The aim of this newsletter «Bitcoin's end of cycle or fourth wave of bullishness? Is the time for cycles over?» is to inform you about the current state of the crypto-asset market, as well as recent news in this field. This letter is not intended as investment advice, but merely as a sharing of my personal point of view.

News

End announced for the US «shutdown»? The crypto market reacts upwards. The U.S. administration has been paralyzed for over a month, in what appears to be the longest shutdown in U.S. history. A situation that could finally come to an end following a recent agreement between Democrats and Republicans.

-

45 % of ETF investors plan to gain exposure to cryptocurrencies over the next year. Since the approval of Bitcoin and Ethereum spot ETFs on the US market in early 2024, exchange-traded funds applied to cryptocurrencies have been on a roll. And adoption could well accelerate over the next year.

-

More than half of hedge funds have invested in crypto. According to a recent report, crypto-currencies are of growing interest to traditional investment structures such as hedge funds. More than half of them are already actively exposed to cryptocurrencies, and that's just the beginning.

-

«We're making the United States the Bitcoin superpower»: Donald Trump reaffirms his pro-crypto ambitions. On Wednesday in Miami, Donald Trump touched on cryptocurrencies in a lengthy speech, claiming to make «the United States the Bitcoin superpower». Let's take a closer look at what he said.

-

Exaion: French bid could block MARA takeover. The takeover of Exaion by Mara, an American Bitcoin miner, has raised concerns about France's digital sovereignty. While the deal is still awaiting approval, a French counter-offer has reshuffled the deck, driven by industry players keen to keep this strategic infrastructure under national control.

Fundamental Analysis

Source : https://www.coingecko.com/fr

Letter No. 47: End of the Bitcoin cycle or fourth wave of bullishness? Is the time for cycles over?

The Bitcoin price at the time of writing is 100,931 $ (07/11/25).

Probability of further downside increases

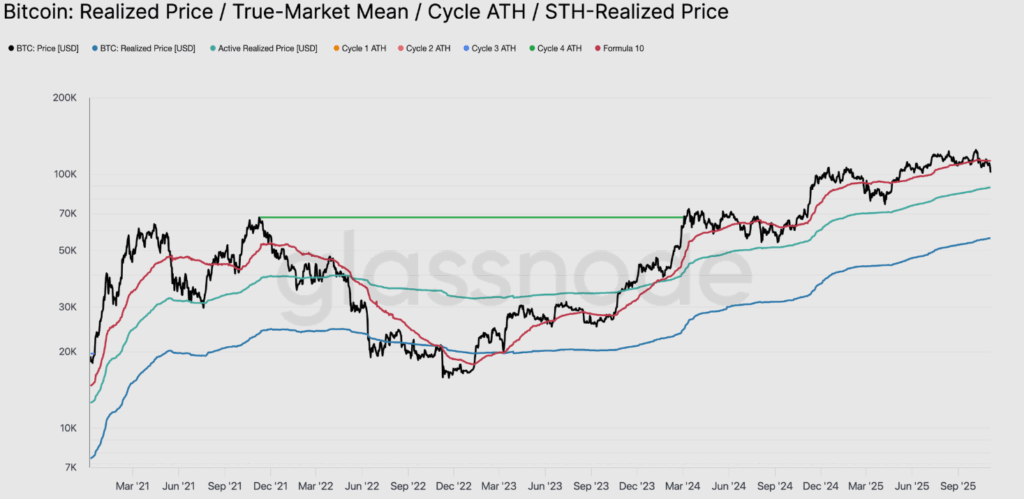

This bull market has been going on since November 2022. We've been on a continuous uptrend for 3 years now.. The Bitcoin price was around 15,000 $ 3 years ago. We are currently in a very mature bull market that is struggling to hold above the cost price of short-term holders, which has led to a sharp drop to around 100,000 $, or around 11 % below this key threshold at 112,500 $.

Historically, such large discounts from this level have increased the likelihood of a further decline towards lower structural supports, such as the price realized by active investors, currently close to 88,500 $ . This indicator tracks the cost price of supply in circulation in real time, and has often served as a crucial reference point during the protracted corrective phases of previous cycles.

Taking a step back and analyzing past cycles (below), we can clearly see the distribution and accumulation phases of long-term holders. In the current cycle, as illustrated in the previous graph, three waves of distribution and accumulation have taken place, in contrast to previous cycles which had only one wave.

Generally speaking, these investors gradually accumulate bitcoins when prices fall, and intensify their purchases during sharp corrections. At present, long-term holders seem ready to embark on a new accumulation phase, which historically lasts between six months and a year at the end of a cycle. This accumulation phase will probably occur when prices fall. Thereafter, accumulation will continue, but at a slower pace throughout the inter-cycle period.

This leads us to consider two scenarios for the continuation of this cycle:

- A consolidation phase that could last a few more months, followed by a fourth wave of price rises, leading to a new distribution on the part of long-term holders and marking the end of the current cycle before they embark on a major accumulation phase later on.

- A more pronounced correction, with the price of bitcoin crossing 97,000 $ per Bitcoin, would signal the end of this cycle. and the start of a new surge in accumulation by long-term holders as prices gradually fall.

We let's lean towards the second hypothesis as long-term holders already seem to be stepping up their sales. And inflows of new capital, particularly via ETFs, have fallen off sharply.

A break below 97,000 $ would send us into a bear market, while a break above 114,000 $ would open the way to potential new record highs. In any case, caution remains the order of the day in the short term.

In the event of a bear market, this could extend over a period of 10 to 12 months, with a final target of $50,000 to $60,000. This scenario may seem improbable, but if it were to materialize, it would still be quite normal and common in the Bitcoin life cycle.

Time markers for Bitcoin cycles

There are several ways to analyze the rhythm of Bitcoin cycles.

The first consists of observing the cycles from the date of each halving, which, let me remind you, is the event written into the Bitcoin protocol that halves money creation every four years.

The second approach is to measure the cycle from the highest point of the previous bull market.

Finally, the third consists of observing it from the last lowest point of the current cycle.

| Cycles | End of cycle in days after Halving | End of cycle since top of previous cycle | End of cycle from cycle low point |

| 2012 | 366 Days | 902 Days | 775 Days |

| 2016 | 526 Days | 1472 Days | 1068 Days |

| 2020 | 546 Days | 1424 Days | 1061 Days |

| Current cycle / today | 571 days? | 1464 Days? | 1081 Days? |

From this table, we can see that the average duration is entirely consistent with the end of a cycle. This scenario would therefore not be particularly surprising.

Here's a graphic visualization of the price superposition of previous Bitcoin cycles. It can be seen that, logically, the strength of each cycle tends to diminish over time, as it becomes more difficult to grow a larger market. In terms of duration, however, the cycles remain relatively regular.

Have the Bitcoin cycles come to an end?

Can we envisage the end of Bitcoin cycles, often considered predictable and too regular?

First of all, it's worth remembering that previous cycles were also identified and anticipated, although this didn't prevent them from recurring. Their form may have evolved, but their general rhythm has remained similar.

On the other hand, the argument relating to halving and the gradual decrease in its impact on the total number of bitcoins already in circulation remains entirely relevant.

That said, markets are ultimately only the average result of the behavior of all players. If the majority continue to believe in the existence of cycles, then many will sell to buy back later, thereby mechanically recreating these same cycles.

The market, however, has undergone a profound evolution and has become considerably more mature than in previous cycles. The new players - investment funds, corporate treasuries or investors via ETFs - are not participating in this market with a short-term rationale. Institutional investors have much longer investment horizons and far greater resources at their disposal than those already committed to Bitcoin.

The answer to this question is: we don't know yet.

The next two years will give us a clearer picture. In the meantime, our priority remains safeguarding our customers' capital, until further notice. If our analysis proves wrong, we will have missed only a marginal part of the bull market. On the other hand, if it proves correct, we will have effectively protected our clients' portfolios.

Our service

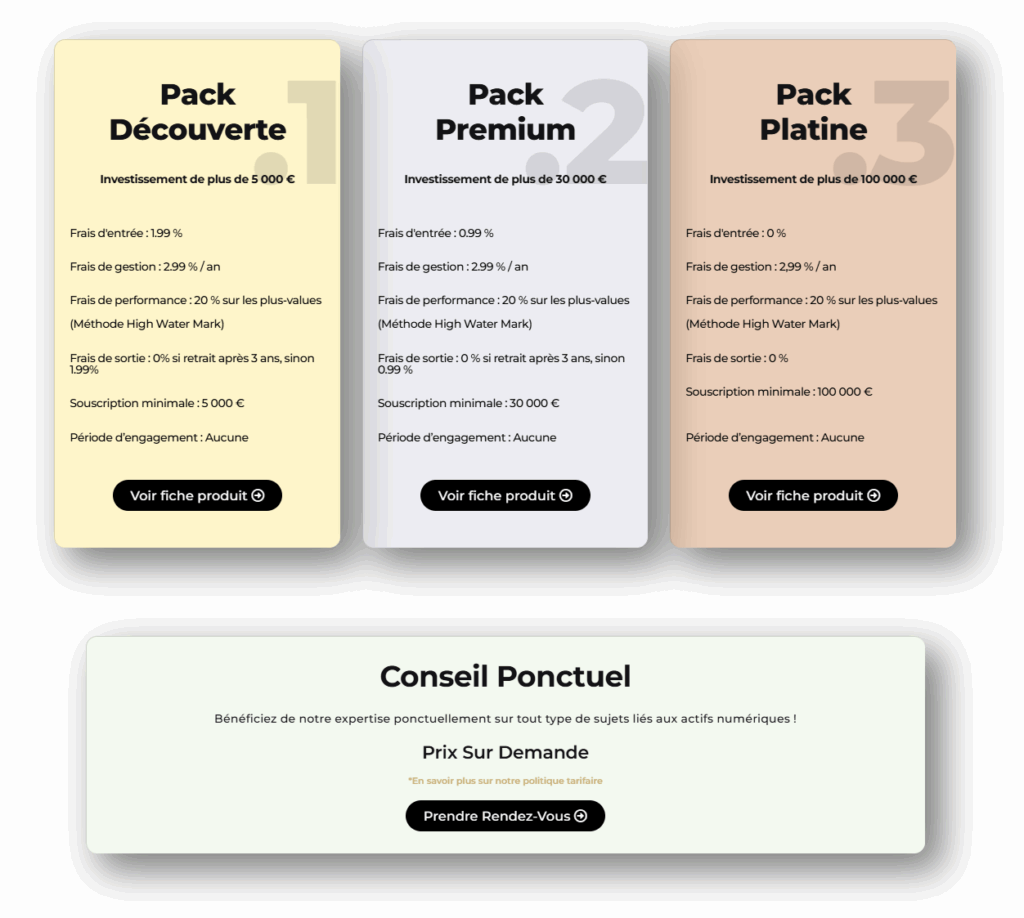

At Crypto Assets Management, we offer discretionary management of digital asset portfolios, customized to your profile. Our strategy is based on analysis and management of Bitcoin cycles (historically 4 years)with a focus on long termmonthly arbitrages, and with a particular focus on tokenomics.

Our rates

Mereau Finance (Crypto Assets Management) is registered as a Service Provider for Digital Assets (PSAN) with the Autorité des marchés financiers (AMF) under number : E2023-084.

- Warning -

This letter does not constitute investment advice.

You alone are responsible for your investment decisions.

Investing in digital assets involves a risk of partial or total capital loss.