Hello everyone,

The aim of this letter is to inform you about the current situation of the crypto-asset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

The euro turns 25: has it succeeded in its initial mission? With a little more hindsight, we can see that beyond having experienced a period of high inflation since the Covid-19 crisis, the euro has lost almost 42 % of its value since 1999. A figure which contrasts with the price stability claimed by the ECB President.

-

Bitcoin spot ETF: the Securities and Exchange Commission (SEC) gives the green light to a series of applications. In a historic turning point for the cryptocurrency world, the US Securities and Exchange Commission (SEC) has approved Bitcoin spot ETFs, marking a major step in the integration of cryptocurrencies into the traditional financial system.

-

Ethereum (ETH): the Dencun update lands on the Goerli testnet. Last night ( 17/01/24), the Ethereum Goerli testnet welcomed the long-awaited Dencun update. This is an important milestone, prior to deployment on other test networks and the mainnet.

-

The United States now holds over $8 billion in Bitcoin (BTC) The U.S. government and its 194,250 Bitcoins (BTC) even surpass MicroStrategy. As a result, the United States is now the world's leading Bitcoin holder. This $8.45 billion arsenal comes from seizures, notably in the Bitfinex affair and the collapse of the Silk Road black market.

-

Bitcoin: the number of merchants accepting BTC will almost triple by 2023. According to data from BTC Map, the number of merchants accepting Bitcoin (BTC) as a means of payment will almost triple by 2023. What can we learn from these figures?

-

In Europe, MICA is increasingly attracting crypto investors. By adopting the Market in crypto Asset (MiCA) last June, Has Europe set in motion a virtuous circle of economic growth for the crypto sector on the Old Continent? That's what the figures in a report published by Kaiko, a company specializing in data research and analysis for Web3 professionals, seem to show.

Fundamental Analysis

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 42,624 $ (on 18/01/24).

The communicating vessels between Bitcoin and Altcoins:

It's easy to see that bullish cycles have two pronounced phases:

The first phase marks the start of the rally, with Bitcoin outperforming the rest of the market. The second and final phase of the cycle is when Altcoins outperform.

We believe that the first phase, characterized by BTC's outperformance, can be explained by several factors. Firstly, Bitcoin is the most widely adopted, most liquid and most trusted digital asset, prompting many investors to focus exclusively on it. In the second phase, investors are turning to new innovations and investing in themes such as ICOs, DeFi, NFTs and so on.

Below is a chart from Pantera Capital that highlights phases 1 and 2. The golden curve representing altcoin market share declines in phase 1 and rises sharply in phase 2.

Around 60 to 70 % of the time, altcoins' market share increases during a bull market.

Source : Pantera Capital

What's surprising is that the scale of Altcoin's outperformance at the end of the bull market makes it more attractive to maintain constant exposure to these Altcoins, provided they have solid fundamentals, rather than staying exclusively on Bitcoin at all times.

This is why, over the long term, judicious token selection becomes crucial, as outperformance will depend on each individual case and will not necessarily be limited to a specific sector. Ultimately, it's akin to corporate stock selection, where the right choice of each stock is crucial.

Profit taking?

Sometimes, during major market events, such as the acceptance of Bitcoin ETFs for cash, we can see long-dormant coins react. This also happens at times of market euphoria, but also during halving periods or when large companies go bankrupt.

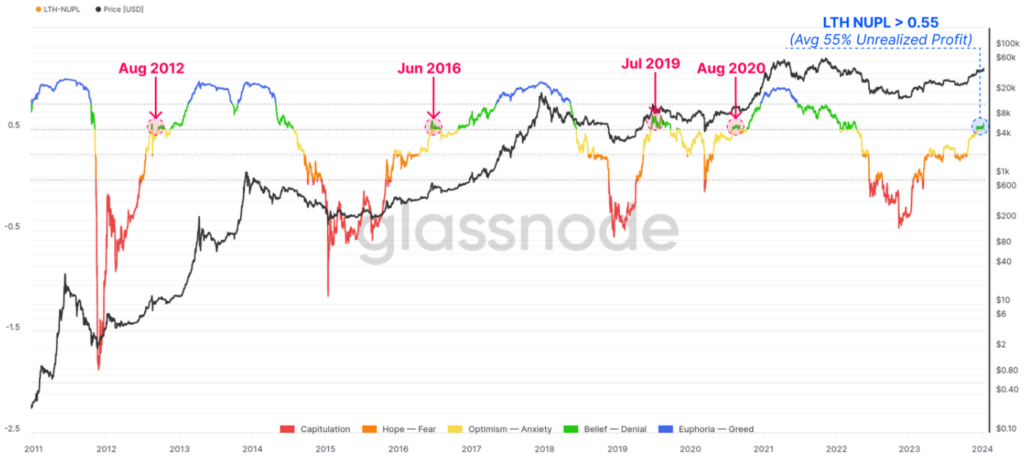

The degree of unrealized profit and loss of long-term holders can be measured by the chart below from Glassnode. This measure reached a significantly positive point recently at 0.55. This is a significant resistance level. This does not indicate that we are close to a high, but rather that this resistance at around 45,000 $ will be difficult to break through.

Source: Glassnode

Perhaps a local high point?

As these legacy coins are reintroduced into circulation, they are contributing to what is currently the largest profit-making event since the all-time high reached in November 2021. The peak profit realized during this cycle was recorded on January 4, with a daily locked-in profit in excess of $1.3 billion. Yet coins traded at higher values.

Taking profits is a common practice in bull markets. The crucial question is whether new demand will be sufficient to absorb the whole.

Source: Glassnode

The start of full adoption?

In our last letter, we talked about the imminent approval of bitcoin cash ETFs and their positive long-term influence on prices. The eleven bitcoin spot ETFs were accepted on January 10, 2024. On the very first day, volumes broke the previous record, reaching 4.5 billion $!

Large institutions now have secure and regulated access to Bitcoin, marking a major milestone in the life of Bitcoin and the beginning of full adoption!

Our service

We offer a portfolio management service specialized in digital assets. We provide complete human support from A to Z in this universe, customizing your portfolio allocation according to your risk profile and situation.

With our turnkey management approach, you can take advantage of industry developments without worrying about digital asset selection, in-depth token research, volatility, arbitrage and more. Simply consult your monthly reports and invest regularly, taking a long-term perspective (4 years and more).

We don't engage in algorithmic trading on a day-to-day basis, preferring only long-term investments in projects we know and understand. Our monthly portfolio arbitrages are accompanied by in-depth asset analysis, with a particular focus on tokenomics.

Discover our website: https://crypto-assets-management.com/

If you have any questions, comments or would like to find out more about our services, please contact us by e-mail at tristan.g@crypto-assets-management.com or schedule a phone call lasting a few minutes by following this link.

Discovery Pack

Investment of less than €20,000

- No entry fees

- Management fee: 2 % / year

- Performance fees: 20 % excl. tax on capital gains (High Water Mark method)

- Exit fee: 3 %

- Minimum subscription: €5,000

- Commitment period : None

Premium Pack

Investment over €20,000

- No entry fees

- Management fee: 2 % / year

- Performance fees: 20 % of performance above the benchmark index*.

- Exit fees: None

- Minimum subscription: €20,000

- Commitment period : None

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of information provided by a third party. in this letter.