The aim of this letter «Political evolution & End of cycle or continuation of the cycle?» is to inform you about the current situation of the crypto-asset market but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

83 % of institutional investors plan to increase their exposure to cryptocurrencies. In 2025, institutional investors intend to strengthen their presence in the cryptocurrency market. According to a study conducted by Coinbase and EY-Parthenon, 83 % of them plan to increase their allocation to digital assets in the coming months. A trend driven by the rise of Bitcoin ETFs, stablecoins and DeFi.

-

Elon Musk denounces «magic money computers» in the US government. Elon Musk, senior advisor to President Donald Trump and director of the Department of Government Efficiency (DOGE), claims to have seen with his own eyes 14 «magic money computers» within the US federal government: machines that would have the ability to issue payments without any real financial counterpart, enough to encourage him to take the country's finances back into his own hands.

-

According to Donald Trump, the U.S. will «dominate crypto» and become «the undisputed Bitcoin superpower». This afternoon, Donald Trump spoke at the Blockworks Digital Assets Summit to a panel of blockchain and cryptocurrency enthusiasts. A short speech that seems to have disappointed overall.

-

USDT: Tether is the 7th largest buyer of US Treasuries, ahead of Canada and Germany. With over $145 billion in capitalization, USDT dominates the stablecoin market. To guarantee its parity with the dollar, Tether invests its reserves in US debt, to the point of becoming one of the world's leading buyers of Treasury bills in 2024.

-

Aave's DAO is preparing one of the biggest changes in its history. With its latest DAO proposal, Aave is poised to become the behemoth of decentralized finance. Changes to the reward system for stakers, increased security in the face of risk, and even service providers for other protocols. Aave is ushering in a new era in DeFi.

Fundamental Analysis

Source : https://www.coingecko.com/fr

Lettre N°46: Two scenarios for the future; The digital gold rush

The Bitcoin price at the time of writing is 85,785 $ (03/28/25).

Two scenarios for the sequel

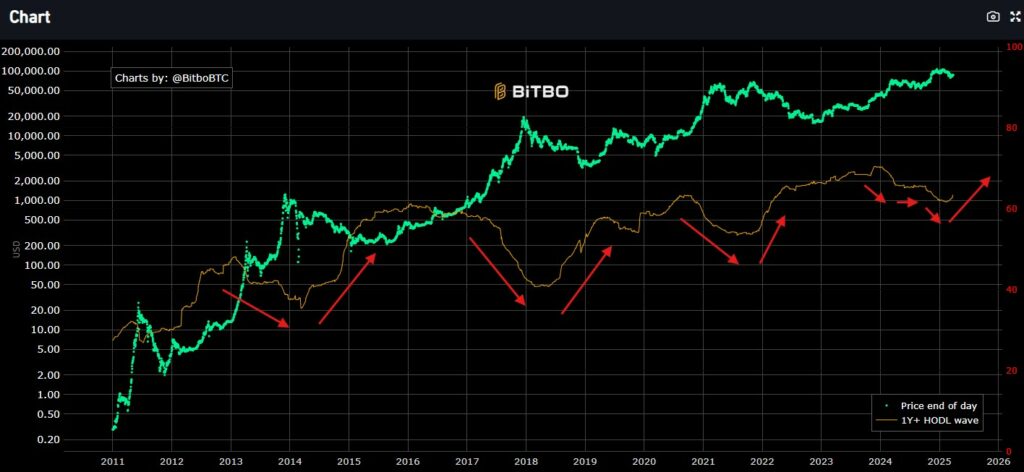

The chart below illustrates the behavior of long-term holders, who widely distributed their Bitcoin tokens (-929,000 BTC, red zone) during the first bullish wave triggered by the launch of the ETFs in early 2024.

Subsequently, the market stabilized before beginning a gradual plateau decline. During this phase, these same investors began to re-accumulate some of the tokens previously sold (+817,000 BTC, green zone).

A similar pattern was repeated in the winter of 2024, with a sale of 1.11 million BTC followed by a gradual redemption phase. This dynamic reflects a cycle marked by successive periods of euphoria and consolidation, a healthier pattern than previous cycles, often dominated by excessive euphoria followed by a brutal correction.

Taking a step back and analyzing past cycles (below), we can clearly see the distribution and accumulation phases of long-term holders. In the current cycle, as illustrated in the previous graph, two major waves of distribution and accumulation have taken place, unlike previous cycles which had only one wave.

Generally speaking, these investors gradually accumulate bitcoins when prices fall, and intensify their purchases during sharp corrections. Currently, long-term holders seem to have entered a new phase of accumulation, which historically lasts between six months and a year at the end of the cycle. Thereafter, accumulation continues, but at a slower pace throughout the inter-cycle period.

This leads us to consider two scenarios for the continuation of this cycle:

- A consolidation phase that could last a few more months, followed by a third wave of price rises, leading to further distribution by long-term holders and marking the end of the current cycle before they enter a major accumulation phase.

- A more pronounced correction would signal the end of the cycle and the start of a new period of strong accumulation by long-term holders.

We're leaning towards the second hypothesis, as long-term holders already seem to be stepping up their purchases. Conversely, in mid-2024, their accumulation was more moderate, resulting in a «plateau» trend.

In any case, caution remains the watchword in the short term.

The digital gold rush in the very long term

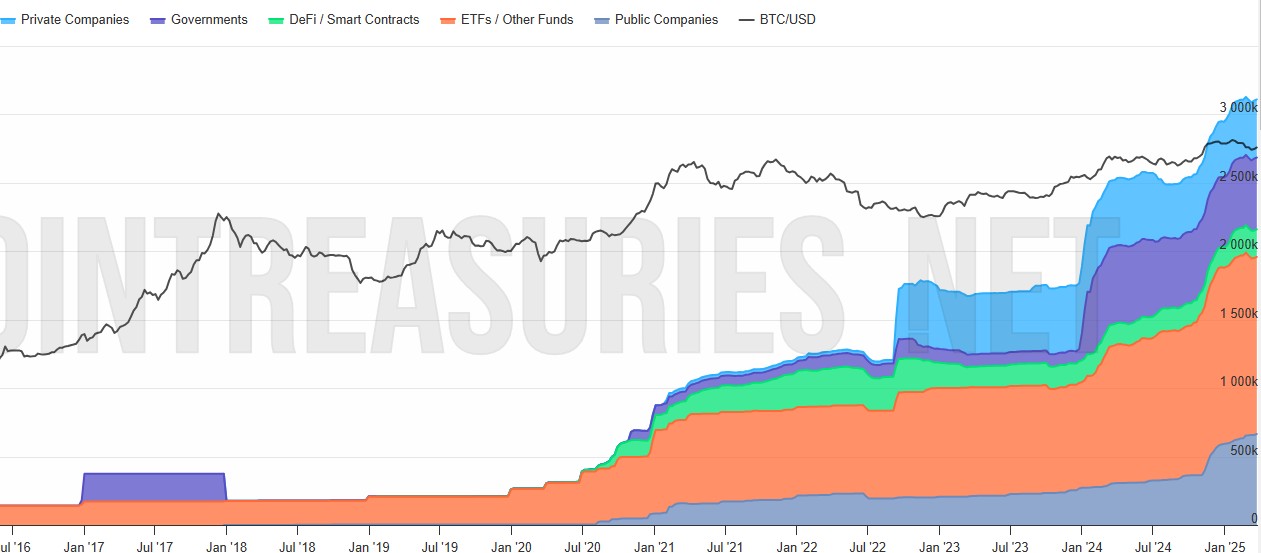

In the very long term, we are witnessing a veritable scramble for the digital gold that is Bitcoin. Large corporations, both public and private, are gradually accumulating Bitcoins over the years in order to gain long-term exposure to this store of value.

Confidence in this asset continues to grow, reinforcing the likelihood of success for the Bitcoin project. As this probability increases, so does its price. Once Bitcoin is fully adopted, it will reach a kind of valuation ceiling measured in gold (because if we measure its value in inflationary currency, which continues to depreciate, its price will keep rising).

Bitcoin will therefore reach an extremely high valuation once the risk associated with its investment has all but disappeared.

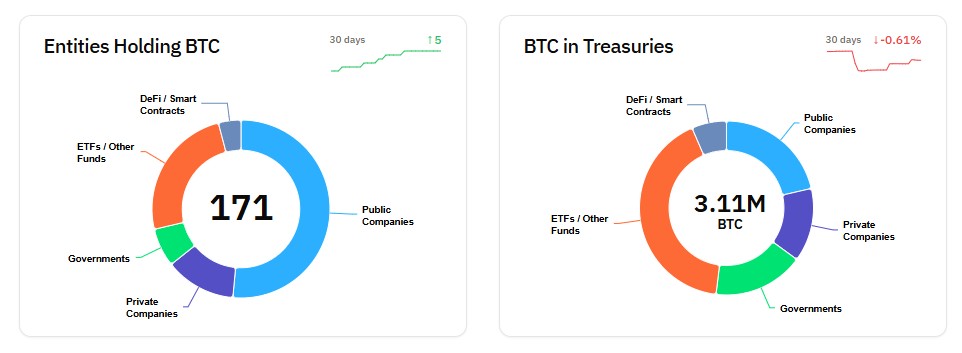

The majority of institutional holders are ETFs, accounting for around 45 %, followed by public companies such as MicroStrategy and Coinbase. Governments hold around 15 %, followed by private companies and a few DeFi contracts.

The strategic Bitcoin reserve in the United States

On March 6, 2025, the President of the United States issued an executive order officially instituting the program, a strategic bitcoin reserve. This reservation does not concern the direct purchase of bitcoins on behalf of the United States, but rather reflects a political will never to sell bitcoins already held by the country, nor those it has acquired to date, nor those it may acquire in the future through judicial seizures.

Many market players expressed disappointment, hoping for an announcement of direct bitcoin purchases by the United States. However, it seems that the move is primarily to preserve existing resources and avoid adding to the budget already in the process of recovery.

Seven years ago, when I first discovered digital assets, the idea of the United States publicly broaching the subject seemed unimaginable, as did the idea of major public companies doing the same. Today, seven years later, we see private companies, public companies and states, including the USA, discussing and accumulating reserves in bitcoins! The long term is moving fast!

Our service

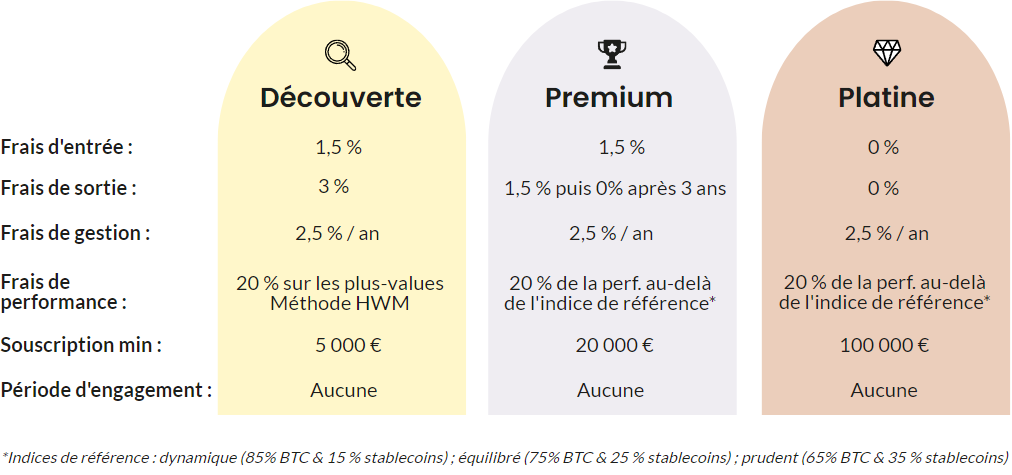

At Crypto Assets Management, we offer discretionary management of digital asset portfolios, customized to your profile. Our strategy is based on analysis and management of Bitcoin cycles (historically 4 years)with a focus on long termmonthly arbitrages, and with a particular focus on tokenomics.

Our rates

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This letter does not constitute investment advice.

You alone are responsible for your investment decisions.

Investing in digital assets involves a risk of partial or total capital loss.