Hello everyone,

The aim of this letter is to inform you about the current situation of the crypto-asset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Follow the SEC's live crusade against cryptocurrencies in real time. The US Securities and Exchange Commission (SEC) has confirmed its intention to declare war on the crypto ecosystem on US soil. Follow the developments pitting the SEC against the crypto ecosystem in the US at the link above.

-

Republican Warren Davidson introduces bill to «fire Gary Gensler».». He did not mince his words about the SEC chairman: «America's financial markets must be protected from a tyrannical president, including the current one. That's why I'm introducing legislation to address the ongoing abuse of power and ensure protection that is in the best interest of the market for years to come. It's time for real reform and to fire Gary Gensler as SEC chairman.»

-

Vitalik Buterin presents 3 transitions for Ethereum. In his latest blog post, Vitalik Buterin outlines 3 areas for improvement that Ethereum (ETH) must go through if it is to be adopted by the general public. While these ideas are still in the thinking stage, they could lay the foundations for the future face of the famous blockchain.

-

France: Binance Pay and Lyzi make cryptocurrency purchases possible at 440 merchants. Binance Pay has teamed up with payment app Lyzi, to enable cryptocurrency spending at 440 merchants in France. A further 330 points of sale are also in the process of being integrated across Europe.

-

The Commissaires de Justice of the Paris Court of Appeal will henceforth use NFTs for their official documents and acts.. The Commissaires de Justice of the Paris Court of Appeal are turning to blockchain to secure and authenticate their documents. They have just announced a partnership with Unikbase, which will enable them to create NFTs on a dedicated blockchain.

-

Japan's largest bank prepares to launch stablecoins on the Ethereum ecosystem. Banks with a growing Web3 presence? Japan's MUFG Group has announced the launch of its stablecoin platform, whose assets will be deployed on the Ethereum blockchain. This is yet another step by the banking sector towards Web3, consolidating the solutions and applications developed around blockchain technology.

-

Polygon (MATIC): $100 million in tokenized bonds from Defactor Labs. If there's one bright future, it's the tokenization of real assets on the blockchain. Startup Defactor Labs has announced the tokenization of $100 million worth of bonds on the Polygon blockchain (MATIC). This will make investing in bonds more transparent, faster, more accessible and less expensive.

-

Nearly $10 billion worth of ETH destroyed: who participates most in Ethereum burn? With nearly 3.37 million ETH burned for $9.8 billion, it's a good time to take stock of Ethereum's burn functions. Who contributes most to reducing emissions on the network? Since EIP-1559 came into force on Ethereum in August 2021, the number of ETH burns continues to rise. This trend has been accentuated by the success of The Merge, which sometimes even tends to make the asset deflationary, depending on activity on the network.

Fundamental Analysis

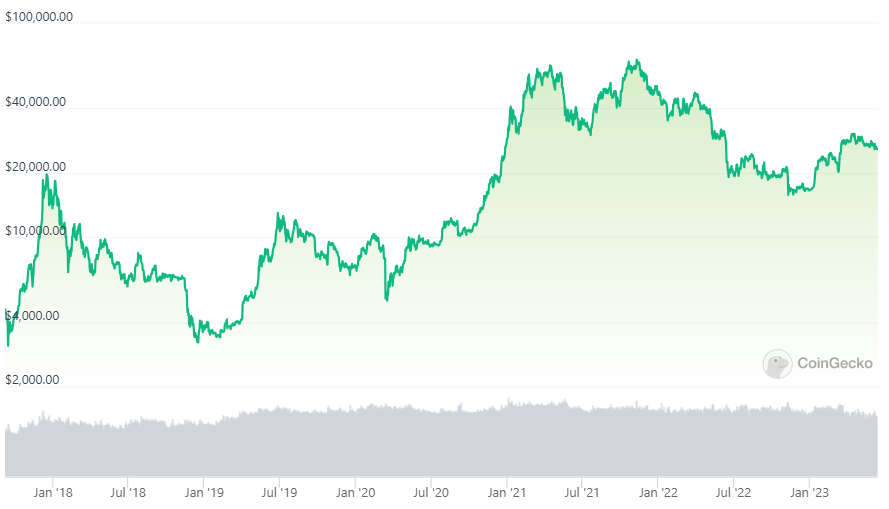

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 26,000$ (06/14/23).

Market Apathy :

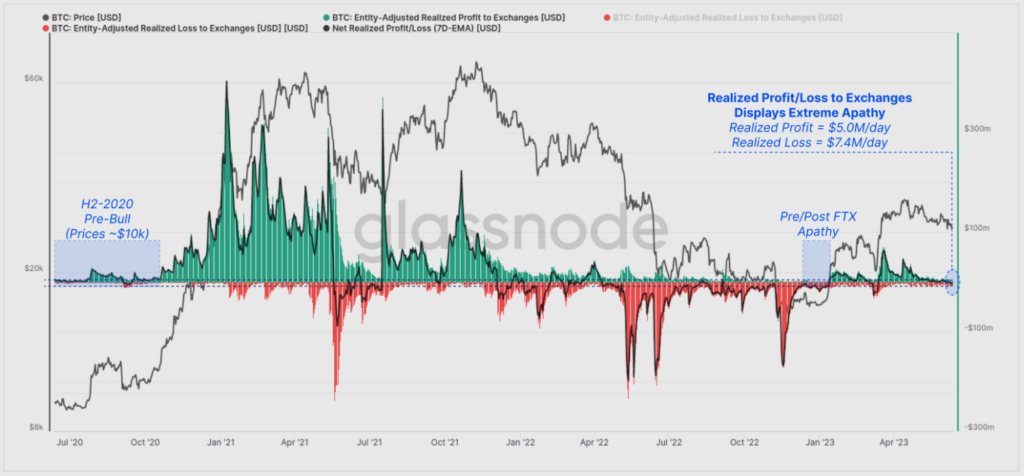

We can describe the current market as being in a state of apathy: a state of indifference or insensitivity. Indeed, on this chart from Glassnode below, we can see that all the Bitcoin coins currently being sent to exchange platforms were acquired at a price very close to the current range (€18k and €32k) and were bought very recently. They are therefore probably held by investors in the STH category (Short-term Holder).

The closer the green and red curves are to the mean (horizontal line), the less incentive investors have to sell, given the proximity of the current price to their purchase price.

Source: Glassnode

The chart above shows a relatively high degree of investor confidence in the subjects of the regulatory attacks underway in the USA, but also investor apathy, i.e. a lack of incentive to sell close to their purchase price.

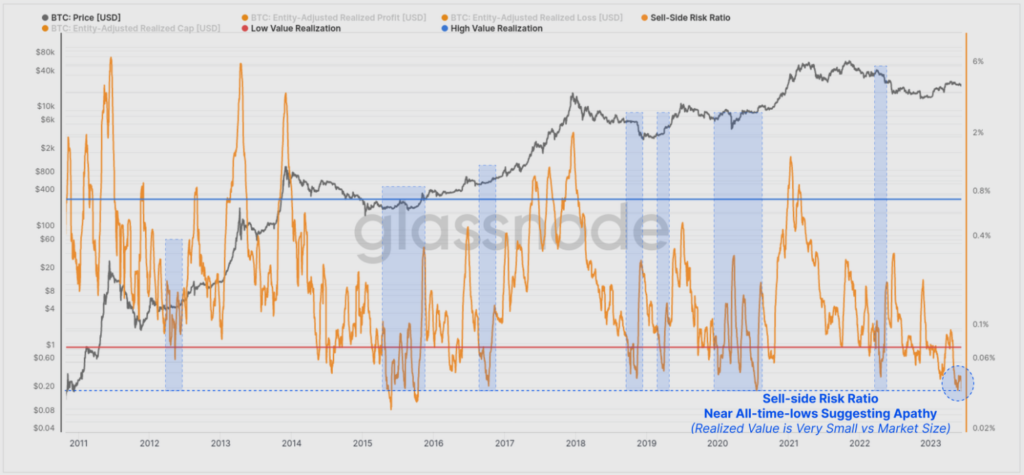

Thanks to these levels of profit or loss (relative to recent investor buying points), the sell risk ratio has fallen to historically low levels. You can see this in the chart below, which compares the profit and loss aggregated by the market in relation to the value of realized market capitalization.

The market's realized capitalization is a variation of classic market capitalization, which values each UTXO (transaction) according to the price at which it was last moved. This realized capitalization reduces the impact of lost and long-dormant coins, and weights coins according to their actual presence in the economy of a blockchain (Bitcoin for our example).

The total value of these profits and losses is extremely small compared to Bitcoin's realized capitalization (which is $391 billion). The low values of the sell risk ratio have historically occurred during periods of heightened investor apathy, typically during the long periods between bitcoin market cycles.

Source: Glassnode

We can also see below that overall transfer volumes trade at cyclical lows. This week, we saw a relatively low global transfer volume (at around $2.85 billion per day). However, this volume represented a very high amount during the previous cycle, in 2020.

Source: Glassnode

To sum up, the market remains flat, inert and bored as it awaits the next cycle, despite the regulatory environment in the US, which remains hostile. Short-term investors have probably sold in fear, and the almost non-existent reaction of long-term holders suggests that many investors were not surprised by the SEC's new attack.

Global adoption of digital assets :

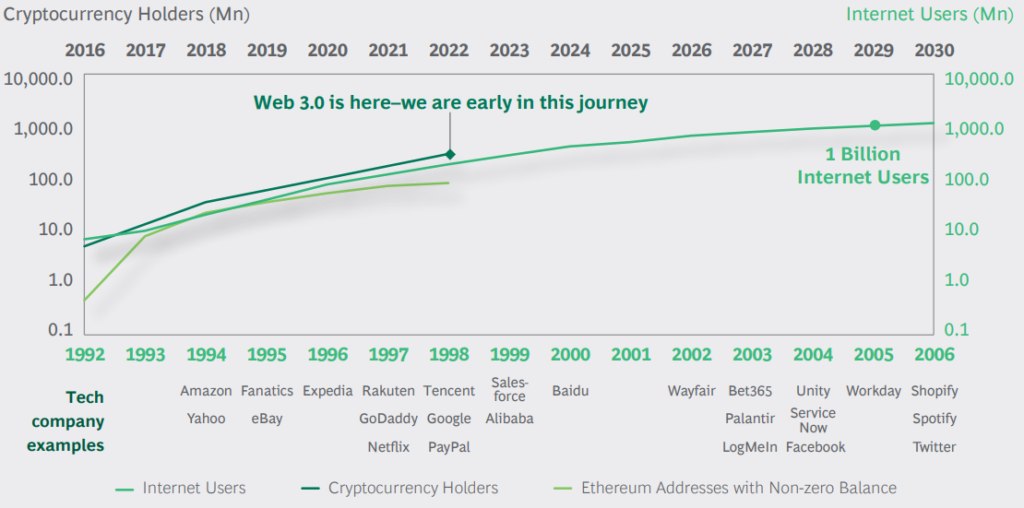

As we can see from the graph below, the adoption of digital assets worldwide is still in its infancy. Compared to the adoption of the Internet, it's as if we were in 1998 or 1999. We have another 20 years of development and adoption ahead of us. The ecosystem landscape can still change radically.

What's interesting to note is that we're on the same speed of adoption as the Internet, perhaps even slightly faster. Numerous projects may yet emerge in the coming years and dominate the market in 20 years' time, like Google (YouTube), Facebook, Twitter, Netflix, Amazon etc...

Source: Report by Boston Consulin Group, Bitget and Foresight Ventures

It's relevant to compare the adoption of digital assets with that of the Internet, because cryptos are a continuation of the Internet: in a way, they're an extension of what we can do with the Internet. Here's a phrase we believe in:

«Blockchain will be to banking, law and accounting, what the Internet has been to media, commerce and advertising.»

You can also find a Global Crypto Adoption Score Index with country rankings on the Chainalysis website. We can see that France is in 32nd position (in 2022).

Source : Chainalysis

572,000,000,000 $ added to US debt in two weeks :

According to the latest figures from FiscalData, as of June 15, the US national debt stood at $32.03 trillion, an increase of $572 billion on June 1 ($31.46 trillion). Total debt now exceeds the combined GDP of China, Japan, Germany and the UK.

At current interest rates, the U.S. pays more than $2 billion a day in interest payments, and even if every U.S. household paid $1,000 a month toward the debt, it would take another 20 years to pay it off.

U.S. debt currently stands at $31,000 billion. Is it more likely to reach $50,000 billion or $25,000 billion? It's more likely to reach $50,000 billion than $25,000 billion. So the situation persists.

Ray Dalio, creator of the world's largest hedge fund, Bridgewater Associates, also recently declared that the U.S. was entering what he calls a «very classic end-of-great-cycle debt crisis».

This is why we believe that, in the long term (+20 years), the value of the dollar will have continued to lose purchasing power, and will probably even have increased. There are only two possible solutions for our Western economies: repayment of our debts through work and production (living below these means to repay) or inflation, which will destroy our debt denominated in a currency that we will continue to «print» (i.e. continue to live beyond our means).

We believe that our economies are heading in the direction of the second option, which will mean long-term inflation and a fall in the value of our Western currencies.

The same applies to Europe and the eurozone.

Our service

We offer a discretionary management service for portfolios specializing in digital assets. We provide comprehensive human accompaniment in this universe, adapting your portfolio allocation to your risk profile and situation.

Our turnkey management allows you to profit from the evolution of this sector without worrying about which digital assets to put in your portfolio, nor about in-depth token research, volatility, arbitrages, etc... All you have to do is read your monthly reports and invest regularly with a long-term horizon (4 years and more).

We don't do algorithmic trading or daily trading, we invest for the long term in projects we know and understand. We make monthly arbitrages in the portfolios and study in depth the assets (especially their tokenomics) that we put in the portfolio.

Discover our website: https://crypto-assets-management.com/

If you have any questions or comments, or if you would like to find out more about our service, please do not hesitate to contact us at this e-mail address: tristan.g@crypto-assets-management.com or make a telephone appointment with us via this link.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of information provided by a third party. in this letter.