The aim of this « 2025, the year of the turnaround? » is to inform you about the current situation of the crypto-asset market but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Towards a more pronounced adoption of Bitcoin Strategic Reserves (BTC) in 2025? Will more and more countries start building strategic Bitcoin (BTC) reserves in 2025? To this question, renowned asset manager Franklin Templeton is categorical: several nations will officially embark on the creation of such a reserve.

-

Bitcoin's (BTC) capitalization will reach 20 % that of gold in 2025, according to Galaxy Research. Bitcoin (BTC) on an upward trajectory by 2025? That's the prediction of Galaxy Research, which estimates that the largest cryptocurrency will see its capitalization explode. What price could it reach?

-

Euro payments down sharply over 10 years according to SWIFT. The greenback, again and again. While the US dollar (USD) is increasingly used in SWIFT payments, this is not the case for the euro, which has seen its use fall sharply over the last 10 years. Why is this?

-

Switzerland: an initiative launched to create a strategic Bitcoin (BTC) reserve. As more and more countries consider setting up a strategic Bitcoin (BTC) reserve, several Swiss cryptocurrency supporters have decided to take action. Depending on popular support, the Swiss National Bank may soon be obliged to create such a reserve.

-

U.S. to sell $6.5 billion in Bitcoins - Is Biden attacking Trump before he takes office? The United States is preparing to liquidate 69,370 BTC, worth $6.5 billion, seized during the dismantling of Silk Road. This decision, taken just days before Donald Trump's inauguration, raises questions about its motivations and potential impact on the Republican camp's Bitcoin strategy.

Fundamental Analysis

Source : https://www.coingecko.com/fr

Lettre N°44: 2025, the year of the turnaround? The opportunity of stablecoins

The Bitcoin price at the time of writing is 93,600 $ (09/01/25).

2025, the year of the turnaround?

Prices rose sharply in 2024, as the chart below shows: the cycle seems to be unfolding with almost mechanical precision. We anticipate that 2025 will be a favorable year for the crypto industry, marking however a transition from a bull market to the beginning of a bear market.

We are gradually approaching the peaks of previous cycles (2018-2022), which, if transposed to the current cycle, could occur between March and May 2025. As for the 2015-2018 cycle, its transposed peak would be reached between November and December 2025.

It's usually in these final phases that the price of Bitcoin and altcoins rises most rapidly in euphoria, before entering a bear market, estimated at between 12 and 16 months.

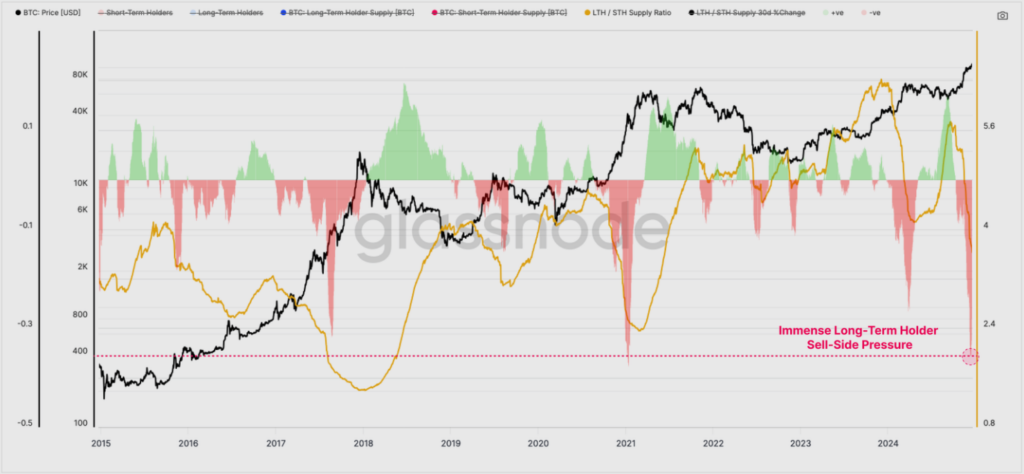

The Glassnode chart below illustrates the ratio between long-term and short-term holders. It shows a drop to around 3.5 (orange line), indicating strong selling pressure from long-term holders. For the time being, inflows are sufficient to offset outflows, but this situation can only last a few months, especially if share prices rise rapidly.

Eventually, the inflows (buyers) risk being swamped by the outflows (sellers) of long-term holders, as they hold the majority of Bitcoin. This pattern repeats itself regularly.

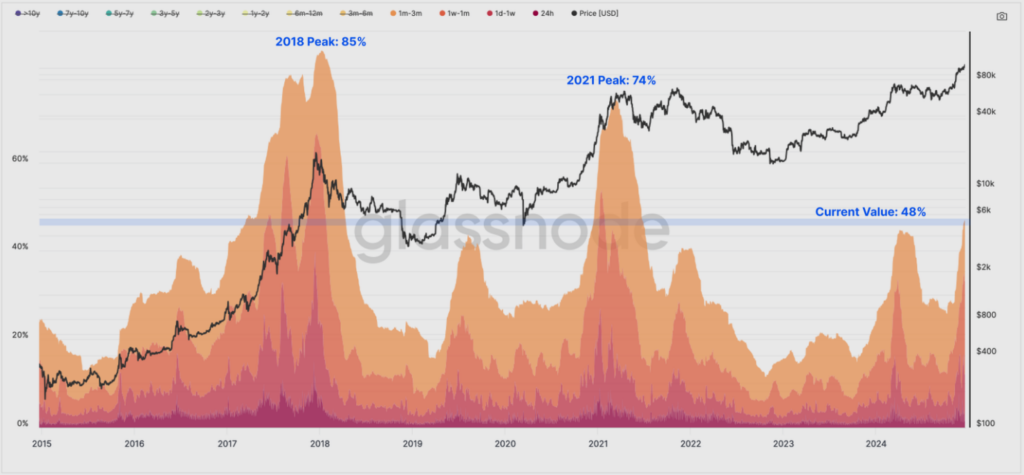

This latest chart from Glassnode illustrates the holding age of each token. An increase in the light orange areas indicates a rise in tokens held for 1 to 3 months, reflecting a transfer of value from long-term to short-term holders.

We're seeing a similar pattern to previous cycles, which calls for caution in our exposure to the market. The complex question is: where exactly are we in this latest phase of the bull market? The more we try to pin down the time scale, the greater the risk of error. However, we believe there is still room for a final upward impulse.

Entering phase 2

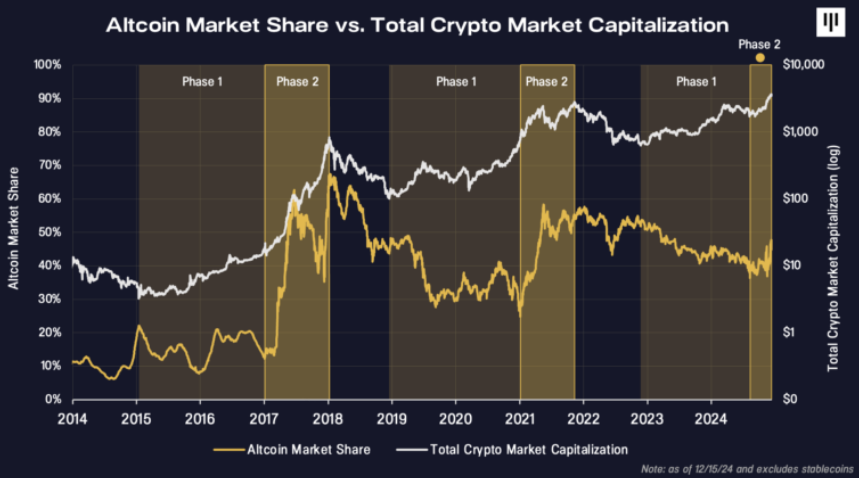

The price of Bitcoin progresses through different market phases. As we can see from the chart below from Pantera Capital. Historically, bull markets are composed of two main phases:

Phase 1, The first stage occurs when Bitcoin tends to outperform the rest of the market. This follows a tentative return of capital to the «king of digital assets». Investor confidence is gradually rebuilt after a bear market, and Bitcoin becomes the only asset to which they are willing to direct their capital.

Phase 2, The second stage is when Altcoins tend to outperform Bitcoin. This is the last phase of a bull market, marked by euphoria. Liquidity then shifts from Bitcoin (in gain) to Altcoins. Sometimes, the scale of Altcoin's performance is so great that it outperforms Bitcoin over the entire duration of the last few cycles.

It would appear that the first signs of this second phase are visible, particularly following the recent surge (November 2024) catalyzed by the US elections. We can clearly see the market share of Altcoins rising again. This second phase is generally 6 to 12 months shorter than the first. Thereafter, 2025 will probably be the year in which the bull market turns to a bear market.

The opportunity of stablecoins?

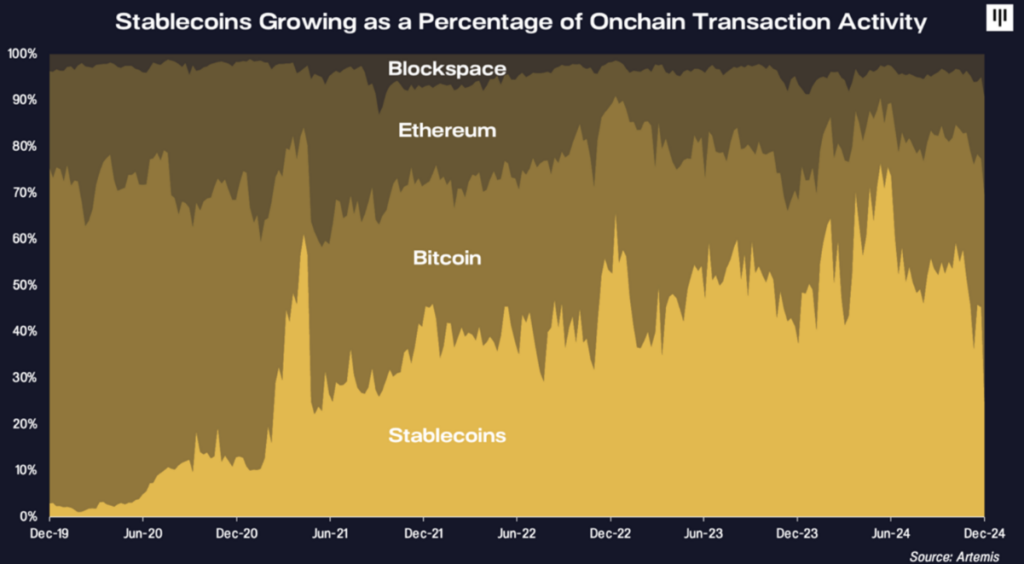

Digital assets are made up of numerous sub-categories: utility tokens, NFTs, stablecoins, security tokens and so on. A relatively discreet category, but essential to sustaining the industry and its adoption, is that of stablecoins.

Stablecoins have grown from 3 % of transactions on the blockchain in 2020 to over 50 % of transactions today. They represent one of the most important value propositions in the ecosystem, although often overlooked due to their non-speculative nature.

Over the past few years, stablecoins have demonstrated their fundamental usefulness for cross-border payments. The fastest-growing geographical areas for the use of stablecoins are mainly in emerging markets, where access to a stable currency for making payments is highly sought-after.

Stablecoins offer a value proposition at least ten times greater than that of traditional payment methods. Cross-border transfers account for hundreds of billions of dollars in annual revenues. These transfers are currently the subject of a disruptive innovation, being carried out via stablecoins circulating on the rails of blockchains!

With this rapid adoption of stablecoins in B2C and B2B payments, the supply of stablecoins in circulation and the volume of transactions are reaching all-time highs!

Projects based on stablecoins could prove promising. Among the initiatives in our portfolio are USUAL (usual.money), a stablecoin that redistributes the US central bank's interest rate to holders of USUAL tokens, with the ambition of rivaling Tether's USDT.

Projects generating tangible income will stand out, particularly those linked to the theme of the fees switch, The USUAL project combines these two dynamics: the power of stablecoins and the redistribution of income. The USUAL project combines these two dynamics: the power of stablecoins and the redistribution of income.

Our service

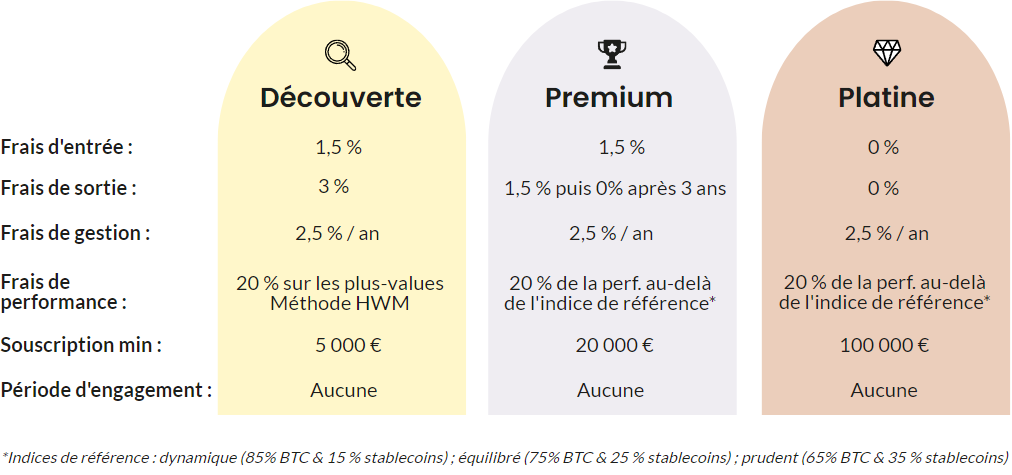

At Crypto Assets Management, we offer discretionary management of digital asset portfolios, customized to your profile. Our strategy is based on analysis and management of Bitcoin cycles (historically 4 years)with a focus on long termmonthly arbitrages, and with a particular focus on tokenomics.

Our rates

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of the information in this letter.