Hello everyone,

The aim of this letter is to inform you about the current situation of the crypto-asset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Banking crisis: half of US banks potentially insolvent. The banking crisis continues in the USA, with half of all US banks having exhausted their capital reserves, according to a report in The Telegraph. Thousands of banks are now potentially insolvent, including a global bank considered systemic. Have we reached the point of no return?

-

1 million addresses now hold more than 1 Bitcoin (BTC). Bitcoin (BTC) continues to win over investors, who are increasingly including it in their portfolios. In May 2023, a new record was set: one million addresses now hold more than 1 full BTC. Let's take a look at what this means.

-

TRIBUNE - Web3: let's not penalize the growth of our companies or the attractiveness of France. At a time when France and Paris rank among the most sought-after locations for the Web3 ecosystem around the globe, the draft law voted through by the French National Assembly at the end of March could penalize our ambitions in this sector full of opportunities. What does the industry risk when 10% of the French hold digital assets in their investment portfolios?

-

PayPal customers have invested $943 million in cryptocurrencies. In a document filed with the SEC, we learn that PayPal has nearly a billion dollars having been invested in cryptocurrencies by its customers. How is the payments giant evolving with regard to this aspect of its business?

-

Payment giant Stripe expands its fiat-to-crypto offering to conquer Web3. Stripe, the US payment solutions giant, has launched its fiat-to-crypto on-ramp solution to enable Web3 businesses to provide an easy option for their customers to purchase cryptocurrencies. The solution aims to accelerate Web3 adoption and has already been adopted by companies such as social network Lens, DeFi protocol 1inch and browser Brave.

-

Tether, a «giant house of cards»? Its latest report divides. Tether, the issuer of USDT, has published its first quarterly report for 2023, revealing record excess reserves of $2.44 billion. The company also shared the breakdown of its reserves into cash, short-term deposits, Bitcoin (BTC) and gold. Tether maintains its dominant position in the stablecoin market, with a market capitalization of $82.87 billion, but some remain doubtful about its transparency.

-

Blockchain: BNP Paribas, Goldman Sachs and Microsoft help launch Canton network. Recently, several major technology and financial groups took part in the launch of the Canton blockchain. Intended to make financial systems interoperable with each other, this network bears witness to the interest of institutional investors at a time when few of them expect the crypto-currency market to recover.

Fundamental Analysis

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 26 780$ (on 17/05/23).

The Ethereum staking rush continues:

Ethereum's latest double upgrade, named «Shapella and Shanghai», was successfully completed in April. In our last newsletter, we reported on the increase in the number of Ether deposited in staking.

To remind you what staking is: it's the act of depositing tokens (Ethers for the Ethereum blockchain) as collateral with the aim of securing the blockchain (Ethereum) and receiving in return a fraction of the fees generated by the network (fees which are paid by users of the Ethereum network). This only applies to blockchains with a Proof of Stake consensus mechanism.

This number of Ethers deposited in staking since the end of 2020 has been growing, but since the update (mid-April 2023), this number has risen sharply. This is a real success story for the network. In the medium/long term, this success could lead to between 50 and 70 % Ethers being staked, as we've seen on other PoS networks.

Below, you can see the marked increase in Ethers deposited in Staking, especially since the mid-April 2023 update.

Source: Glassnode

Ethereum tokenomics changed in 2022/23. We don't think that market players have really integrated this change. We are very optimistic about the Ether token for the years to come.

Bitcoin adoption cycles:

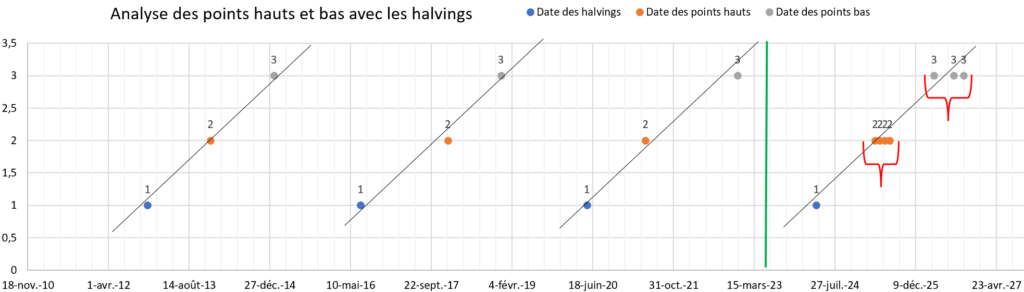

In our research, we analyzed the frequency of Bitcoin cycles. We isolated only 3 points per cycle: the Halving Day, the low point of a cycle and the high point of a cycle. As we can see from the graph below, the frequency of each of these points is almost perfectly regular. As for the Halving dates, this is normal, but what's interesting is that the low and high points of the cycles have adapted perfectly to the Halving frequency.

- The blue dots are the Halving dates, set at an average frequency of 4 years by the Bitcoin protocol.

- The orange dots are the dates of the market high points for each cycle.

- The grey dots are the dates of the market lows for each cycle.

Source : Internal

There's one thing in common, and many people know it, but it's important to repeat it: each of the orange points, i.e. the market high points, are higher cycle after cycle:

- December 2013: $1 237

- December 2017: $20 089

- May 2021: $68 789

Ditto for the blue dots, i.e. the low points of the market, which are higher cycle after cycle:

- December 2014: $171

- December 2018: $3 191

- November 2022: $15 599

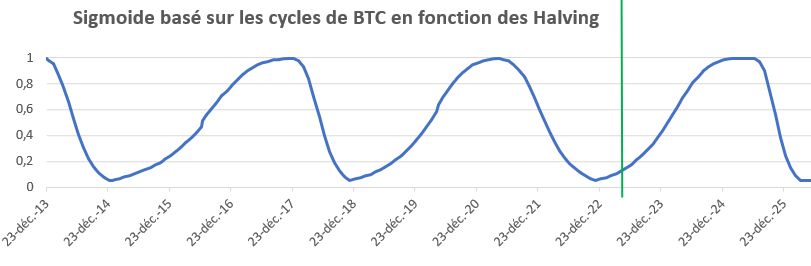

These same cycles can be seen more visually on the graph below. Only the high and low points of the cycles are represented in this graph by the horizontal line with value 1 (high points) on the y-axis and by the horizontal line with value 0 (low points).

Source : Internal

In the end, it's quite easy to predict the highs and lows of future cycles. Obviously, it's more difficult to exit or enter positions at these times, as the psychology of our human brains disrupts our decision-making. That's why we try to automate our decision-making on non-psychological and/or non-sentimental elements.

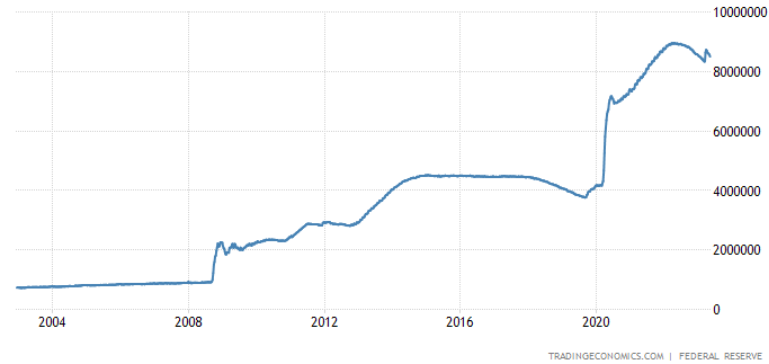

Balance sheet of the US central bank and the euro zone central bank :

The graph below shows the increase in the US central bank's balance sheet since 2004. It's easy to understand why the value of the dollar has depreciated so sharply over the last two decades.

Source : tradingeconomics

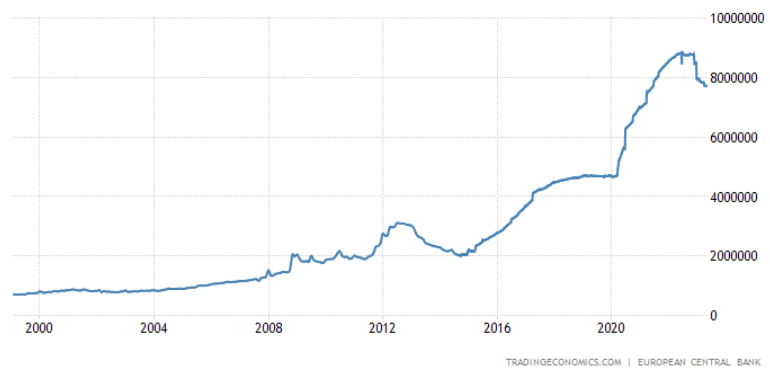

The same applies to the balance sheet of the Eurozone Central Bank:

Source : tradingeconomics

Readers may tell us that inflation is only very recent, that we haven't had any for a very long time, whereas our central banks have been «printing» for a long time - why?

Yes indeed, but the answer is that the way we measure inflation is simply wrong. We only measure inflation according to highly selective criteria that in no way represent reality.

We calculate the inflation rate in our economies in the same way as this metaphor:

«It's a bit like trying to measure the amount of water that falls in our garden when it rains with a bucket of water, and multiplying the surface area of the bucket of water until we reach the total surface area of the garden. The calculation works mathematically and seems logical, but it doesn't work if you stand under your headlight with your bucket to try to catch the rainwater.»

Inflation, as calculated by INSEE for example, has not been very high over the last two decades. On the other hand, the price of all «non-printable» assets has risen:

Gold, real estate, equities, commodities, etc. all rose sharply. It is in these assets that all the money printing, and therefore «inflation», has been stored for years. This creates huge wealth gaps between the richest people, who own «inflating» assets, and the poorest, who remain «stuck» in a state of poverty. Inflation is unfair.

Our service

We offer a discretionary management service for portfolios specializing in digital assets. We provide comprehensive human accompaniment in this universe, adapting your portfolio allocation to your risk profile and situation.

Our turnkey management allows you to profit from the evolution of this sector without worrying about which digital assets to put in your portfolio, nor about in-depth token research, volatility, arbitrages, etc... All you have to do is read your monthly reports and invest regularly with a long-term horizon (4 years and more).

We don't do algorithmic trading or daily trading, we invest for the long term in projects we know and understand. We make monthly arbitrages in the portfolios and study in depth the assets (especially their tokenomics) that we put in the portfolio.

Discover our website: https://crypto-assets-management.com/

If you have any questions or comments, or if you would like to find out more about our service, please do not hesitate to contact us at this e-mail address: tristan.g@crypto-assets-management.com or make a telephone appointment with us via this link.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of information provided by a third party. in this letter.