Hello everyone,

The aim of this letter is to inform you about the current situation of the crypto-asset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

European Union: DAC8, companies will soon have to declare all your cryptocurrency transactions to taxes. Will crypto companies in European Union countries have to declare all transactions and transfers in future, regardless of the amounts involved? Yes, according to the European Parliament, which has just validated a new common rule, the DAC8. What does this mean, and is it the end of anonymity in Europe?

-

Ethereum (ETH): 1 year after The Merge, what are the results and outlook? One year ago today, at around 8:42 a.m. Paris time, the Ethereum blockchain (ETH) successfully completed a historic update: The Merge. What did this mean for the network? What happened next? What's next? Let's take a look.

-

Crypto: Germany's 1st bank to hold cryptocurrencies for its institutional customers Could it be that finance's biggest private companies are about to embrace cryptocurrencies? Deutsche Bank, Germany's leading bank, has announced a partnership with Swiss company Taurus to offer cryptocurrency custody services to its institutional clients. The German bank thus joins the giant French and Anglo-Saxon banks in the race for crypto-friendly services.

-

«No support for an MNBC»: in the United States, the digital dollar divides the political class Could the Federal Reserve face strong opposition if it chose to develop a digital dollar? Yes, on the Republican side. The U.S. opposition party is trying to prevent the development of a central bank digital currency (CBDM), deemed dangerous to the country's economic equilibrium.

-

Binance unveils opBNB, its layer 2 based on Optimism's OP Stack for reduced transaction costs. The developers of Binance's BNB Chain have just made official the arrival of opBNB on its mainnet. Layer 2, based on Optimism's OP Stack, has been designed to increase the scalability of the BNB Chain while reducing its transaction costs. An overview of opBNB, which has officially entered the Layer 2 ecosystem.

-

France: digital asset management company Fipto raises $15 million. French company Fipto has just completed a funding round that raised $15 million. The blockchain-based international payment service intends to facilitate international payments and digital asset management for businesses.

-

Global recession: JPMorgan CEO issues warning. Is a severe recession on the cards for the months and years ahead? That's the opinion of JPMorgan's CEO, who reminds us that corporate profits are just one indicator. What does he foresee?

-

Blockchain Capital offers two new funds totaling $580 million. Who said VCs were losing interest in the crypto ecosystem? Venture capital firm Blockchain Capital has just closed two new funds, raising $580 million. Zoom in on this new initiative.

Fundamental Analysis

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 27,100$ (on 20/09/23).

Capital turnover on Bitcoin:

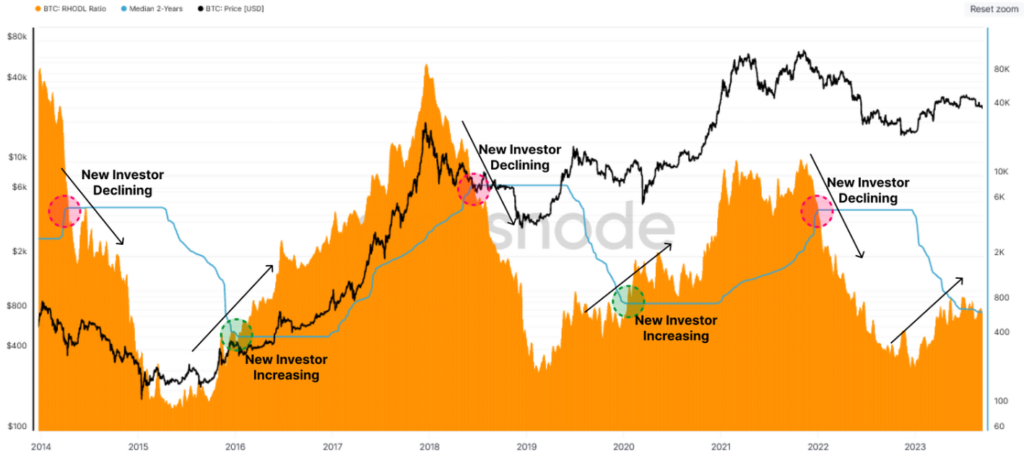

The realized HODL ratio (RHODL) is a market indicator that tracks the balance between wealth held in recently moved coins (<1 week) and that of longer-term investors (1 to 2 years). In this chart, Glassnode has applied a median of 2 years (i.e. half a cycle) in order to have a threshold value for periods when capital flow patterns change from a bullish to a bearish market structure.

We can see that by this measure, 2023 saw a modest influx of new investors. However, the RHODL ratio has just about matched the 2-year median level. The influx of new investors is positive, but relatively weak in terms of momentum. It looks like 2020 in the previous cycle: we're probably in the same period as January/February 2020, as you can see from the chart below. Of course, we must omit the «black sign» of Covid-19, which arrived in March 2020. These events are always possible in the future, but we can't anticipate them and factor them into long-term cycles. Ultimately, these events have no long-term impact.

Source: Glassnode

The future lies in Layer 2:

One of Ethereum's main criticisms is that, during periods of increased activity, transactions on the base layer can be slow and expensive. While the roadmap for creating a scalable platform has been hotly debated, Layer 2s such as Arbitrum, Optimism and Polygon are now the means to solve this problem.

Layer 2s are off-chain solutions. In other words, they are fully-fledged protocols whose main aim is to offload the parent blockchain.

These protocols are built on a different philosophy. Where traditional Layer 1s focus on security and decentralization, Layer 2s are primarily concerned with scalability. The considerable advantage of Layer 2 comes from its dependence on its parent blockchain, inheriting its security.

There are many ways to improve scalability. Most of them are based on a simple principle: combine several transactions into a single operation. This is then sent to the parent blockchain, where it is validated.

We believe that the Layer 1 race is over, and that it's now time for competition and the development of Layer 2. The future will involve several Layer 2s, perhaps each specialized in a particular segment.

Below, we can see the relative shares of Layer 2 transactions + those of Ethereum. There are other Layer 2s under development and/or not yet tokenized. We're keeping a close eye on them. There will probably be stiff competition in Layer 2 in the years to come.

Source : Pantera

The important thing is to be invested for the long term :

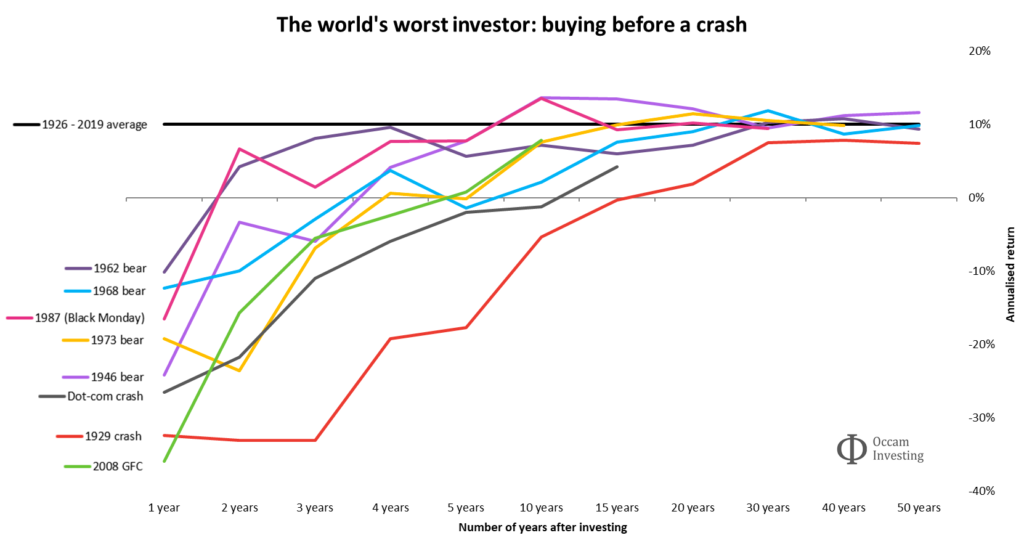

Here's an interesting simulation by Occam Investing: what if an investor were the worst investor in the world? The market would collapse immediately after he has invested. What would this investor's return be cursed ? Let's take the data back to 1926. The graph shows the returns of the cursed investor who bought On the eve of one of the world's worst bear markets in history.

The black line at the top corresponds to lhe average performance of the S&P500 between 1926 and 2019 (approximately 10% per year). The colored lines represent the number of years it will have taken our doomed investor to return to the mean. There's the Internet bubble at gray, the Black Monday of 1987 in rose.

Unsurprisingly, the short term is catastrophic. The 2008 financial crisis resulted in a drawdown (fall between the high and low points of a cycle) particularly hard over a year. But let's look at the big picture. Let's look at the long-term figures (which are counted in decades, not years).

The more time passes, the more the cursed investor's return tends towards the long-term average.

Good things come to those who wait. Even after the biggest crash in history in 1929. The key is to stay invested.

Our service

We offer a portfolio management service specializing in digital assets. We provide complete human support from A to Z in this universe, adapting the allocation of your portfolio to your risk profile and situation.

Our turnkey management allows you to profit from the evolution of this sector without worrying about which digital assets to put in your portfolio, nor about in-depth token research, volatility, arbitrages, etc... All you have to do is read your monthly reports and invest regularly with a long-term horizon (4 years and more).

We don't do algorithmic trading or daily trading, we invest for the long term in projects we know and understand. We make monthly arbitrages in the portfolios and study in depth the assets (especially their tokenomics) that we put in the portfolio.

Discover our website: https://crypto-assets-management.com/

If you have any questions or comments, or if you would like to find out more about our service, please do not hesitate to contact us at this e-mail address: tristan.g@crypto-assets-management.com or make a telephone appointment with us via this link.

Discovery Pack

Investment of less than €20,000

- No entry fees

- Management fee: 2 % excl. tax / year

- Performance fees: 20 % excl. tax on capital gains (High Water Mark method)

- Exit fee: 3 % excl. tax

- Minimum subscription: None

- Commitment period : None

Premium Pack

Investment over €20,000

- No entry fees

- Management fee: 2 % excl. tax / year

- Performance fee: 20 % excl. tax of performance in excess of the benchmark index*.

- Exit fees: None

- Minimum subscription: €20,000

- Commitment period : None

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of information provided by a third party. in this letter.