Hello everyone,

The aim of this letter is to inform you about the current situation of the cryptoasset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

The Merge represents migration of the Ethereum blockchain (ETH) to a new consensus method. This merger is one of the most impressive technical feats in the crypto-asset industry, and the event is fast approaching. The merger marks the end of many years of research, engineering and development, and will move the Ethereum blockchain from a proof-of-work (PoW) consensus mechanism to a proof-of-participation (PoS) consensus mechanism.

In many ways, this event could be seen as the equivalent of switching from a combustion engine to an electric motor on an airplane during flight! This $200 billion airplane, which also carries hundreds of billions of dollars of financial infrastructure, travels at full speed.

The merger has been officially scheduled for tonight. Find out the exact date and time of the Ethereum update here : https://cryptoast.fr/the-merge-countdown-timer-date-heure-exact/

-

THE MERGE: why is Ethereum becoming the banks' favourite project? As The Merge approaches, the pace of change accelerates. On September 7, the Swiss-regulated SEBA Bank launched Ethereum staking for institutional customers. Through its new offer, SEBA Bank is increasing the adoption of Ethereum by institutional investors, who will be able to « play a key role in securing the future of the network, via a trusted, secure and fully regulated counterparty »according to Mathias Schütz, the bank's Head of Technology and Solutions.

-

The Bank of Russia is considering legalizing cross-border cryptocurrency payments. In a television interview, the Bank of Russia, historically opposed to cryptocurrencies, is said to have finally rethought its approach to the point of showing itself favorable to the use of this type of asset for cross-border payments. Russian Deputy Finance Minister Alexei Moiseev declared that he was « now impossible to do without cryptocurrency payments » given the current geopolitical context. The crypto industry could never have imagined this statement just 2 years ago, as certain use cases have become interesting for large institutions and countries alike.

-

Bitcoin (BTC): MicroStrategy aims to raise $500 million to finance its investments. Through a share sale, MicroStrategy hopes to raise up to $500 million to invest part of these funds in Bitcoin (BTC). At the time of writing, MicroStrategy was still in possession of 129,699 bitcoins. The average acquisition price is reported at $30,664 per unit. Private and public companies continue to acquire Bitcoins over the long term, a sign that despite the bear market, professionals continue to be convinced of the fundamentals and adoption of this industry. Here's a site that lets you view the amount of Bitcoin held by different parties (private companies, public companies, countries, ETFs).

-

Does Bitcoin distribute wealth better than the current system? As the number of addresses owning more than one bitcoin (BTC) continues to rise, we'll try to determine whether the distribution of bitcoins is more equitable than the distribution of wealth in today's world. Thus, in relation to its users, the percentage of addresses with at least 1 bitcoin is greater than the percentage of millionaires worldwide, with 2.11% and 0.71% respectively. These figures should be treated with caution, as they are approximations.

On the other hand, thehe number of addresses owning at least 1 bitcoin (BTC) continues to grow. It even exceeded 900 000 a few days ago. Below is a chart from Glassnode with, in orange, the number of addresses owning 1 bitcoin and, in black, the price per bitcoin.

Fundamental Analysis

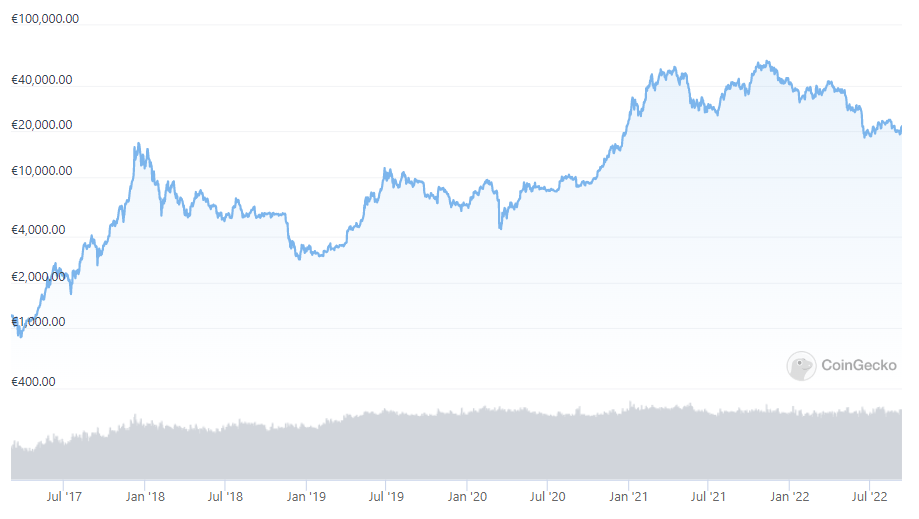

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 22,100 $ (on 12/09/22).

As we pointed out in our last newsletter, caution was the order of the day for September. A downward phase even began at the end of August, as the market corrected the summer's bullish phase by hitting a low around 18,300 $, thus creating a double low around this zone almost 3 months apart (June and September). For the past week, the market has been rallying as Ethereum's update approaches.

No one can announce with certainty the end of the bear market, but numerous indicators tell us that we are very close to the end of this downward cycle (see letter N°15). Perhaps the upgrade (The Merge) of the Ethereum network will be a bullish catalyst to end this downward cycle. It will also depend on macroeconomic trends: let's not forget that the crypto-asset ecosystem is still just a drop in the global economy.

It is likely that by the end of the year, we will have exited this bear market above the realized price (*) for long-term holders, see the blue curve below.

*The realized price is a chain indicator that measures the price of BTC at the time of its last movement.

We believe that in the coming months, there will be a decorrelation between equity markets and cryptos. We believe this for several reasons:

- Firstly, because equity markets still have downside potential, which is less the case for Bitcoin and the crypto majors, which have returned to their fundamental values according to numerous indicators (see letter N°15).

- Then, because we believe that central bank interest rates, which are currently on the rise, have a big impact on businesses in the long term, as these businesses grow with debt. Crypto-assets, on the other hand, do not require debt to grow. We can assume (in the long term) that rising rates will not impact them.

To illustrate my point, let's take the example of Tesla, which wants to open a new factory in a country: the company will then create debt to build it and develop its business. If this debt costs the company more today (with the rise in key interest rates), then it will abandon its new factory project, and this will reduce its growth.

The crypto-asset industry doesn't work like that: it's primarily adoption, usage and use-case building that creates the long-term growth of cryptos, not debt.

However, in the short term, when key interest rates rise, risky assets fall.

-

The ECB is raising its key rates from 0 to 0.75 % to combat inflation and bring it back to its target of 2%, which is the sole purpose of its mandate. This rate hike is insignificant in overcoming current eurozone inflation, which stands at 9.1 %, at the very least, rates should be as high as inflation, i.e. 9 %. In order to maintain economic stability in Europe and avoid excessive rate differentials between countries within Europe, the ECB cannot afford to raise rates so high. Inflation is likely to be here for the long term, and well above 2 %.

-

It should be noted that in Europe, despite the absence of official announcements, we are already in recession (definition : period of temporary decline in a country's economic activity). The question is, how deep and how long will this recession last?

With recent events, notably the total cut-off of gas supplies from Russia, we can be sure that this recession will not be a light one. The economy is just transformed energy. If Europe's energy supply is cut by 10 %, the European economy will shrink by 10 %. Many companies in France and Europe will go bankrupt or temporarily shut down production, because the price of gas (and electricity) is inelastic. If availability is 100 and demand is 101, then prices will explode until the surplus (1) can no longer pay for its energy (the economically weakest) and demand is back at 100.

The price freeze imposed by our politicians won't save us; it only postpones and amplifies the problem.

A few tips for homeowners: pace your life to suit your assets, Be thrifty to prepare for this recession, consume little and intelligently, plan in advance your energy sources for the winter if they can be stored, preserve your capital in rare assets (gold, real estate, crypto...).

The crypto-asset ecosystem will be very little impacted by this event, firstly because it's a global market, but also, because it requires little electricity for all cryptos that operate on Proof of Stake. For cryptos that operate on Proof of Work (notably Bitcoin), their mining does not take place in Europe, nor in place of human electricity needs. Mining mainly takes place near areas of energy surplus. It is also developing at oil stations, to replace flares, or in underdeveloped countries where there is an abundance of energy, but no infrastructure to use it.

If you have any questions, comments or would like to find out more about our service, please do not hesitate to contact us: crypto.assets.manage@gmail.com

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not responsible for any loss resulting from a decision taken on the basis of the information in this letter.