Hello everyone,

The aim of this letter is to inform you about the current situation of the cryptoasset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Ethereum (ETH): Visa develops automatic payment system. The company specializing in payment solutions has just announced its commitment to the development of a tool in the Web3 sector. Developed on Ethereum (ETH), this solution enables users to make programmed and automated fund transfers.

-

Société Générale makes its very first DeFi transaction on MakerDAO. Société Générale - Forge has just completed its first stablecoin borrowing operation on decentralized finance. The French bank's innovation arm used its vault on MakerDAO to withdraw $7 million in DAI.

-

Binance and Coinbase bet big on Europe. Could Europe be the new promised land for the two major exchange platforms Binance and Coinbase? It would appear that the exchanges are banking on the Old Continent to secure their place.

-

Mastercard and Polygon join forces to bring music artists to Web3. It's another masterstroke for the Polygon ecosystem, which has just forge a partnership with payment giant Mastercard. This cooperation is part of the new Mastercard Artist Accelerator program for musical artists.

-

US debt default: why worry? Time is running out for Janet Yellen and the US Treasury, who must act this week to prevent the US defaulting on its debt in the coming months.

The solution is to raise the public debt ceiling once again. The debt ceiling a colossal 121% of GDP31,400 billion.

As a reminder, this famous ceiling is a ceiling in name only: since 1960, it has been recorded 79 timesto accommodate the growing debt of the world's largest economy.

-

Stables: PMU's ambitious project to bring horse racing to Web3. The Stables experience, which began on January 9, 2023allows the first interested parties to sign up for a dedicated whitelist and take part in Web3-style horse racing with a racehorse represented as a 3D NFT.

-

Avalanche joins forces with Amazon. Ava Labs, the company behind Avalanche, has announced its partnership with Amazon Web Services (AWS) to accelerate the adoption of blockchain to customers of Amazon's cloud computing platform.

-

Neuilly-sur-Seine's municipal youth council voted via blockchain. It's a well-known fact. Blockchain can be used and useful in many areas of economic and social life. This is what Neuilly-sur-Seine town hall has been experimenting with, by organizing elections using the Tezos-based Electis voting application. This election is a first and could lead to other events of this type.

Fundamental Analysis

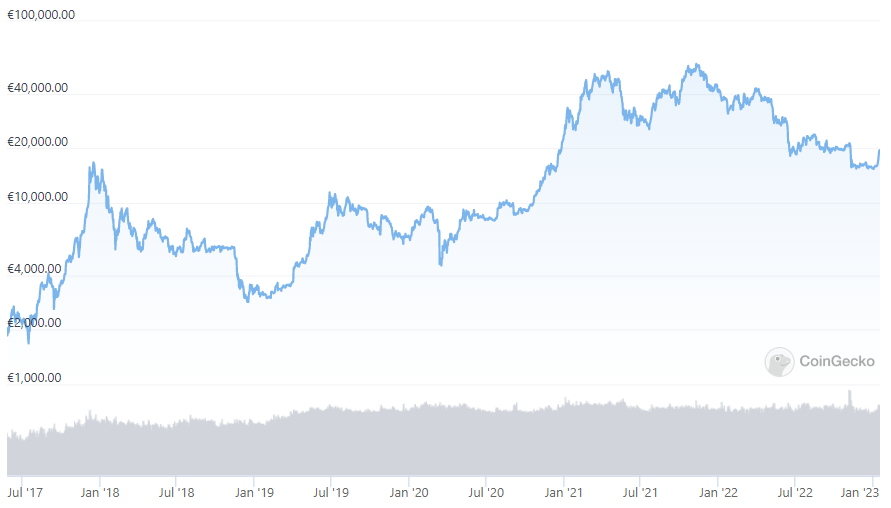

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 21,411 $ (on 17/01/23).

This first month of the year gives us a positive signal for the cryptoasset market. After a difficult year for the ecosystem and a bear market throughout 2022, the market has decided to wake up with a rise of over 23 % in one week and potentially signal the end of the bear market.

This doesn't mean, however, that we're already at the start of a bull market which will go on to set new records. Historically, what has followed is a period of range (a channel in which the price evolves) which will slowly tend towards the old highs. We don't expect a powerful bull market on new records until at least 2024.

2023 could be a year of accumulation and slow price rises. We are not immune to macroeconomic risks, which remain high at present. Even so, we believe that the crypto market will be in better shape at the end of this year than the equity market. The crypto ecosystem is benefiting from a major boost that other markets are not getting: adoption.

Bitcoin's cycles are set like a timer. We can see this in the graph below, which represents the MVRV ratio. It simply represents a division of market capitalization by realized capitalization.

Realized capitalization is an alternative approach to market capitalization as a measure of network valuation, rather than using the last traded price and multiplying it by coins in circulation as in the traditional calculation. Realized capitalization, on the other hand, approximates the value paid for all existing coins by adding up the market value of coins at the time they last moved on the blockchain.

Source: Glassnode

As we can see above, this ratio is below 1 for an average of 190 days in each 4-year cycle. These periods (in red) have each time represented the low points of each of the last three cycles. It's likely that the same will happen again. This punctuality is quite astonishing, as it is punctuated by Halving (halving of rewards programmed into the Bitcoin network protocol).

The impact of these Halving tokens is perhaps destined to disappear over time, as their importance is diluted in relation to the total number of tokens already in existence.

-

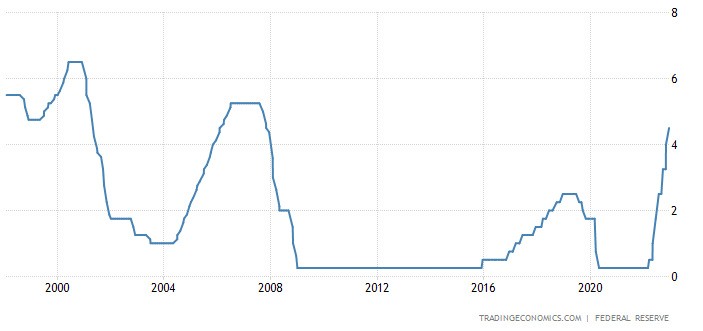

US inflation is down again this month, from 7.1 1TP3Q to 6.5 1TP3Q. There is a good chance that the FED will slow down its rate hikes, which are currently at 4,5 %. The markets are awaiting the FED's pivot. We can see that past pivots over the last 20 years have been at 6.5 % in 2001; 5.5 % in 2007 and 2.5 % in 2019. See image below.

Source : https://tradingeconomics.com

It is increasingly unsustainable to keep rates high because of the size of the US debt, which is steadily increasing. It's highly likely that we won't go any higher than the rates of 2001 and 2007. We can easily understand why with the article I presented in the "news" section: US debt default: why worry?

The American solution is to raise the public debt ceiling once again. This has reached a colossal 121% of GDP31,400 billion.

As a reminder, at the risk of repeating myself, this famous ceiling is a ceiling in name only: since 1960, it has been recorded 79 timesto accommodate the growing debt of the world's largest economy.

All this means that we will probably never have very high rates (nominally, i.e. deducted from inflation, they are all negative). This implies a steady decline in the purchasing power of a dollar, due to the money printing required by the system. All this over the long term, of course.

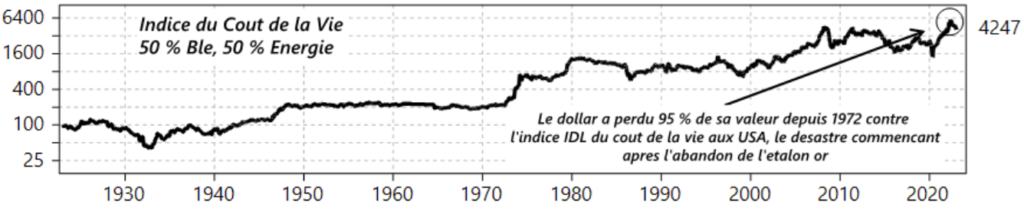

Here's an example, with a cost-of-living index made up of 50 % of wheat and 50 % of energy compared to the dollar. The dollar has lost 95 % of its value since 1972, and the disaster began after the gold standard was abandoned.

Source: Institut des libertés

Please note that all this applies to Europe and the Euro, and unfortunately for the worse.

If you have any questions, comments or would like to find out more about our service, please do not hesitate to contact us: tristan.g@crypto-assets-management.com

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not responsible for any loss resulting from a decision taken on the basis of the information in this letter.