Crypto Assets Management - Mereau Finance

Company registered as a PSAN with the AMF under number E2023-084

RCS Nanterre: 894 424 902

Address: 35 rue Jean Jaurès, 92800 Puteaux, France

Date: April 29, 2025

PORTFOLIO MANAGEMENT UNDER MANDATE

OUR VISION

We are committed to supporting you in your investment in digital assets over the long term. In this volatile and risky asset class, a calm and sustainable approach is essential.

«Digital assets are to the transfer and storage of value what the Internet was to the transfer and storage of information.»

OUR STRATEGY IS BASED ON TWO PILLARS

OUR INVESTMENT PHILOSOPHY

Our investment approach is based on identifying high-efficiency projects with solid fundamentals. We carefully analyze their tokenomics to spot any market anomalies. Our selection focuses on projects in the top 200 by capitalization, with a medium-to-long-term vision, covering various sectors of the crypto ecosystem.

Our thesis today is based on the following idea: Aave is today the beating heart of DeFi. And as this finance structures itself, connects to the real world and attracts institutional flows, Aave is ideally placed to capture this value, by placing the AAVE token at the center of this dynamic.

Fluid (FLUID) - Research report

An established project: Instadapp, pioneer of DeFi

Founded by the Instadapp team, Fluid builds on an already well-established and recognized project in the DeFi ecosystem. Since 2018, Instadapp has established itself as a key player, providing aggregation and optimization solutions that have enabled thousands of users to navigate more easily between major protocols such as Aave, Compound, MakerDAO, Curve or Uniswap.

Behind Instadapp are brothers Sowmay and Samyak Jain, two iconic figures in the crypto ecosystem, who left their studies to devote themselves entirely to building tools that simplify access to DeFi. Their visionary approach quickly attracted the support of prestigious investors, including Pantera Capital, Naval Ravikant and Balaji Srinivasan, with a $2.4 million round to be raised as early as 2019.

With over $7 billion in value having passed through its platform since its launch, Instadapp has established itself as one of the most powerful and flexible interfaces in the DeFi ecosystem. Its DeFi Smart Accounts system has enabled advanced users and institutions alike to manage complex positions (leverage, refinancing, arbitrage) smoothly and securely. Instadapp has often been at the forefront of innovation: it introduced multi-protocol integrations even before most aggregators saw the light of day, while developing a UX hailed for its clarity and power. By 2022, the platform was consistently among the top 3 most-used dApps on Ethereum in terms of volume processed, with peaks of over $500 million per day.

Building on this experience, the team decided to go one step further with Fluid, an integrated DeFi infrastructure that aims to overcome the current limits of the ecosystem. Where DeFi often suffers from fragmentation of separate pools and compartmentalized strategies, leading to capital inefficiency, Fluid provides a systemic solution, unifying the lending, borrowing and exchange layers in a single architecture.

FLUID, an integrated DeFI infrastructure

Fluid is distinguished by an architecture designed to optimize each of its components. Each layer is designed not as an isolated product, but as a complementary brick that amplifies the overall efficiency of the protocol. Here are the main components:

Liquidity Layer :

This strategic core unifies liquidity across all Fluid components. Where other protocols segment pools and fragment funds, Fluid creates a common, flexible pool, enabling users and protocols to maximize capital utilization. This approach reduces inefficiencies, improves rates and makes every dollar more productive.

Lending Protocol :

Based on ERC4626-compliant fTokens, the lending module enables users to deposit their assets and generate interest. It's more than just lending: the design leverages the Liquidity Layer, facilitating third-party integrations and increasing the attractiveness of returns, especially for automated DeFi strategies.

Vault Protocol:

The Vault Protocol offers flexible lending and borrowing options, incorporating advanced liquidation mechanisms directly inspired by Uniswap v3 logic. As a result, gas costs are reduced, liquidations are more efficient, and users benefit from better protection against unexpected losses. This makes Fluid particularly attractive to borrowers.

DEX Protocol :

The DEX module is one of Fluid's major innovations, along with the Smart Collateral and Smart Debt concepts. These mechanisms transform deposited assets and contracted debts into liquidity that can be directly exploited in trading pools. In concrete terms, this means that every position, whether on the assets or liabilities side, generates additional income through trading fees, creating a multi-layered return without additional capital mobilization.

DEX PROTOCOL: a revolution in capital efficiency in decentralized finance

Fluid's DEX Protocol marks a fundamental break with traditional decentralized exchange models. Where conventional DEXs are limited to liquidity pools fed by external LPs, Fluid incorporates a radical innovation: the simultaneous use of collateral and debt as sources of liquidity, via its flagship Smart Collateral and Smart Debt concepts.

In practice, this means that every dollar deposited in Fluid can generate up to $39 of effective liquidity, thanks to a multiplier effect combining borrowed capital and collateral deployed in the pools. This figure places Fluid at the pinnacle of capital efficiency, far surpassing current market standards.

Smart Collateral: multifunctional capital

With Smart Collateral, users can not only deposit assets for borrowing, but also deploy them as active liquidity in the DEX AMM (automated market maker). As a result, they earn both the interest of the lending protocol and the trading costs generated by the swaps.

Smart Debt: transforming liabilities into productive leverage

Even more daring, Smart Debt converts debt into a productive asset. Borrowed funds, instead of simply remaining in storage or being used for speculative purposes, feed directly into DEX's liquidity, generating fees that offset all or part of the cost of borrowing. By reversing the traditional logic of MAs, Fluid creates a synergy where more borrowing equals more productivity, rather than just risky leverage.

Revenue sources and model resilience

The DEX Protocol brings at least three new revenue streams to the Fluid protocol:

- A percentage deducted from trading fees

- Increased organic demand for certain borrowed assets (wstETH, weETH, etc.), boosting lending activity

- Additional fees applied to Smart Vaults, e.g. 0.1% on Smart Debt pairs such as USDC/USDT

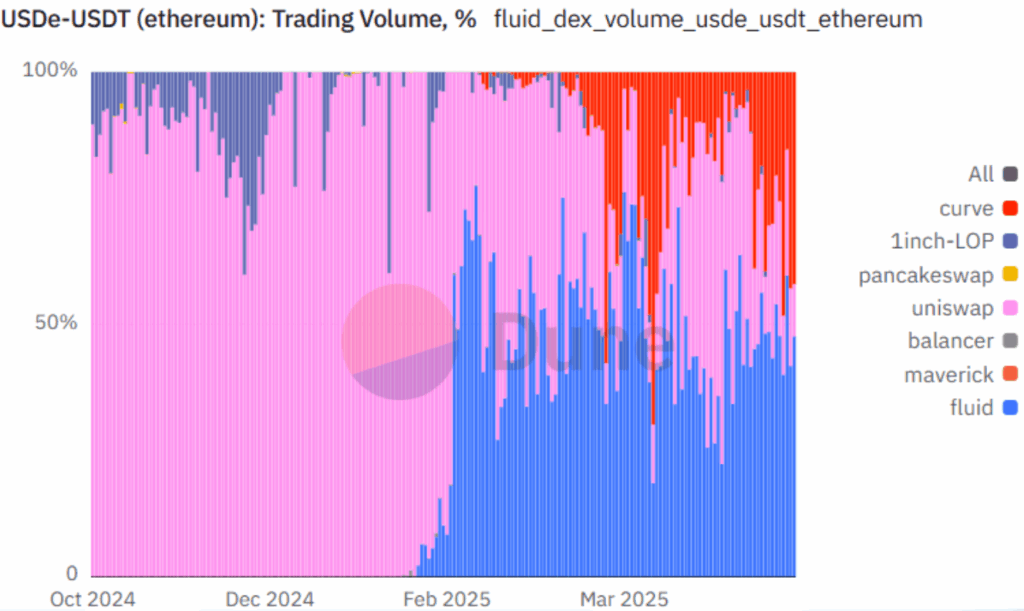

Fluid's DEX Protocol has proved remarkably effective in a highly competitive segment: stablecoin trading. Thanks to its innovative architecture, it has rapidly captured significant market share on the main stablecoins on the Ethereum network.

On the USDe/USDT and USR/USDC pairs, trading volume data is particularly revealing. Fluid, which was virtually non-existent on these markets until February 2025, has managed in just a few weeks to overtake Curve and Uniswap, which historically dominated these trades. The chart below shows that Fluid now holds a majority position on these markets, with deep and consistent liquidity.

Stable pairs, where margins are low but volumes are high, are an ideal testing ground for evaluating the effectiveness of an AMM. Fluid excels here, with tighter spreads, more evenly distributed fees and a more stable liquidity structure, attracting traders, arbitrageurs and market makers alike.

DEX PROTOCOL V2: an even more optimized version of the DEX protocol

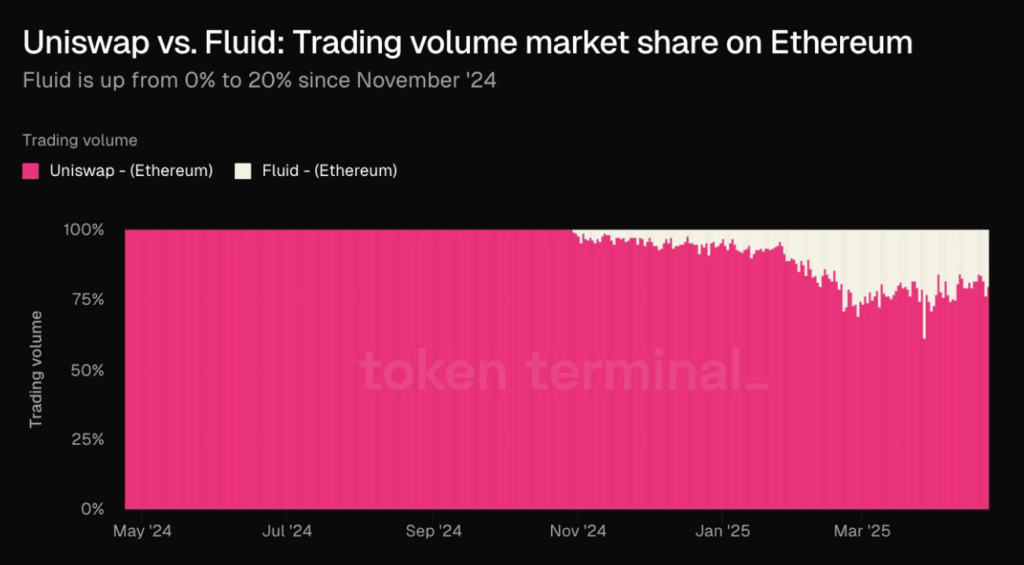

Since the launch of its DEX, Fluid has made remarkable progress on the decentralized exchange market. The graph below illustrates this trend: in the space of just a few months, Fluid has gone from 0 % to almost 20 % market share of trading volume on Ethereum, gradually nibbling away at the shares of Uniswap, until then the undisputed leader in this field.

The team recently unveiled Fluid DEX v2, an ambitious version that aims to push the limits of capital efficiency and introduce new order types such as Smart Range Collateral/Debt. This version aims to make the protocol even more modular, composable and attractive to sophisticated traders and LPs.

The objective is clear: dethrone Uniswap on Ethereum, and become the biggest DEX in the entire ecosystem.

According to Fluid's COO, if all goes well, the protocol should become the market leader in DEXs, and potentially reach +$100 million in annualized revenues.

A long-term vision

Fluid's roadmap doesn't stop at improving the current DEX. Here's what's planned for the coming months.

Deployment of Fluid DEX on L2s and cross-chain integration

Fluid plans to extend its architecture beyond Ethereum mainnet, with strategic deployments on other Layer 2s in addition to Arbitrum and Base, and cross-chain integrations. This expansion will enable:

- Drastically reduced transaction costs for users

- Greater accessibility for new entrants, especially those on cell phones

- Cross-chain liquidity depth, unified by Fluid's Liquidity Layer

Integration of new assets and vaults

One of Fluid's strengths lies in the flexibility of its vaults. In the coming months, the protocol plans to add :

- New algorithmic or collateral-backed stablecoins

- Assets linked to real-world assets (RWA), such as tokenized Treasury bills or money market products

- Light« versions of certain vaults (e.g. ETH Lite) to offer low-cost, low-risk alternatives

Hosting third-party protocols on Fluid infrastructure

The Fluid model is intended as a basic infrastructure on which other projects can build. With this in mind, the team plans to open up the protocol to :

- Derivatives protocols (options, perpetuals)

- Algorithmic credit or stablecoin markets

- Decentralized forex applications, where Smart Debt would be used as the basis for creating an on-chain currency market.

- A cross-chain bridge, benefiting from the liquidity of the Liquidity Layer, making it one of the most efficient bridges on the market.

A model already imitated by competitors

Fluid's technical and economic success has not gone unnoticed in the DeFi ecosystem. A number of competing projects are beginning to draw openly on its architecture to apply it to their protocol, starting with Euler, which is currently working on the integration of a DEX directly connected to its lending vaults.

This dynamic reflects an obvious fact: Fluid has broken new ground in the design of DeFi infrastructures, proving that the relationship between debt, collateral and market liquidity can be transformed. Where the traditional approach separated these functions, Fluid has brought them together in a single logic, based on a unified liquidity layer.

According to the project team, this wave of imitation is not a direct threat; on the contrary, it validates the relevance of the model. The main reason for this confidence? Smart Debt. This technical brick, at the heart of Fluid's mechanics, transforms debt into a productive asset. As long as no competitor has such a robust equivalent, the project remains structurally ahead of the game, since Smart Debt is very complex to add if the protocol was not designed from the outset to work with it.

Indeed, Smart Debt doesn't just enhance borrower returns: it generates native, deep and dynamic liquidity, using debt as the basis for pooling in DEX. This creates a unique strategic advantage: the more the platform is used, the more liquid it becomes, a virtuous circle that competing attempts struggle to replicate without this component.

Reasons to hold FLUID tokens

Currently, around 40 % of the total FLUID token supply is in circulation, while the remaining 60 % is held in the protocol treasury. This distribution gives the DAO considerable leeway to define the future use of these tokens: financing development, supporting ecosystem growth, burn, or redistribution. While this flexibility can be seen as an opportunity, it also presupposes active, responsible and transparent governance, which remains to be confirmed over time.

In the medium term, the token's economic interest is largely based on the activation of the buyback program, which will only be triggered once $10 million in annual revenues has been achieved. This threshold, though realistic, has not yet been reached at the time of writing. The mechanism envisaged (dynamic buyback of tokens according to revenue levels and the token's FDV) has the merit of aligning the token's valuation with the protocol's actual performance, but remains to be proven in an evolving market context.

For the time being, the FLUID token does not directly redistribute income, and holders need to take a long-term view, betting on the gradual rise of the ecosystem and the DAO's ability to activate these economic levers. It's a position that requires confidence, but also vigilance.

In short, to own FLUID today is to be exposed to growth under construction, driven by an innovative infrastructure and a business model still in the activation phase. Lhe potential for value enhancement is based on rigorous strategic execution, growing revenues and governance's ability to effectively manage redistribution mechanisms. For an informed and patient investor, it's an opportunity to align early on a structured growth trajectory, in an ecosystem in search of sustainability.

To watch out for: an incident on DEX v1, awaiting structural response with DEX v2

At the time of writing, an incident affected the USDC/ETH pair on Fluid's DEX, resulting in losses for some liquidity providers (LPs). The team recognized the problem afterwards and announced compensation in the form of 500,000 FLUID tokens, distributed with a one-year vesting period. This compensation is a posteriori, rather than a structural protection.

Although this episode does not call into question the overall thesis, notably the soundness of the architecture and the protocol's potential, it does highlight an important point of attention: the current version of DEX (v1) remains perfectible on certain risk management mechanisms, particularly for non-stable pairs, since liquidity ranges are defined automatically.

The release of DEX v2, announced as a complete overhaul with more secure range order logic and reinforced protections, will be a key test to follow to see if this type of malfunction can be avoided in the future. In the meantime, this incident serves as a reminder that rapid innovation is always accompanied by a running-in phase, and that we need to keep a critical eye on even the most promising projects.

For more details on this incident, a discussion with the community has been opened on the Fluid governance forum.

Conclusion

At Crypto Asset Management, we see in Fluid one of the most promising protocols of the new DeFi generation. By integrating lending, DEX and liquidity into a unified architecture, the protocol offers a coherent response to the structural limitations of decentralized finance.

With innovative building blocks such as Smart Debt and an efficient Liquidity Layer, Fluid is already positioning itself as a credible technical base. Its cash-rich governance and revenue-driven buyback strategy add further attractive alignment with holders.

Nevertheless, there are still a number of aspects to watch out for. The economic structure of the $FLUID token would benefit from better formalization of value capture for holders, and the release of DEX v2 will be an important test, especially after the first incidents with v1.

Despite these points of vigilance, we consider that $FLUID as a strategic asset to be closely monitored, at the crossroads of innovation, sustainability and the construction of a robust, scalable DeFi infrastructure.

If you wish to download the report in PDF :

A word from the author :

Mine is LittleGhost. I spend my days studying DeFi, reading governance proposals, and trying to figure out how to build something truly sustainable in this fast-moving ecosystem.

If you wish to continue to follow my work :

📺 YouTube: LittleGhost

🐦 Twitter/X : @0xLittleGhost

Thank you very much for taking the time to read this report, and see you soon for further analyses.

Our service

At Crypto Assets Management, we offer discretionary management of digital asset portfolios, customized to your profile. Our strategy is based on analysis and management of Bitcoin cycles (historically 4 years)with a focus on long termmonthly arbitrages, and with a particular focus on tokenomics.

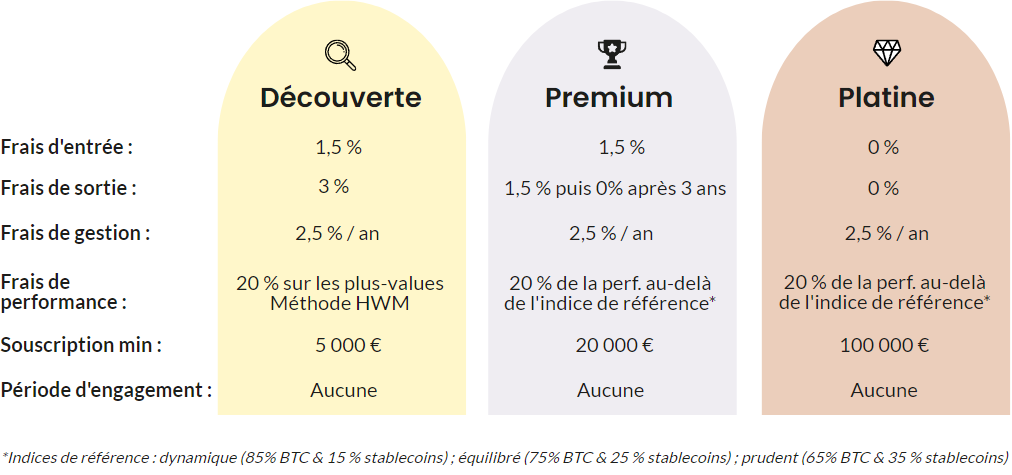

Our rates

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This letter does not constitute investment advice.

You alone are responsible for your investment decisions.

Investing in digital assets involves a risk of partial or total capital loss.