Crypto Assets Management - Mereau Finance

Company registered as a PSAN with the AMF under number E2023-084

RCS Nanterre: 894 424 902

Address: 35 rue Jean Jaurès, 92800 Puteaux, France

Date: April 29, 2025

PORTFOLIO MANAGEMENT UNDER MANDATE

OUR VISION

We are committed to supporting you in your investment in digital assets over the long term. In this volatile and risky asset class, a calm and sustainable approach is essential.

«Digital assets are to the transfer and storage of value what the Internet was to the transfer and storage of information.»

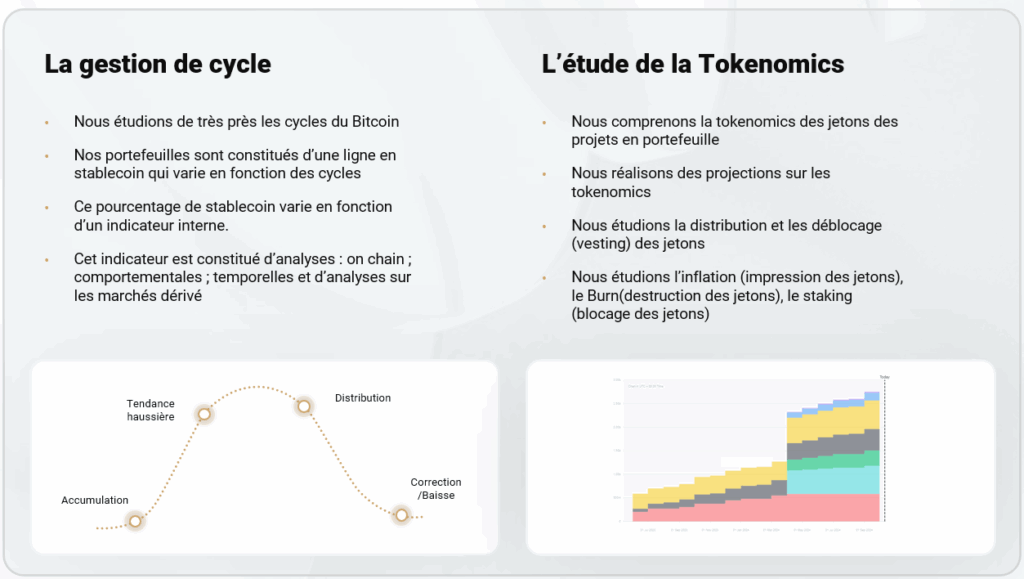

OUR STRATEGY IS BASED ON TWO PILLARS

OUR INVESTMENT PHILOSOPHY

Our investment approach is based on identifying high-efficiency projects with solid fundamentals. We carefully analyze their tokenomics to spot any market anomalies. Our selection focuses on projects in the top 200 by capitalization, with a medium-to-long-term vision, covering various sectors of the crypto ecosystem.

Our thesis today is based on the following idea: Aave is today the beating heart of DeFi. And as this finance structures itself, connects to the real world and attracts institutional flows, Aave is ideally placed to capture this value, by placing the AAVE token at the center of this dynamic.

Aave (AAVE) - Research report

AAVE, A FINANCIAL INFRASTRUCTURE IN ITS OWN RIGHT

Aave is no longer just a lending protocol. Over the years and with each new version, it has become a foundation for decentralized finance.

Originally a simple P2P lending platform, it has evolved into protocol based on liquidity pools, then in interoperable multichain infrastructure, governed by a Dynamic CAD.

Today, the protocol operates on 14 blockchains, with independent markets.

Each evolution of Aave has served a clear purpose: develop a decentralized monetary structure, capable of absorbing the financial uses of blockchain, while guaranteeing transparency, safety and community governance.

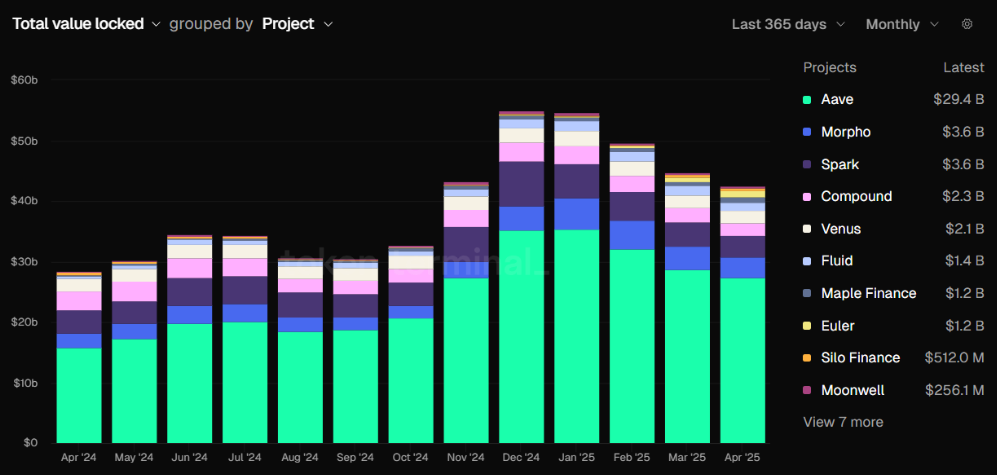

One of the best indicators of confidence in a DeFi protocol is the total value deposited (TVL). Aave significantly outperforms its competitors:

- 27.9 billion $ of TVL, i.e. nearly 50 % of the total liquidity of the decentralized lending market.

- In comparison, Spark and Morpho each reach 3.4 billion $, or eight times less than Aave.

This structural dominance reflects several dynamics. Firstly, a robust multi-channel architecture that ensures a presence on all major networks, attracting users with a wide range of profiles, both individual and institutional.

Secondly, the network effect comes into full play: the more abundant the liquidity, the greater the incentive for users to deposit their assets there to benefit from better lending and borrowing conditions.

Finally, governance and continuous innovation - notably with the deployment of Umbrella, the AAVE token buyback program, real asset tokenization (Horizon), and the development of V4 - reinforce Aave's credibility and competitiveness.

Beyond quantitative metrics, Aave also stands out for the quality of its execution and the strategic coherence of its evolutions. Each new feature - whether it's the introduction of the GHO stablecoin or the isolated mode for integrating new collateral - responds to a real market need and is part of a long-term vision. Where some competitors launch products that are experimental or dependent on artificial incentives, Aave builds solid financial primitives, designed to last and adapt to the evolution of both crypto and institutional uses.

Finally, the open, modular nature of the protocol - reinforced by its active governance - makes Aave a programmable infrastructure with high backing value. Many DeFi protocols, but also Web3 companies and RWA initiatives, rely on Aave as a liquidity layer or monetary back-end. In this way, Aave is not just dominating a market: it is becoming the technical foundation on which a new kind of finance is developing. A finance whose foundations are still under construction, but in which Aave is already asserting itself as one of the essential architects.

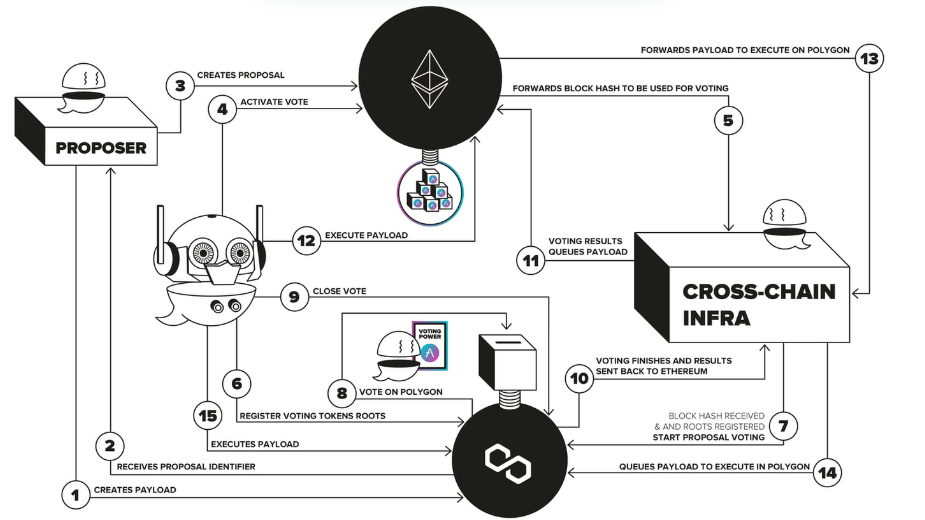

GOVERNANCE AS A DRIVER OF INNOVATION

Aave is one of the few protocols where community governance is not limited to a symbolic role. Since 2021, the Aave DAO has voted on dozens of decisive proposals: deployment on new channels, integration of assets, adjustment of risk parameters, changes to tokenomics, and so on.

The AAVE token is at the heart of this governance. Holding an AAVE token gives you the right to influence the evolution of the infrastructure, with the possibility of voting on governance proposals, or delegating your voting power to DAO service providers.

But it also means access to economic opportunities: staking in the Safety Module, which will soon be replaced by a Staking Module, which will enable Aave stakers to benefit from part of the protocol's revenues.

Among the Aave DAO's most active service providers, Chaos Labs and Llamarisk play a central role in risk management, modeling collateral parameters and continuously monitoring the economic health of the protocol. TokenLogic is in charge of cash management, with regular proposals on fund allocation, swap strategies, and now the implementation of the AAVE token redemption program.

For its part, the Aave Chan Initiative (ACI) acts as a strategic driver of governance, structuring major proposals such as the updating of Aavenomics.

Together, these entities form a decentralized yet highly functional structure, halfway between a developer collective and an extended enterprise, capable of competing with the largest organizations in traditional finance.

GHO: A STRATEGIC TURNING POINT IN THE AAVE MODEL

The launch of GHO in 2023 represented a major bifurcation in the protocol's trajectory.

But the key innovation lies not in the design of the stablecoin, which is already well established. It lies in the value capture model. Whereas Maker redistributes interest to its stakers, Aave redirects it entirely to the DAO. This detail changes everything: the interest paid by GHO borrowers becomes a native revenue of Aave governance, which can do with it as it wishes: finance token buybacks, feed cash flow, subsidize integrations, or even fund incentives.

GHO is not just a functional extension. It's a powerful economic lever, enabling Aave to add a monetary layer to its infrastructure. And this leverage is still largely under-exploited. In April 2025, GHO represented a supply of 200M$, a low figure compared with DeFi's total potential. Its extension to other blockchains (already on Polygon, Arbitrum and Base), coupled with a more aggressive adoption strategy (integration into payments or Web3 applications such as the on-chain social network Lens), could explode this metric.

A PLURAL GROWTH TRAJECTORY: AAVE TAKES ON GLOBAL FINANCE

If there's one thing the markets reward over the long term, it's the ability to grow beyond one's home market. And that's precisely what Aave is about to do: move beyond the historical DeFi framework to become a global monetary infrastructure, at the crossroads of three major trends - the tokenization of real-world assets (RWAs), the move towards robust native economic security, and the unification of liquidity across blockchains.

Horizon: Aave opens up to institutions and tokenization

The Horizon project is probably the most ambitious strategic move undertaken by Aave since the launch of V3. Its principle: to enable regulated financial institutions to interact with Aave via a permissioned instance of the protocol, capable of hosting tokenized assets such as money market funds, credit or even real estate.

This initiative responds to a clear need: RWA markets are exploding (+700 % in TVL over twelve months), but the Aave DAO captures only a marginal fraction of this value. Horizon proposes to fill this gap by combining DeFi infrastructure and regulatory requirements, via a shared revenue model (50/50) between Aave Labs and the DAO. This strategy would enable Aave to generate revenues uncorrelated with traditional crypto cycles, while reinforcing the relevance of the GHO stablecoin within the ecosystem.

The most promising?

The ability for qualified institutions to borrow GHO against RWA collateral, creating a structural bridge between traditional finance and the on-chain economy. As these uses become normalized, Aave could become one of the major invisible players in global tokenization, capturing massive flows of stable liquidity.

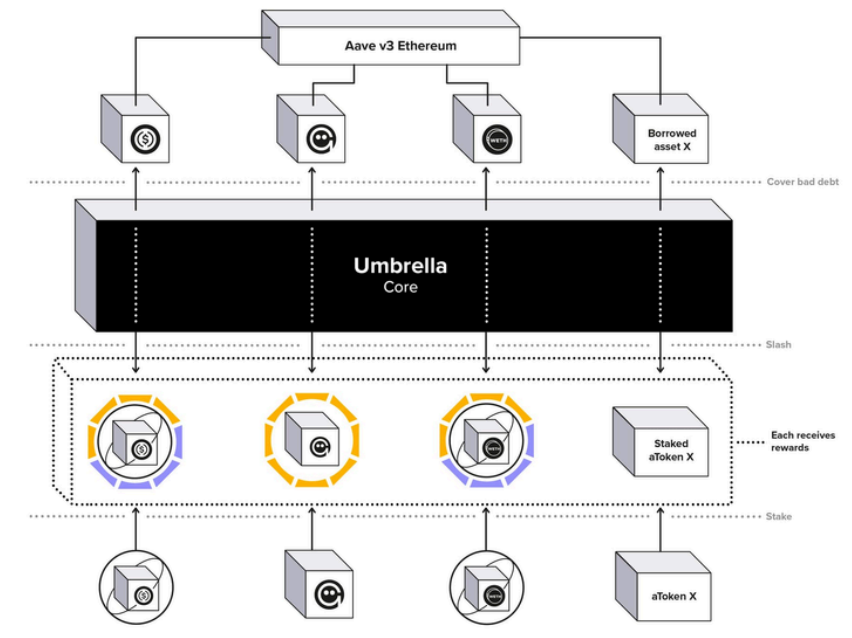

Umbrella: securing growth through native risk coverage

The final brick in this expansion is Aave Umbrella, a security system based on the staking of aTokens themselves (such as aUSDC, aDAI, etc.). Unlike the classic Safety Module, where stakers risk their AAVE, Umbrella allows users to directly stake the tokens used as collateral in Aave. In the event of uncollectible debt, staked aTokens can be burned to cover the loss, automatically and objectively.

This mechanism changes everything:

- It removes the selling pressure on the AAVE token in the event of slashing.

- It improves the solvency of the protocol, by aligning incentives with the reality of financial flows.

- It paves the way for large-scale, multi-chain coverage, with dynamic rewards calibrated according to TVL and protection needs.

By enabling “native” risk coverage, Umbrella strengthens Aave's legitimacy as a credible lending infrastructure in the eyes of institutions - a prerequisite for mass adoption.

Aave 2030: a technical roadmap for a decade ahead

At the same time, Aave Labs' Aave 2030 vision proposes an in-depth overhaul of the protocol based on three major pillars:

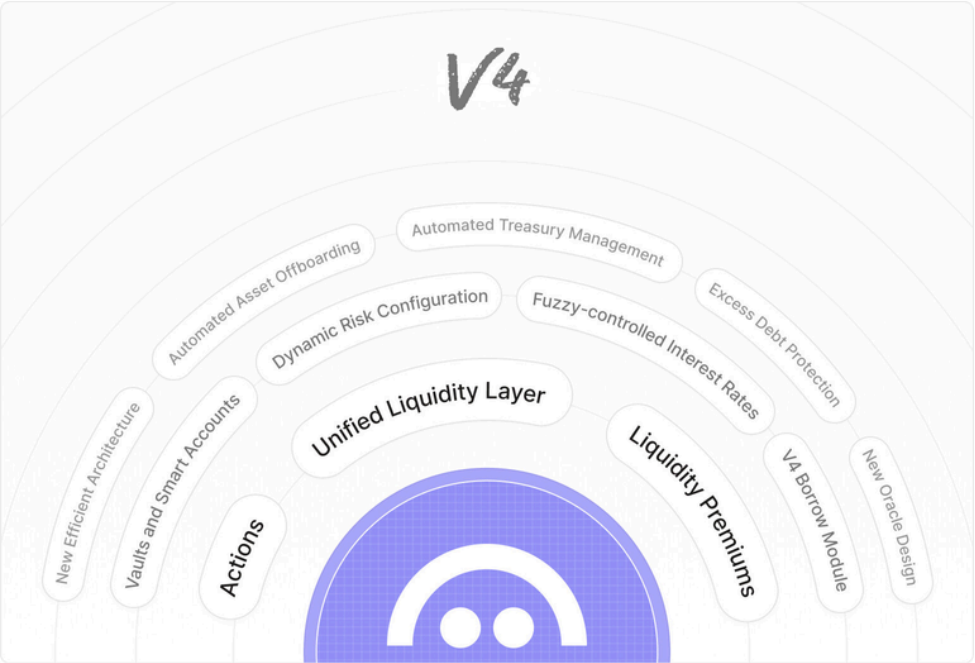

- Aave V4, a new modular architecture with unified cross-chain liquidity management, native ZK-rollup support and a streamlined governance system; ;

- Cross-Chain Liquidity Layer (CCLL), designed to make Aave a “universal bridge” between blockchains, where a user can borrow on Arbitrum with collateral on Base or Ethereum without friction ;

- The Aave Network, a home-grown L2 (probably based on Validium or zkRollup) where GHO would be used as a fee token, AAVE as a staking asset, and unified governance for all instances.

These technical choices are not insignificant: they enable Aave to remain independent of the underlying blockchains while controlling its distribution, fees and incentives.

It's a paradigm shift: Aave is no longer just an Ethereum-integrated protocol. It becomes a sovereign infrastructure, able to deploy, monetize and evolve according to its own rules.

A DISCIPLINED BUYBACK STRATEGY

STRUCTURALLY ALIGNED WITH VALUE CREATION

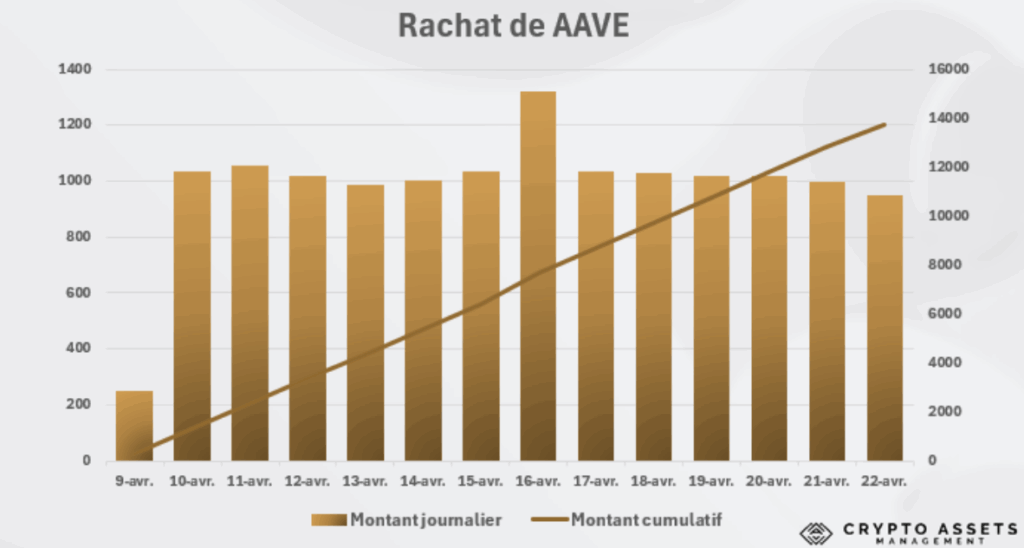

April 9, 2025 marks a turning point in Aave's financial governance, with the official launch of its AAVE redemption and redistribution program, as part of the progressive implementation of the Aavenomics plan. This program is more than just a symbolic token support operation - it materializes a coherent macro-economic strategy for recycling surplus protocol revenues to the benefit of token holders.

A structural program, backed by real surpluses

In the space of just ten days, 11,285 AAVEs were bought back at an average value of 139.25 $, representing an investment of over $1.57 million, financed in stablecoins via the protocol's reserves. This rate corresponds exactly to the budget voted in the governance: 1 million dollars per week for six months, i.e. a provisional envelope of 26 million dollars for this first cycle.

Unlike the majority of buyback programs seen in DeFi, Aave's is not a one-off, or even “opportunistic” (linked to a drop in price). It is designed as a systemic and sustainable mechanism, sized according to the protocol's actual budget, with strict safety margins.. The newly-mandated Finance Committee (AFC) adjusts allocations every month according to the assets available in the treasury, with purchases potentially entrusted to third-party market makers.

Beyond its accounting impact, this buyback program reflects a fundamental change in the way the DAO manages its surpluses: move from a logic of passive accumulation to one of active valuation of the AAVE token. By redirecting part of its revenues to the secondary market, Aave introduces a regular price support mechanism, while reinforcing the perceived value for its stakers. This policy also helps to further align interests between protocol users, token holders and governance, creating a virtuous circle of value creation based on organic growth rather than dilution.

Visible effectiveness despite neutral conditions

From a strictly financial point of view, the program posted a slightly negative performance on April 20 (-9,200 $, i.e. -0.59 %), reflecting an average purchase price slightly higher than the current price. But that's irrelevant: the aim is not short-term speculative profit. What this operation really achieves is :

- Reduce the circulating supply of AAVEs by transferring purchased tokens to the ecosystem reserve. If the average purchase price remains around 140 $, more than 350,000 AAVEs could be redeemed over the course of a year, i.e. around 2.2 % of the current supply.

- Redistribute redeemed AAVEs to protocol stakers, now freed from their cover role thanks to Umbrella.

This choice gives priority to rewarding holders aligned with the long term, rather than carrying out a burn that would indiscriminately benefit all holders, including those who speculate or do not actively participate.

In this way, redistribution targets those who truly support the ecosystem, reinforcing commitment and loyalty to the protocol.

CONCLUSION

At Crypto Asset Management, we believe that Aave is one of the most underrated protocols in terms of fundamentals in the crypto universe. While the market has often favored novelty or artificially boosted returns, Aave has pursued a clear course: robustness, economic sustainability and the construction of sustainable infrastructures.

By combining a dominant position on the lending market, a clear vision around the GHO stablecoin, strategic initiatives in tokenization (Horizon), security (Umbrella), and governance (Aavenomics), the protocol is building a comprehensive financial architecture that anticipates the needs of both individual and institutional users.

The AAVE token embodies this vision: not only a governance tool, but also and above all a share in the capital of an organically growing, well-financed platform, capable of redistributing its revenues to its aligned holders.

In an ecosystem looking for quality and the long term, we see AAVE as a strategic asset for any investor wishing to gain exposure to the backbone of tomorrow's DeFi.

If you wish to download the report in PDF :

A word from the author :

Mine is LittleGhost. I spend my days studying DeFi, reading governance proposals, and trying to figure out how to build something truly sustainable in this fast-moving ecosystem.

If you wish to continue to follow my work :

📺 YouTube: LittleGhost

🐦 Twitter/X : @0xLittleGhost

Thank you very much for taking the time to read this report, and see you soon for further analyses.

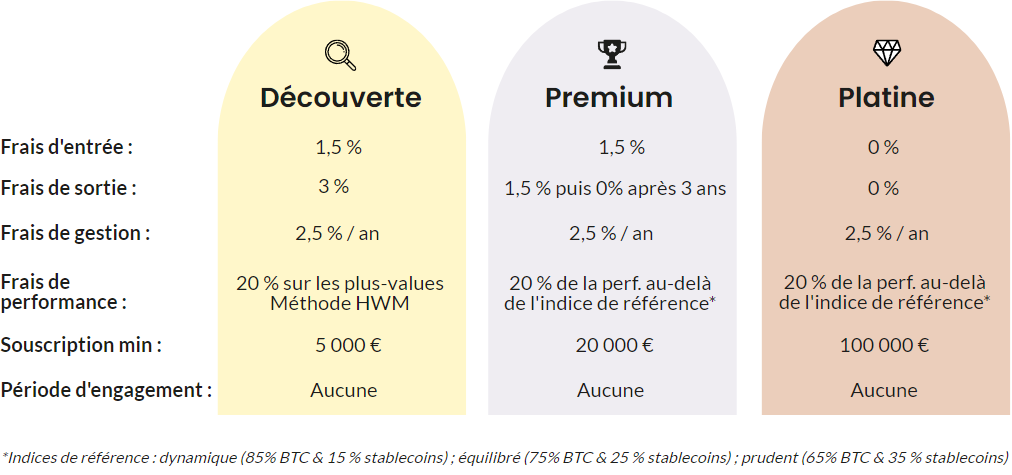

Our service

At Crypto Assets Management, we offer discretionary management of digital asset portfolios, customized to your profile. Our strategy is based on analysis and management of Bitcoin cycles (historically 4 years)with a focus on long termmonthly arbitrages, and with a particular focus on tokenomics.

Our rates

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This letter does not constitute investment advice.

You alone are responsible for your investment decisions.

Investing in digital assets involves a risk of partial or total capital loss.