Hello everyone,

The aim of this letter is to inform you about the current situation of the cryptoasset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

FTX is currently going through an unprecedented crisis. The funds of users of Sam Bankman-Fried's platform are still blocked. Follow the FTX situation in real time.

To sum up in a few lines: a fraud has been perpetrated by Sam Bankman-Fried, founder and CEO of the FTX exchange platform and trading company Alameda Research.

The FTX platform would have used the funds deposited by its customers to bail out Alameda Research's losses and to carry out its trading activity. In addition, most of the company's assets and loan collateral were FTTs, the platform's native token.

When rumors of insolvency circulated, FTX customers began withdrawing their funds in large quantities. Withdrawals were then blocked: FTX could not honor them because it did not hold its customers' assets at a 1:1 ratio.

Once the market was gripped by panic, the FTT token collapsed, drastically reducing all platform assets from FTX and Alameda Research. The crypto-asset market then fell sharply, and a major wave of asset withdrawals from exchange platforms ensued. This period is a stress test for all exchange platforms, especially the financially weaker ones.

The cryptoasset market is currently undergoing a «purge» of weak and/or overleveraged players, following this event of fraud by a centralized player. Despite the difficulties for both players and investors, the «purges» are healthy and necessary for the continued development of this recent asset class.

Things to remember :

-> The value propositions of blockchains (Bitcoin, Ethereum and others) remain just as solid and have by no means failed.

-> The DeFi (decentralized finance) sector continues to operate perfectly.

-> The cause of this event is fraud, which to my knowledge remains a human property.

-> Crypto exchange platforms should not have fractional reserves. Customer deposit reserves should be 1:1.

-> Exchange platforms should not use their own tokens as assets in their companies.

-

Additional note: none of our customers have suffered losses on the FTT token or on the FTX exchange platform. We only work with the most solid platform on the market: Binance.

-

71 billion in cryptocurrencies - Binance's insane reserves. Following this event, the founder of the Binance platform launched a transparency campaign. The platform published its portfolio addresses, and we learn that it has substantial reserves, to the tune of $71 billion. Many other platforms subsequently published their reserves. Binance has by far the largest reserves.

-

Shell and Bitcoin: the oil giant goes mining. Oil company Shell is gradually diving into Bitcoin (BTC) mining. The company offers products that enable companies in the sector to improve their profitability and ecological footprint.

-

DeFi: JP Morgan completes its first transaction on Aave. As part of experimental projects with the Central Bank of Singapore, JP Morgan carried out transactions on the Aave Arc decentralized finance protocol (DeFi) for the first time. For Singapore's central bank, the focus is resolutely on focused on blockchain experiments. The MAS (Monetary Authority of Singapore) carried out this operation with JP Morgan as part of the «Project Guardian» program. This vast plan comprises a series of projects designed to test the value propositions of DeFi's innovations, to consider their use in the longer term.

-

Google launches a cloud service dedicated to Ethereum nodes. This week, we learn that the tech giant is now offering a «Blockchain Node Engine», which can host Ethereum nodes. In concrete terms, this means that the synchronization process will be greatly accelerated by Google's service. A new node can be deployed in a single operation. For the moment, the service is focused on the Ethereum blockchain, but will be open to other networks in the future. Slowly and quietly, the Web 2 giants are making the transition to Web 3, which is a good sign of the adoption that's taking place.

-

Mastercard welcomes 7 blockchain and Web3 companies to its startup incubator. Payment giant Mastercard is getting ever more involved in the blockchain ecosystem, accompanying seven Web3 startups in a new promotion of its incubator. The interest of Mastercard s commitment to blockchain is well established, and the new beneficiaries of its Start Path incubation program are just one more example.

Fundamental Analysis

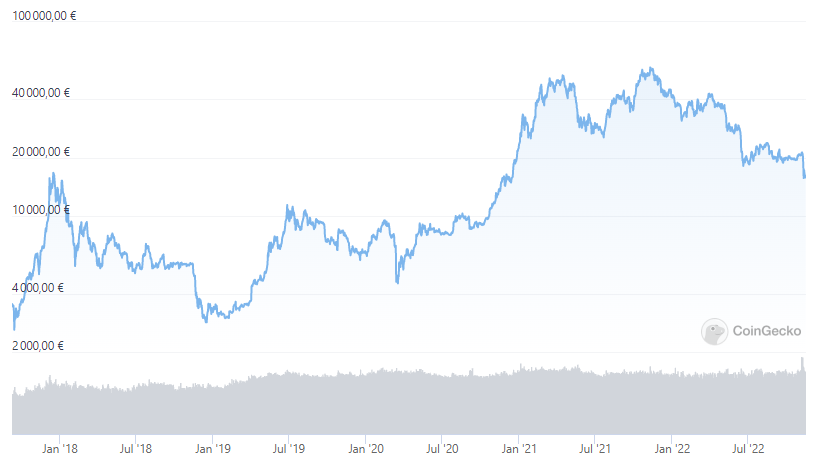

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 17,000 $ (11/15/22).

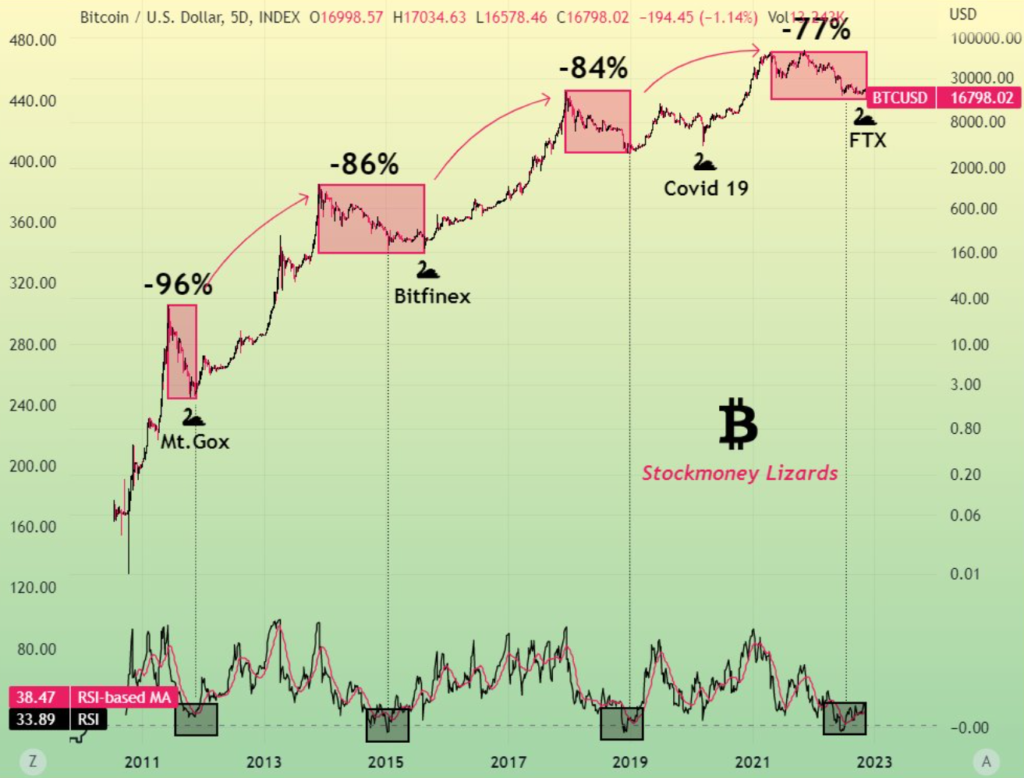

The bankruptcy of the FTX exchange platform is strongly reminiscent of the failure of Mt Gox in 2013. This platform owned 80 % of the centralized exchange market, so it was a difficult time for the market and for the investors left behind.

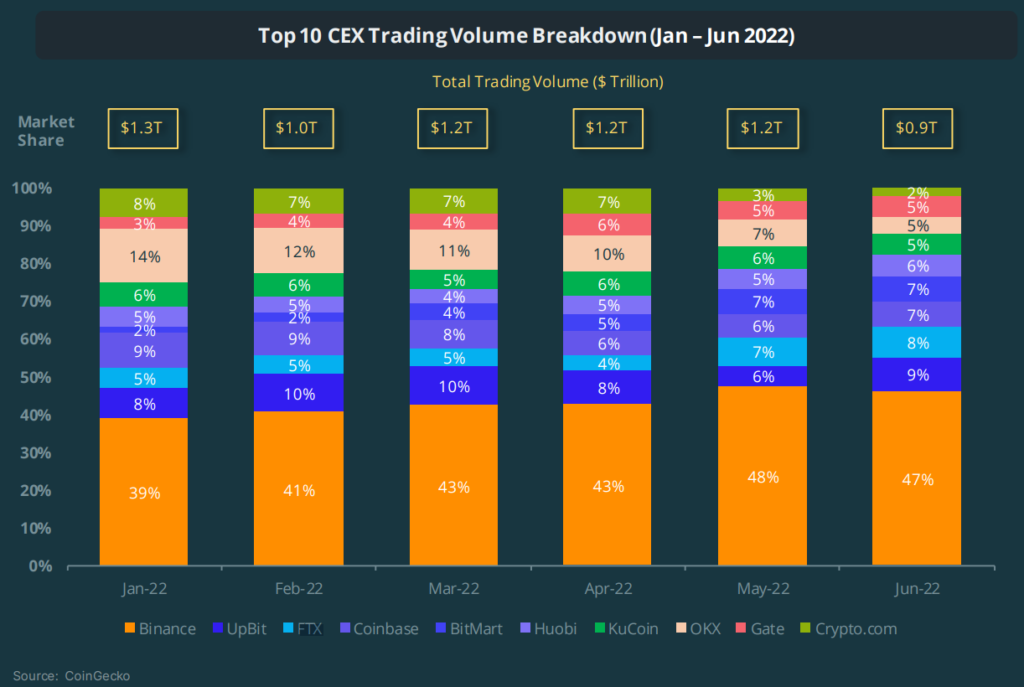

However, FTX had 8 % of the centralized exchange market in terms of volume (see below), which is less serious than Mt Gox. On the other hand, there will be fallout in the weeks to come: other companies will probably go bankrupt, and a chain reaction may occur. This is a major blow for the ecosystem, which will lose its good reputation, temporarily slowing the speed of adoption. There will also probably be a knock-on effect in terms of tighter regulation.

This event is regrettable and has broken the momentum the crypto market was building. Inflation in the US fell and the dollar came to a screeching halt: it was the perfect cocktail for an upward exit from the long plateau the market has been building over the last few months. Following the market panic, it was a bottom exit from the plateau and the potential upside is postponed until the consequences of the FTX bankruptcy are fully known and absorbed by the market, which will take time, probably a few months.

As we can see below, most end-of-cycle events bring «corpses out of the closet»: Mt. Gox, Bitfinex, FTX. When the market is under stress and lacks liquidity: history repeats itself.

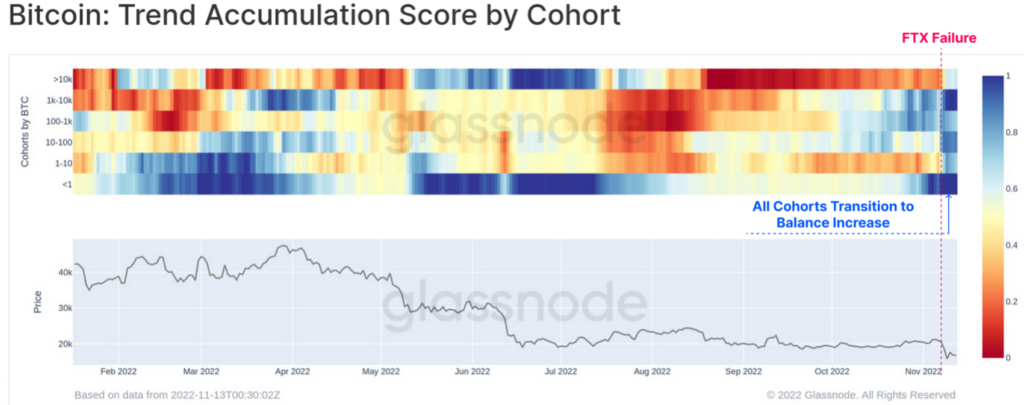

On the good news side, all categories of investors have accumulated Bitcoins following the FTX collapse. Below is a graph breaking down investors by category (those with 10 k). We can easily see (in blue) on the far right, the positive accumulation score for each investor cohort.

The important variable representing network adoption is the cohort of small entities with less than 1 bitcoin. This cohort known as shrimp (<1BTC) added 33.7k BTC this week, resulting in a 30-day increase of +51.4k BTC. This level of balance inflow is the second highest in history. As we can see below, in the green circle, small investors bought heavily during this downturn. This is a sign of the network's good health and continued adoption, as well as growing confidence, even as prices fall.

-

U.S. inflation is down this month, from 8.2 % to 7.7 %. Core« inflation (deducted from food and energy) is also down, from 6.61 % to 6.31 %. This is good news for risky markets (equities, crypto), as rate hikes by the FED are likely to slow down, which at the same time signals the end (for now) of the dollar's meteoric rise against other currency baskets. This was to be expected, given the unsustainable pace of the dollar's rise. On the other hand, FTX's bankruptcy made the crypto market the »fall guy«, and it was unable to benefit from any upside from the weakening dollar.

In Europe, the situation is quite different, since we are not energy-independent and have made major strategic errors. Inflation, which we were already talking about almost a year ago, is driven by 4 major factors that are all intertwined:

- Dependence on foreign energy, We've decided to suddenly deprive ourselves of gas from Russia without a spare tire.

- ECB rate hike, which is far too little, too late.

- Decline against the dollar, and therefore an increase in all foreign products paid for in dollars.

- Finally, the large amount of money «printed» over the last 2 years to make up for strategic errors (management of covid and the Russia/Ukraine conflict).

All these factors add up to a spine-chilling result for the people of Europe:

Unfortunately, the peak has not yet been reached. Inflation in Europe will be sustainable.

If you have any questions, comments or would like to find out more about our service, please do not hesitate to contact us: crypto.assets.manage@gmail.com

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not responsible for any loss resulting from a decision taken on the basis of the information in this letter.