The aim of this letter on Internet adoption compared with cryptos is to inform you about the current state of the crypto-asset market, as well as recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Cryptos have never been so widely used, according to a16z : 220 million active addresses in September. In a16z's latest report on the crypto ecosystem in 2024, we learn that September was a record month in terms of active addresses. What are the key data points that testify to the growing adoption of blockchain technologies?

-

MicroStrategy's ambition is to become a Bitcoin bank (BTC) valued at $1,000 billion. MicroStrategy's strategy of accumulating as many Bitcoins (BTC) as possible continues to grow. The company has set itself an ambitious long-term goal: to become a Bitcoin bank with a valuation in excess of $1,000 billion.

-

Cryptocurrencies and flat tax seem to be spared: what's in the Finance Bill 2025? On Thursday, the Finance Bill 2025 was presented to the Council of Ministers. While there were fears about the flat tax, a possible increase does not appear to be on the agenda for the time being. Here are the key points.

-

Vitalik Buterin proposes drastic changes for the Ethereum (ETH) network - What could change? Vitalik Buterin, Ethereum's co-creator, has made several far-reaching proposals for the evolution of the payment network, which could strongly affect ETH's staking mechanism. What are they, and what might they change for users?

-

Bitcoin in France: transformations and prospects for asset managers. As Bitcoin takes hold in the United States, there is an urgent need for education among French wealth managers. At the Patrimonia trade show, Paymium mobilized Lyon's community of bitcoiners to facilitate knowledge-sharing with professionals interested in this sector.

Fundamental Analysis

Source : https://www.coingecko.com/fr

Lettre N°42: Internet adoption compared with cryptos; Volatility on the decline and still diversifying!

The Bitcoin price at the time of writing is 67,000 $ (on 17/10/24).

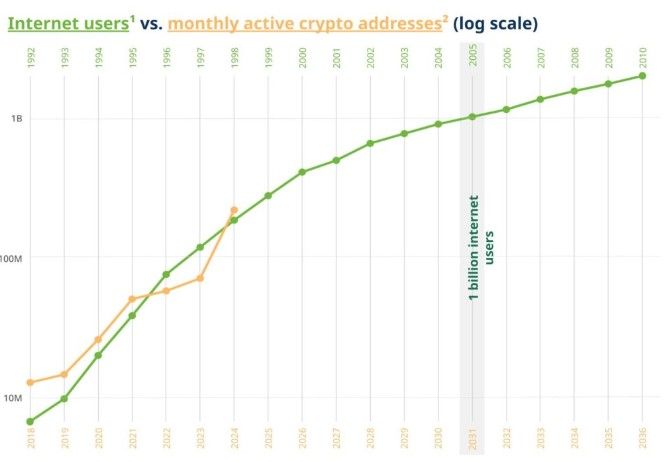

Internet adoption compared with cryptos

There have never been so many active cryptographic addresses per month! In September, 220 million addresses interacted with a blockchain at least once, a figure that has more than tripled since the end of 2023. We can compare this to the Internet adoption rate (in monthly activity), and what's striking is that the curves follow the same trends, which is encouraging.

Today, we're at the same level of adoption as the Internet was in 1998, which shows that the potential for growth is immense. So it's essential to invest in tomorrow's uses for the long term!

Source : a16z

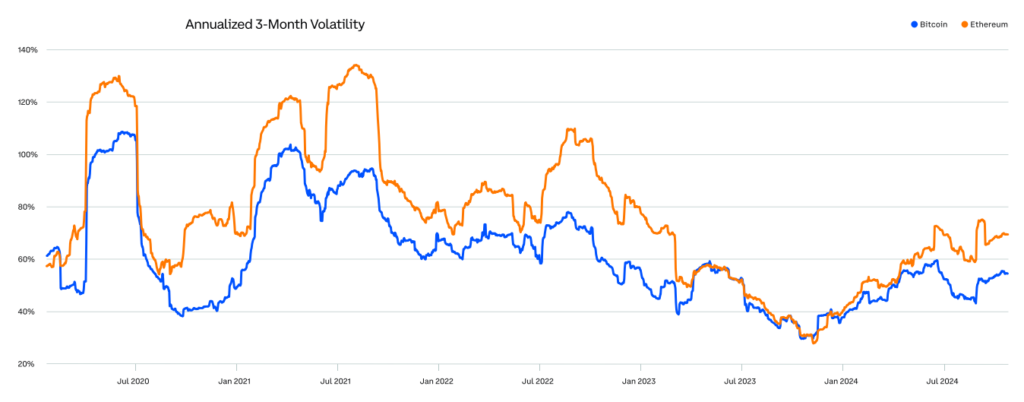

Lower volatility and still diversifying!

Volatility in BTC and ETH is falling sharply as the market matures. This is a very positive signal, as it reflects continued adoption and further growth of the crypto ecosystem.

In the case of Bitcoin, as liquidity increases, volatility decreases, opening the door to growing involvement by institutional investors. Once Bitcoin is fully adopted, volatility will be at a minimum, while liquidity will be at a maximum. The maturity of the Bitcoin project and the market thus continues to progress.

Source: Coinbase Institutional, Glassnode

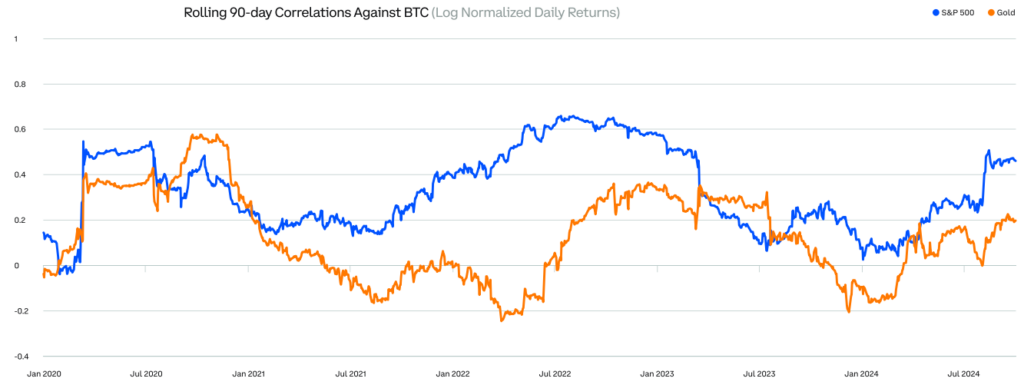

Since 2020, Bitcoin has shown an average correlation of just 0.33 with the S&P 500 and 0.13 with gold, underlining its powerful role as a portfolio diversifier. Contrary to popular belief, BTC is not directly correlated with the equity market.

However, both equities and BTC share common correlations with liquidity and money-printing policies.

As well as being a good diversifier against equities, Bitcoin is also a good diversifier against gold. This shows that it has its own dynamic and constitutes an independent and distinct asset class (along with digital assets).

Source: Coinbase Institutional, Glassnode

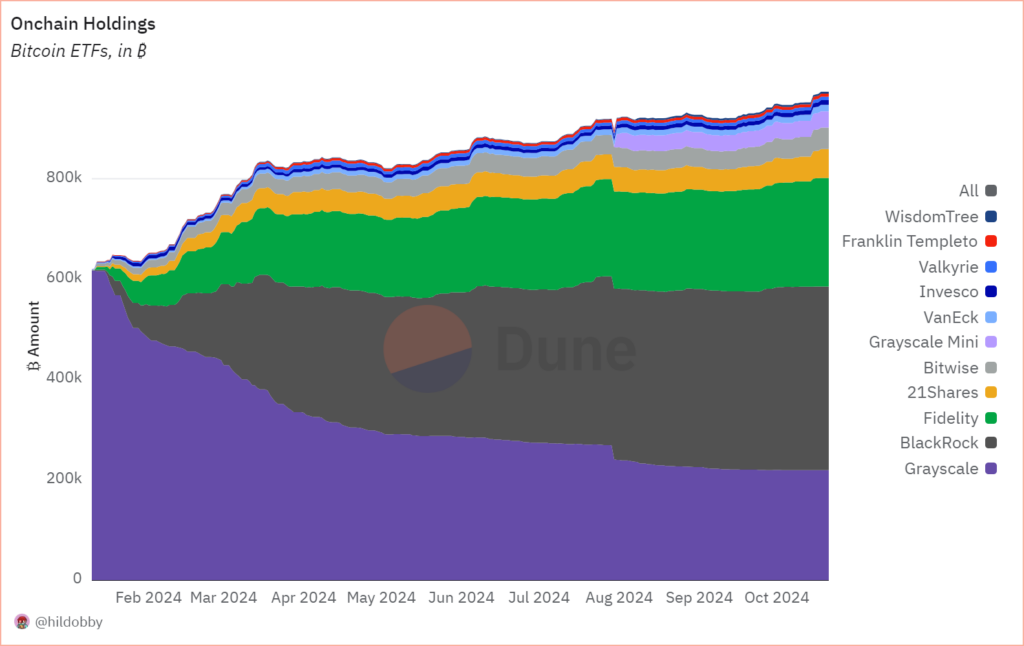

Bitcoin ETFs: voracious accumulators of BTC?

Since their launch in January 2024, the progress of Bitcoin ETFs has been truly impressive. These financial instruments, which enable institutional investors to gain exposure to Bitcoin without having to hold it directly, are experiencing a rapid rise in popularity and influence.

It took gold ETFs 5 years to break the $20 billion barrier: Bitcoin did it in 10 months. The most successful ETF launch in history! This is the result of global recognition and adoption.

In conclusion, the speed with which Bitcoin ETFs are capturing the available supply marks a key turning point in the market. This dynamic highlights the growing adoption by institutions and accentuates the scarcity aspect of an already limited Bitcoin supply. Today, thousands of advisors, managers and financial experts from major companies like BlackRock are helping to democratize and explain Bitcoin.

Here's a graph illustrating the evolution of the number of Bitcoins held in ETFs, from around 600,000 BTC to almost 1 million BTC in the space of ten months.

The colors represent the competition between the various ETF issuers, highlighting their struggle to attract investors and sell their shares of Bitcoin through their ETF products. This dynamic creates heightened competition between them to quickly explain what Bitcoin is, as well as its benefits.

Source : Dune

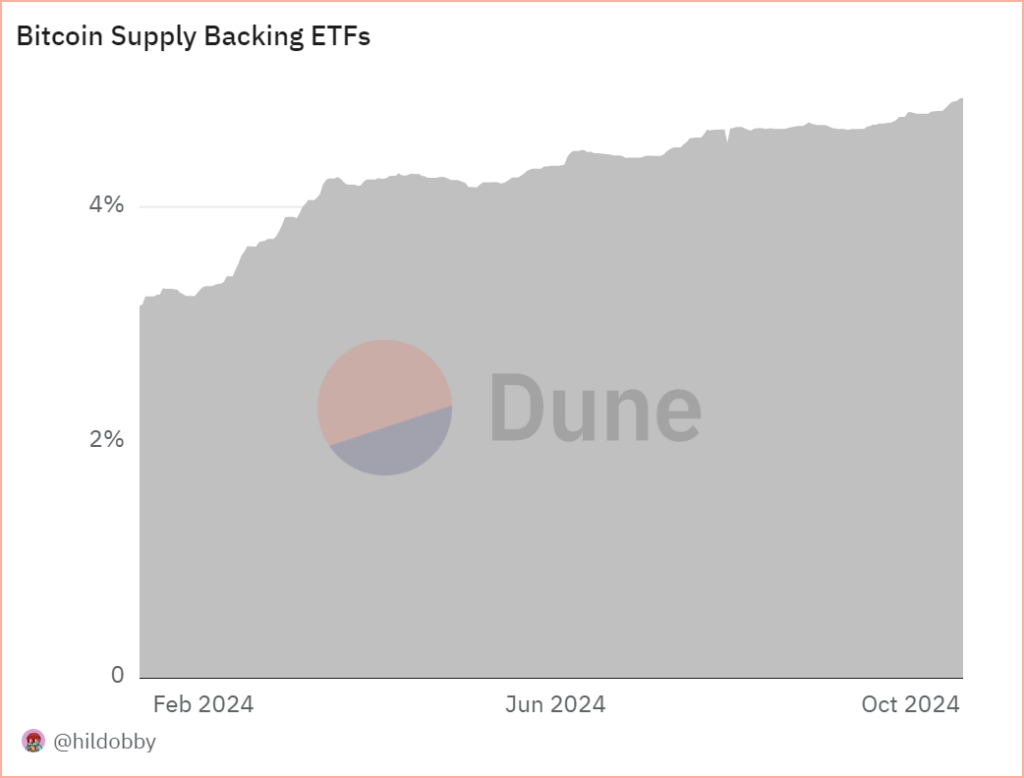

Spot Bitcoin ETFs are beginning to capture a significant portion of Bitcoin's circulating supply. The percentage of supply captured has risen from 3.24 % to 5 % of the total supply as of today.

This increased demand reduces the supply available on the market, generating an additional «scarcity effect» on the limited quantity already available.

Source : Dune

Our service

At Crypto Assets Management, we offer discretionary management of digital asset portfolios, customized to your profile. Our strategy is based on analysis and management of Bitcoin cycles (historically 4 years)with a focus on long termmonthly arbitrages, and with a particular focus on tokenomics.

Discover our website: https://crypto-assets-management.com/

Discovery Pack

Investment of less than €20,000

- Entry fee: 1.5 %

- Management fee: 2.5 % / year

- Performance fees: 20 % excl. tax on capital gains (High Water Mark method)

- Exit fee: 3 %

- Minimum subscription: €5,000

- Commitment period : None

Premium Pack

Investment over €20,000

- Entry fee: 1.5 %

- Management fee: 2.5 % / year

- Performance fees: 20 % of performance above the benchmark index*.

- Exit fee: 1.5 if withdrawn before 3 years

- Minimum subscription: €20,000

- Commitment period : None

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of the