Hello everyone,

The aim of this letter is to inform you about the current situation of the cryptoasset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

ADAN (Association pour le Développement des Actifs Numériques) recently unveiled a groundbreaking study on the state of the crypto sector in France. As this sector develops rapidly, it's essential that our public decision-makers and businesses grasp the challenge of establishing France as the future crypto stronghold.

This study confirms the need to act now and quickly in France, so as not to miss the challenge of the crypto sector in the same way as we missed the challenge of the Internet in the 2000s. You can download this study on the ADAN website directly here. There is a long version and a summary.

A few figures to sum up the study:

-> 8 % of French people have already invested in cryptos, compared with 6.7 % of French people who own shares (according to the AMF). It is estimated that there will be 12 % of French crypto investors by the end of the year.

-> 30 % of French people are considering investing in cryptos, compared with 37 % of French people who are interested in acquiring shares.

-> 77 % of French people have heard of cryptos

-> 46,7 % haven't invested, because they don't know enough about how cryptos work.

-> More 1129 direct employeess in the crypto sector (low bound with the 29 largest companies in the sector surveyed). The projection for January 2023 is approximately 2500 jobs.

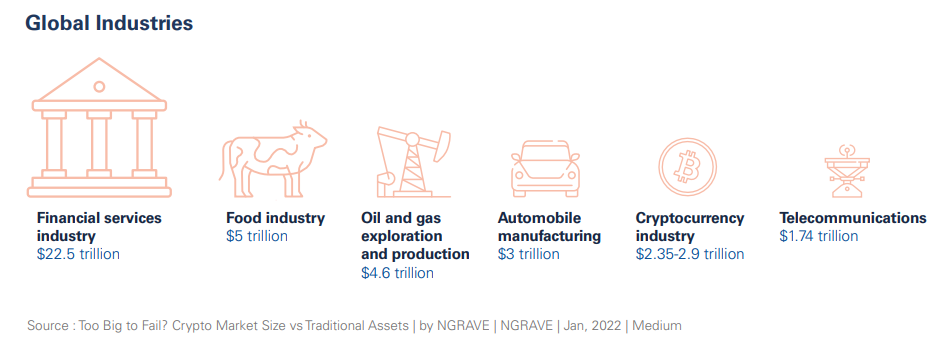

The crypto market is growing rapidly both nationally and globally

The year 2021 saw the crypto market surpass the €2 trillion capitalization mark for the first time, putting it ahead of the capitalization of silver (precious metal) (€1135 billion).

This capitalization represents the total value of cryptos in circulation, but does not count the value generated by the companies that produce services in this industry or all the indirect value produced by the sectors that gravitate around it.

-

Uber will accept Bitcoin «sooner or later» - Uber CEO's shock statement. The CEO admits that the subject is becoming increasingly serious internally. Discussions on the adoption of cryptos are an almost daily occurrence within the company.

«As this mechanism evolves into a less and less expensive and more environmentally responsible model, I think you'll see us looking even more into cryptos. And if what you want me to say is «Will Uber accept cryptos in the future? Yes absolutely, eventually.» Khosrowshahi CEO of Uber.

-

Toulouse: a new campus will open in May 2022 to train digital experts. This new campus will open its doors on May 16, 2022, in response to the talent shortage in the digital sector. Specializations will be opened for virtual and augmented reality and blockchain subjects.

Miscellaneous

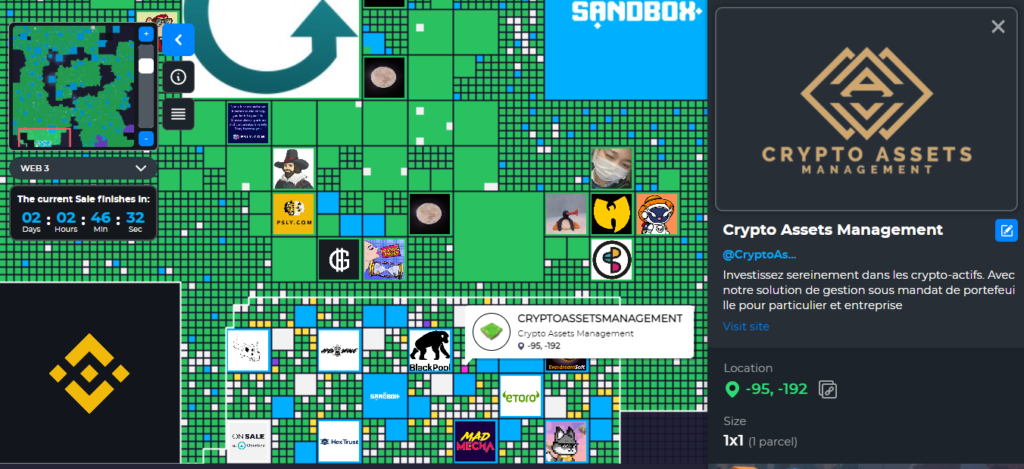

We're delighted to announce that Crypto Assets Management now owns a digital plot in Metavers The Sandbox! You can reach us at coordinates (-95, -192).

Our site is located close to Binance, BlackPool and ETORO. Other companies have also chosen to enter this metaverse, including Adidas, Atari, Warner music group, Carrefour, The Walking Dead, Snoop Dogg, Gemini, Galaxi Interactive, CoinMarketCap and many others.

What is a metaverse? It's a a digital world in which Internet users can communicate with each other on a global platform via their own unique avatar. These sets of virtual spaces allow you to spend time with friends, work, play, learn, shop, attend sporting or musical events, create and much more.

Blockchain technology and the birth of crypto-assets were the missing link in the edifice of a true metaverse. We'll be writing about this in the near future.

The Sandbox is a decentralized metaverse based on the Ethereum blockchain, which enables peer-to-peer exchanges of value with an ERC-20 digital token (token based on the Ethereum blockcahin) but also enables the detension and ownership of digital objects thanks to the ERC-721 format (NFTs). A whole economy is created in this metaverse, and unlike a simple video game, this economy is linked to the tangible world we know. Indeed, the value of the token circulating in The Sandbox's economy is very real and transferable to our world, unlike the currency of a fictitious game locked away within it.

New professions appear in this type of metaverse: owners of the land that makes up the metaverse can rent out their land, builders/architects construct the game's elements, creators of objects, equipment and art, but also creators of activities, experiences and adventures within the game.

You can click here to discover some videos and better understand what this metaverse looks like.

It can be hard to imagine this new digital world. But if you think about it for a few minutes. Before the 2000s, people would never have imagined the image of the world we live in today, and the extent to which, by 2022, digital technology would be completely entrenched in our societies, and how dependent we would be on it on a daily basis. But it's happened, and we can't change these trends.

Fundamental Analysis

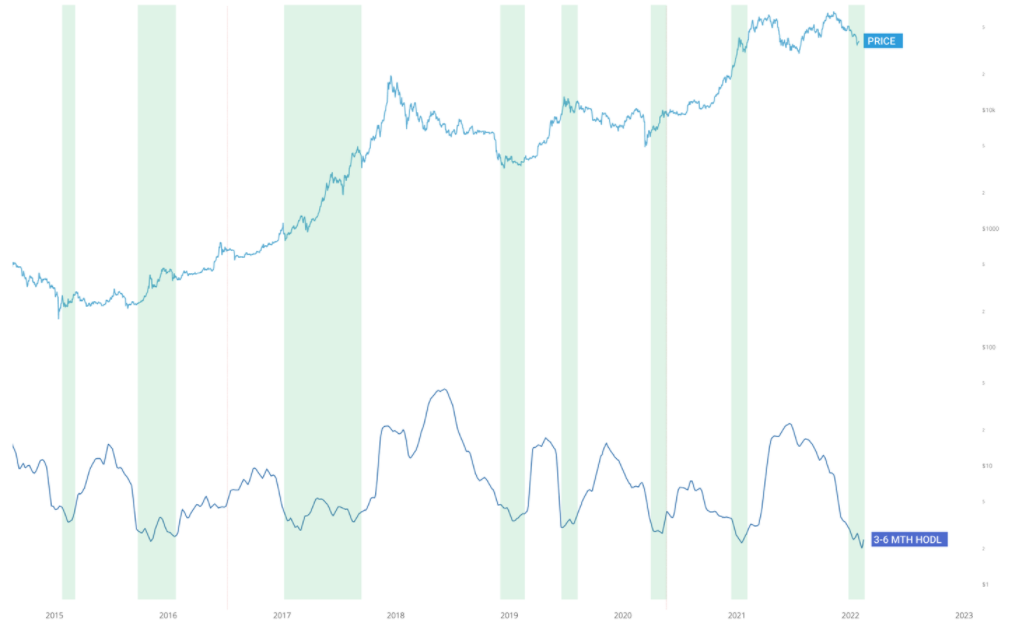

Here's the price of Bitcoin over the past two years in dollars.

The Bitcoin price at the time of writing is 44,100 $ (on 16/02/22).

The recent rebound we had 3 weeks ago was the result of an extreme undervaluation of fundamentals. As mentioned in our previous newsletter (N°9), The price in relation to hodlers and speculative fundamentals was at the extreme of oversold.

In contrast to past downward phases, the last 3 months of downward price action have been initiated by selling pressure on the futures markets: probably, due to the fact that institutional investors are holding on to their BTC while shorting futures contracts.

We're noticing that the market is evolving with more and more derivatives, as more and more professionals and institutions are investing. This is good news for the large quantity of flows pouring into the crypto-asset economy, but our «on-chain» analyses are a little modified by it, as we don't have as precise an overview as we used to when investment activity was solely on the Bitcoin blockchain. So we're going to try and take better account of derivatives, which now have an increasingly important impact on prices.

We are no longer at maximum oversold levels relative to fundamental supply and demand on the blockchain. During the 14 days when bitcoin traded below 40,000$. There was very strong buying by the «whales» (very large wallets).

- Long-term cycle : In terms of the broader macro cycle, we're on a countdown to the next bullish phase. Coin holdings by large investors are steadily increasing. The more coins these types of investors hold, the closer we are to a bullish phase.

- Medium-term cycle (3 months) : Chain selling has eased, with futures continuing to sell off. We expect continued sideways price action followed by an accumulation phase before the bullish phase can occur.

- Short-term cycle (1 month): Chain supply and demand is no longer oversold, which means we are not sure that prices will recover strongly in the short term. Short-term investors have sold off strongly in recent months, which means further selling pressure is unlikely.

In the chart below, we can see that coins held by short-term holders (3 to 6 months) are in a bottom zone. We can therefore assume that investors intending to sell have already sold. So the risk of a further sharp fall has been largely mitigated.

This tells us that we are close to a macro bottom (a long-term low). We are more likely to go sideways with a gentle rally.

As stated in our previous letters, we still believe that ETH (Ethereum) will outperform BTC (Bitcoin) in the future. This has been true for the past few months.

If you have any questions, comments or would like to find out more about our service, please do not hesitate to contact us: crypto.assets.manage@gmail.com

- Warning -

This is not investment advice. No one can predict the future.

You are solely responsible for your own investment decisions.

We are not responsible for any loss resulting from a decision taken on the basis of the information in this letter.