresholds of extreme latent losses for long-term holders. As you can see from the chart below, history repeats itself in every cycle. This one took the form of a double peak during the UST and FTX collapse events. We're on maximum pain thresholds for holders, but also on very interesting long-term buying points.

Taking the long view. Despite these spectacularly large losses, the age of BTC coin supply and the propensity to accumulate tokens by those who remain convinced, continue to rise. Regular buyers have already completely absorbed the panic spending during the FTX collapse. The uptrend has been almost linear on this metric for almost 6 months.

We have witnessed the deleveraging of DeFi. The sharp contraction in liquidity in the global economy, but also in the crypto ecosystem, has sharply reduced TVL (total locked value) from a high of to $160 billion in November 2021, compared with $40 billion today. This creates interesting opportunities in most of the high-quality DeFi projects that will be present for the following cycles. Contrary to what we hear in many media, cryptos have not failed, only the failures of CeFi (centralized finance) have created setbacks for the industry. Blockchains and DeFi are working very well and continue to develop.

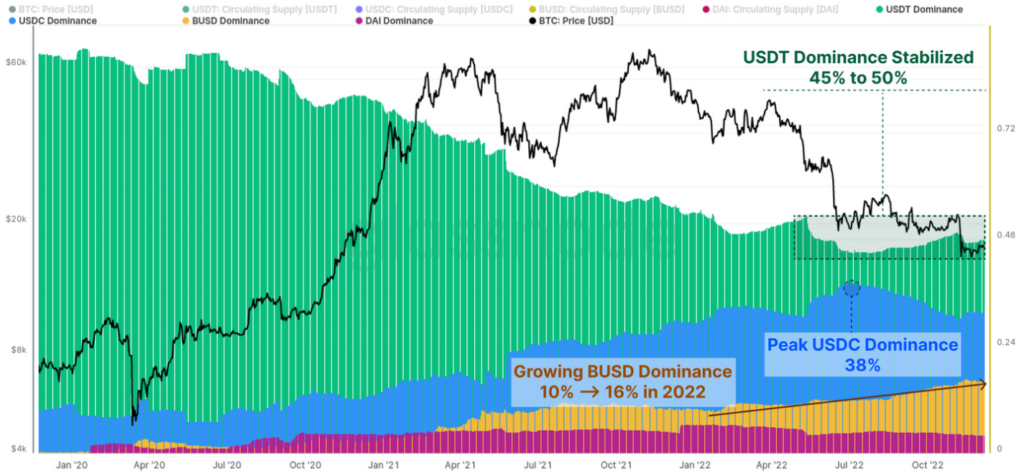

We're witnessing stiff competition in the relative dominance of stablecoins between USDT, USDC, BUSD and DAI. This competition is healthy for the ecosystem, and ensures that there are no players too systemic for the industry. Unfortunately, «decentralized» stablecoins are struggling to make their mark in this market.

-

U.S. inflation is down again this month, from 7.7 % to 7.1 %. Core« inflation (deducted from food and energy) is also down, from 6.3% to 6%. The FED has slowed its rate hikes, and is currently at 4,5 %. Markets await the FED's pivot. At the same time, the dollar halted its unsustainable rise and began a correction.

In Europe, not only have we not seen the last of inflation (and the ECB's rate hike won't be enough to beat it), but we're now in recession. We spoke of this recession several months ago in a previous letter. This means that in Europe, we have both disadvantages: recession and inflation. A cocktail that will be painful for Europeans.

A recession means a drop in activity, and therefore a drop in sales for companies. In addition, inflation means lower margins for companies. Add to this the higher cost of energy, and European companies are at risk of going bankrupt all over the place.

Inflation erodes all future profits for companies, especially those that expand using debt. The cryptoasset industry should do well in the coming years with inflation and recession.

Firstly, because the majority of digital assets in the ecosystem are protected from inflation, due to their nature and limited quantity. But also, because these assets don't require debt to develop: they don't need low interest rates to grow. in the long term.

Only adoption and use cases will be their driving force for growth. The abundance of liquidity was an added advantage, but it's not necessary for their intrinsic development, unlike many growth (tech) companies which are heavily dependent on debt.

Unfortunately, inflation in Europe will be long-lasting.

If you have any questions, comments or would like to find out more about our service, please do not hesitate to contact us: tristan.g@crypto-assets-management.com

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not responsible for any loss resulting from a decision taken on the basis of the information in this letter.