The aim of this letter on US ETFs on Bitcoin is to inform you about the current situation of the crypto-asset market but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

https://cryptoast.fr/selon-sec-eth-ethereum-eth-spot-lances-mardi-prochain/. According to sources, the first spot Ethereum ETFs (ETHs) could hit the market next Tuesday (July 23). What's the latest?

-

«It's great.» - Donald Trump explains his infatuation with cryptocurrencies. US presidential candidate Donald Trump has distinguished himself by his enthusiasm for cryptocurrencies in recent months. In a lengthy interview with Bloomberg, he explained why he felt it was important to favor the sector in the face of China. What does he envisage?

-

Payment giant Stripe now offers cryptocurrency purchases by credit card in Europe. Stripe, a company specializing in Internet payments, will enable European users to buy Bitcoin, Ether and SOL directly by credit card.

-

«My opinion was wrong» - BlackRock's CEO admits he was wrong about Bitcoin (BTC). BlackRock has just published its Q2 results, which are better than expected. An opportunity for Larry Fink to revisit the role of Bitcoin (BTC) - BlackRock's CEO has admitted his mistake of 5 years ago.

-

France: InterInvest brings Bitcoin to retirement savings. InterInvest, a group specializing in the management and distribution of investment solutions, has just introduced a major innovation to the French market, enabling its customers to invest in Bitcoin via their pension savings plan (PER).

-

United Arab Emirates, Singapore, Turkey... These territories where cryptocurrencies are snapping up. The percentage of cryptocurrency holdings is reaching record highs in certain territories such as the United Arab Emirates, Singapore and Turkey. Why the digital gold rush?

-

France: European Union points to «excessive deficit». In the wake of spiraling debt over the past 10 years, the Council of the European Union has warned France about its management of the public deficit. What is the current situation?

Fundamental Analysis

Source : https://www.coingecko.com/fr

Letter N°39: Programmed scarcity; US ETFs: a constant bullish force

The Bitcoin price at the time of writing is 64,539 $ (on 18/07/24).

Bitcoin's programmed scarcity

Halvings are a key moment in the Bitcoin calendar, reflecting both the asset's scheduled scarcity and the market's historical performance following these events.

The chart below illustrates indexed performance over the 365 days following the last four halving cycles. The 2016 (blue) and 2020 (green) cycles are particularly relevant, as they represent a more mature and developed market for digital assets.

The two previous cycles saw a period of relative calm for several months after the halving, followed by remarkable peak returns of +350 % and +650 %, respectively.

In 2024, the Bitcoin market looks set to follow a similar trajectory after the fourth halving in April, with BTC prices having varied by just a few percentage points since that event.

Source: Glassnode

The German government's Bitcoin sale

Focusing on the selling pressure exerted by the German government, we see that their balance of 48,800 BTC was liquidated in just a few weeks.

The majority of these sales took place over a very short period, from July 7 to 10, with over 39,800 BTC leaving the identified portfolios. Interestingly, this wave of sales occurred after the market had bottomed at around 54,000 $, suggesting that the market had already absorbed the impact of this news.

A few days later, the BTC price climbed back to around 68,000 $, while the German government had sold its Bitcoins at an average price of around 58,800 $ per Bitcoin. In reality, the sale of the bitcoins was the result of a standard procedure applied to assets seized during criminal investigations. The decision to sell the bitcoins was not motivated by an investment strategy, but by a legal obligation to liquidate the confiscated assets within a certain timeframe. This is a pity for the German government, which perhaps should have kept these BTCs as part of an investment strategy.

Source: Glassnode

US Bitcoin ETFs: a constant bullish force

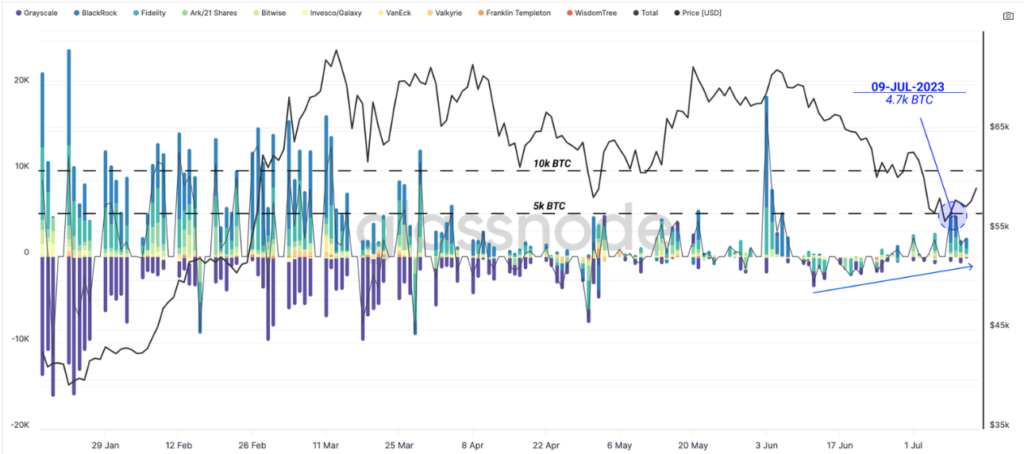

After a prolonged period of volatile and limited trading, the aggregate net flows of all US Bitcoin ETFs experienced a phase of continuous outflows. As prices dropped towards the 54,000 $ low, they fell below ETF holders' average cost basis, currently 58,200 $.

In response, US Bitcoin ETFs recorded their first significant wave of positive interest since early June, with over $1 billion in total inflows last week alone.

The buying power of US ETFs on Bitcoin whenever the price falls is considerable. The long-term impact of this institutional buying power over several years is probably underestimated. The purchasing power ofes US Bitcoin ETFs over the past 7 years months has been from 2.5 billion euros per month. That's a lot of money!

Source: Glassnode

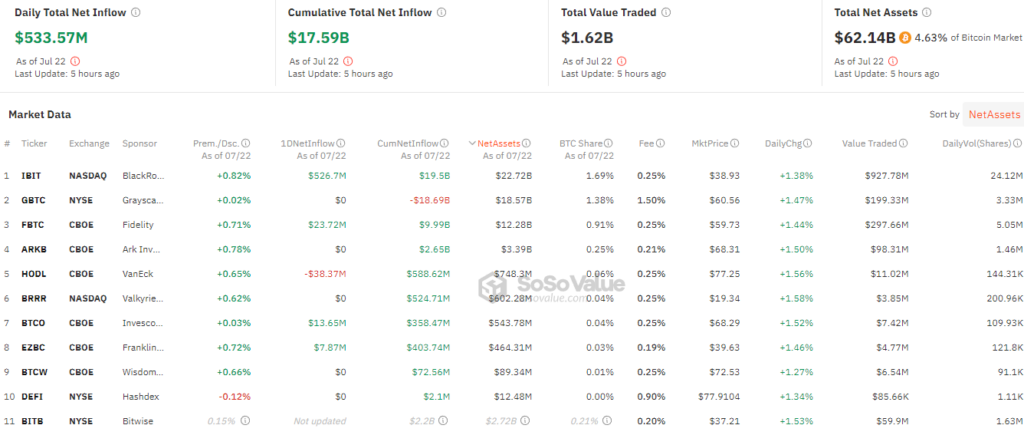

Here are the results of the last 7 months of purchases of US spot ETFs on Bitcoin. We can see that Blackrock's IBIT ETF is in the lead and has overtaken Grayscale's GBTC. Today, nearly 4.63 % of total Bitcoins are in US ETFs!

Source: SoSo Value

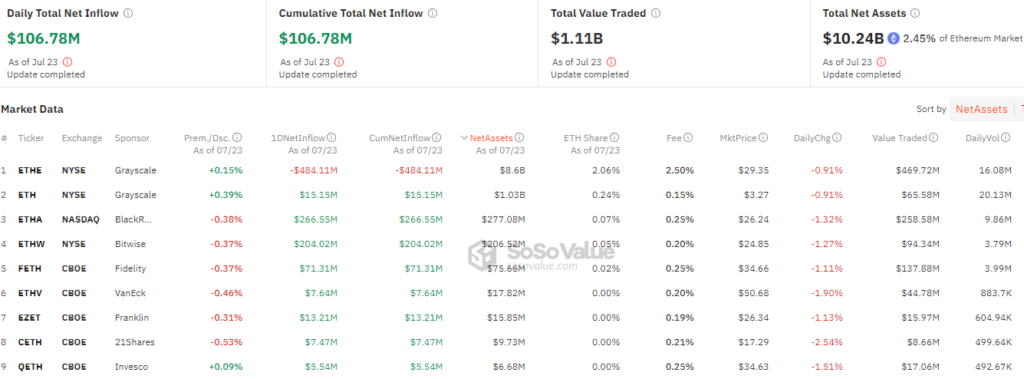

Here are the results for the first day of launch (07/23/24) of the 9 US Ethereum spot ETFs. As with the launch of the US Bitcoin ETF, there was a redistribution of capital from investors already committed to Grayscale's product. BlackRock's Ethereum ETF attracted the most inflows on launch day.

At present, the Ethereum ETF totals $10.24 billion, compared with $62 billion for the Bitcoin ETF. We can anticipate a net inflow of between $5 and $10 billion over the next six months, excluding Grayscale's fund. The target would be to reach around 4 % of Ethereum's total market capitalization within six months.

Source: SoSo Value

Our service

We offer a portfolio management service specializing in digital assets. We provide complete human support from A to Z in this universe. Our aim is to personalize your portfolio allocation according to your risk profile and situation.

With our turnkey management, you can take advantage of the sector's evolution without worrying about: the choice of digital assets, in-depth research, volatility, arbitrages and so on. Simply consult your monthly reports and invest regularly over the long term (4 years or more).

We don't engage in algorithmic trading on a daily basis. We only favor long-term investments in projects we know and understand. Our monthly portfolio arbitrages are accompanied by in-depth asset analysis, with a particular focus on tokenomics.

Discover our website: https://crypto-assets-management.com/

If you have any questions, or would like to find out more about our services, please do not hesitate to contact us: tristan.g@crypto-assets-management.com. You can also schedule a phone call lasting a few minutes by following these steps this link.

Discovery Pack

Investment of less than €20,000

- Entry fee: 1.5 %

- Management fee: 2.5 % / year

- Performance fees: 20 % excl. tax on capital gains (High Water Mark method)

- Exit fee: 3 %

- Minimum subscription: €5,000

- Commitment period : None

Premium Pack

Investment over €20,000

- Entry fee: 1.5 %

- Management fee: 2.5 % / year

- Performance fees: 20 % of performance above the benchmark index*.

- Exit fee: 1.5 if withdrawn before 3 years

- Minimum subscription: €20,000

- Commitment period : None

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of information provided by a third party.ions in this letter.