Hello everyone,

The aim of this letter is to inform you about the current situation of the cryptoasset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

How will staking withdrawals on Ethereum (ETH) work? Future Shanghai and Capella updates to the Ethereum blockchain will enable validators to withdraw ETH locked in the Beacon Chain or rewards earned through staking. How will these withdrawals work? How long will it take? All the answers are in this article.

-

Coinbase ready to defend the legitimacy of its staking services in court. While all eyes are on the Securities and Exchange Commission (SEC) and its hostility towards staking services, Coinbase maintains that these are not securities. If need be, the platform is ready to defend its convictions in court.

-

Paxos «categorically» disagrees with the SEC's decision to classify the BUSD as a security. Although Paxos will indeed stop issuing the Binance BUSD from February 21, the company defended itself in a press release, claiming that the BUSD could not be classified as a security. Paxos also said it was prepared to engage in litigation with the SEC should the organization prove unwilling to engage in dialogue.

-

Siemens issues its first digital bond on the Polygon blockchain (MATIC) Siemens, Germany's 3rd largest listed company by market capitalization, has issued its first digital bond worth 60 million euros on the Polygon blockchain (MATIC). Thanks to the many advantages that digital bonds offer over traditional bonds, the multinational looks set to repeat the experience.

-

Mastercard CEO imagines «a world where everything will be tokenized».». Mastercard, the world's second-largest payment solutions company, is planning to get ahead of its competitors. After years of using blockchain, its CEO Michael Miebach claims that «we're moving towards a world where everything will be tokenized». We take a look at the company's position in Web3.

-

Bitcoin's Lightning Network has no bear market. The Lightning Network, the second-layer solution for the Bitcoin blockchain, continues to expand worldwide. The highly scalable network has just surpassed one of its records: almost 5,400 bitcoins (BTC) are now deposited in this solution, proof of the continuing craze for the queen of cryptocurrencies.

-

Neobank Revolut launches staking service for ADA, DOT, XTZ and ETH. Neobank Revolut is taking another big step towards cryptocurrencies. It is reportedly in the process of launching staking services, available from this week for users located in the European Union and the UK.

Fundamental Analysis

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 24,600 $ (on 19/02/23).

It's highly likely that we've come to the end of this bear market, which will have lasted from November 2021 to November 2022. This was the sixth down cycle in Bitcoin's history, and we're now entering the seventh up cycle. Here's a chart to give you a better idea of each of these cycles. There are major 4-year cycles, and smaller intermediate cycles within these cycles.

Source : Pantera

Above, we can see bullish cycles in orange and bearish cycles in black. What's impressive is that the average secular uptrend is x 2.3 per year! Not all assets can boast such high fundamental growth. It depends on adoption, of course, and it's not infinite.

Adoption stops when we're close to 80 % or even 100 %. It depends on the relevance and use of the technologies, bearing in mind that this time we're talking about Blockchain technology and not just Bitcoin. Today, worldwide adoption is estimated at 4 %.

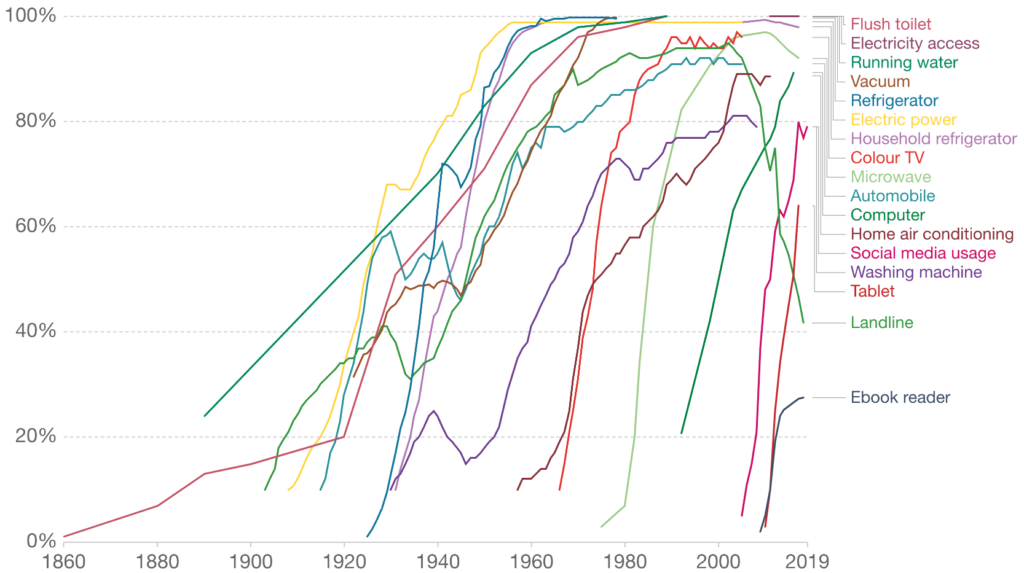

Below is a graph showing the rates and speeds of technology adoption in the US over the past 150 years.

Source: Our World in Data

The closer we get to recent years, the more rapidly technologies are adopted. In fact, some of them use previously adopted technologies. For example, the computer uses the Internet and access to electricity to be adopted.

It was at the start of this year, with players reinvesting in digital assets, that the market realized that the bear cycle was over. The largest entities, such as whales and institutional investors, were the accumulators of the last few months of the bear market. These entities, which accumulated near the bottom, tended to recoup profits immediately afterwards, and therefore to distribute their tokens at the beginning of February. This is no doubt why, after hitting a local high on February 2 at 24,300$, we had a retracement down to 21,400$.

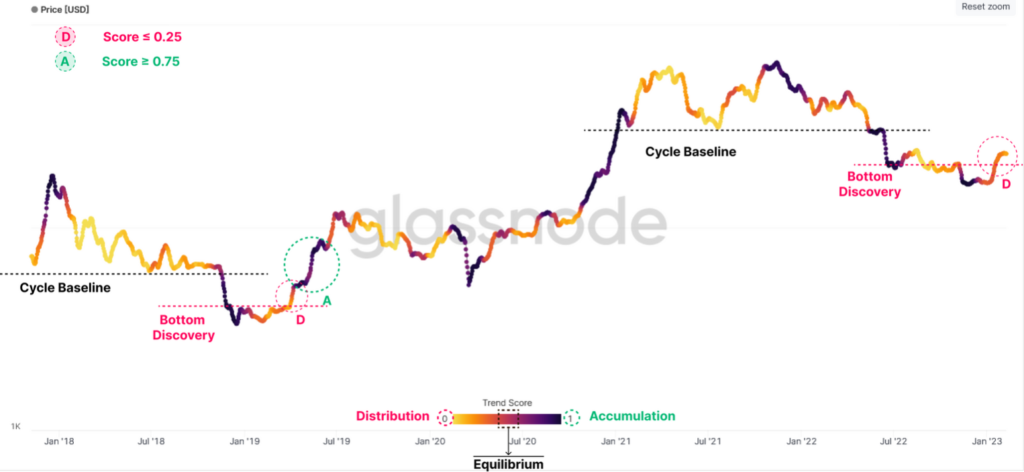

On the graph below, we can see in yellow the periods of distribution (on a 7-day moving average) and in purple the periods of accumulation.

Source: Glassnode

As at the end of the previous major bear cycle in April-June 2019 (red and green circles above), we can expect buyers to regain control in several stages with accumulation/distribution phases. The next stage will probably be a phase of the same type as circle A (in green) in April-June 2019. The accumulation phase has already begun, as we have already returned to the highs of 2023.

We can see below on the chart, which represents the relative share of dollar wealth changing hands daily, that we're at the start of a potential influx of liquidity which should cross the 1.5% - 2.5% band in orange. Historically, this has been the case at the start of every major bull cycle.

Source: Glassnode

-

In terms of macroeconomics, inflation is falling in the US and Europe, and the US inflation peak has probably already passed. However, underlying inflation has taken a strong hold in our economies, and I think the market is underestimating this risk. The market believes that inflation will return to its lows below 2 % in the next two years. I don't think this will happen. Inflation will take much longer to disappear: it's not enough to have raised rates for inflation to fall immediately afterwards.

What's more, the strength of the increase in real interest rates (nominal interest rate minus inflation) is not very high compared to other historical rate rises: on each occasion, inflation was not easily and quickly overcome. I think inflation will remain above 4 % for the long term.

Source : https://tradingeconomics.com

If you have any questions, comments or would like to find out more about our service, please do not hesitate to contact us: tristan.g@crypto-assets-management.com

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of information provided by a third party.