Hello everyone,

The aim of this letter is to inform you about the current situation of the cryptoasset market, but also about recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Ethereum 2.0 closer than ever? At the Web 3.0 developers' summit in Shanghai, Vitalik Buterin himself spoke of a arrival of Ethereum 2.0 between August and October 2022! So, be patient... Ethereum 2.0 should arrive in 2022!

What does the Ethereum 2.0 update bring? In a nutshell:

- A reduction in the ecological footprint of 98 % thanks to a change in the type of block validation consensus. From Proof of Work (PoW) to Proof of Stake (PoS).

- Ultimately, a reduction in transaction costs on the Ethereum network, particularly with the layers 2.

- Eventually, with the use of technologies such as Sharding and layers 2, an increase in network capacity.

- A change in the metrics of the Ether token (ETH) that will shift the tokenomics of the Ether token from inflationary to deflationary. Mathematically, this can have the effect of increasing the value of ETH tokens.

This update will be a great feat for the crypto ecosystem and is the most eagerly awaited event of this year.

Blockchain technology was invented at the same time as Bitcoin in 2009, making it the very first digital asset. Since then, numerous blockchains have enabled many digital assets to function and fulfill the use cases for which they were created. Beyond its speculative appeal, blockchain remains above all a technology that is increasingly attracting the attention of professionals. A school was created by Jérémy Wauquier : Alyra offers distance learning courses with a flexible syllabus, enabling you to become a true expert in this ecosystem, through a course paced by professionals, with a certificate of competence at the end.

Despite the downturn in the crypto-asset market, bitcoin is still the darling of financial behemoths. PricewaterhouseCoopers (PwC) has published a report on the’adoption cryptocurrencies by traditional hedge funds.

And 3 statistics provide insight into the current and future level of commitment of these funds to cryptocurrencies:

- Around a third of the participants (89 funds) in the study invest in digital assets;

- 57 % of funds already committed to cryptocurrencies have allocated at least 1% of their assets under management to the sector ;

- 2/3 of these funds plan to increase their investments in the industry by the end of 2022.

According to this data, these funds, already investing in cryptocurrencies, want to increase their exposure, despite the market turmoil.

Brazil: bill introduced to recognize Bitcoin (BTC) as a means of payment. On June 10, a Brazilian deputy introduced a bill aimed at recognizing Bitcoin (BTC). as a means of payment. From now on, it's the Brazilian legislator to deliberate on this bill. The adoption of this bill could be an important milestone for the country, which could follow in the footsteps of El Salvador and the Central African Republic.

Fundamental Analysis

Source : https://www.coingecko.com/fr

The Bitcoin price at the time of writing is 21,800 $ (16/06/22).

Over the past few weeks, we've witnessed the final phase of the crypto-asset market's capitulation. As a reminder surrender phases on the stock market are phases of accelerating decline, and they precede a rebound, as a kind of “purge” before sentiment normalizes and a bullish period resumes. In previous cycles, after phases of capitulation, it took several months for the market to recover and start its next major cycle.

As you can see below, we've entered the deep and painful bear market phase. These phases were reached during early 2015, early 2019 and punctually during the Covid-19 crisis in March 2020. These phases have previously lasted between 3 and 6 months before the start of the next cycle. These are generational buying opportunities before the next cycle.

The chart below is a heat map of the 200-week moving average of the Bitcoin price in dollars. In each of its major market cycles, the Bitcoin price historically bottoms around the 200-week moving average. This indicator uses colors based on the percentage increase of this 200-week moving average. Depending on the monthly increase in % of the 200-week moving average, a color is assigned to the price chart.

Source : https://www.lookintobitcoin.com/charts/200-week-moving-average-heatmap/

In order for the start of the new cycle to get underway, geopolitical and inflationary tensions around the world will need to stabilize, as crypto-assets are well connected to today's economic world.

The crypto-asset market isn't the only one to be down sharply; all stock market indices are down sharply, particularly in the technology sector. There's a reason for this: central banks are raising interest rates and scaling back quantitative easing (QE). In a nutshell: central banks are stopping printing money because of rising inflation (loss of purchasing power through a generalized increase in prices). The result is a liquidity crisis and a deflation of all the markets irrigated by this money printing.

Nevertheless, the interest rates set by the central banks (FED, ECB...) of rich, over-indebted countries (such as France at 150% of GDP) cannot rise too much, because if these interest rates rise, this increases the interest these countries have to pay on their debt.

As a result, central banks were left with two choices:

- Either they raise their interest rates sharply to beat inflation, but the markets collapse and the interest on government debt can no longer be paid: these states therefore go bankrupt. We can already see the first repercussions of this monetary tightening with the exceptional meeting on Wednesday 15/06/2022..

- Or, they can resume the money-printing they've been doing for the past few decades, so that governments don't have to pay the consequences of their over-indebtedness and the markets continue to rise: in which case, the bill will be paid by the people in general, with high inflation or hyper-inflation that will last over time.

Several factors lead us to believe that the second choice will be selected. In the meantime, in the long term, crypto-assets will not be impacted by inflation, notably Bitcoin with its limited quantity of 21 million tokens. It will continue to build up as a store of value over time and over time. the long term as you can see from the 200-week moving average chart I showed you earlier! In the short term, it's a risky, volatile asset that's strongly impacted by market liquidity, which is why it's punctually correlated with stock market indices, which are also impacted by the liquidity injected by central banks.

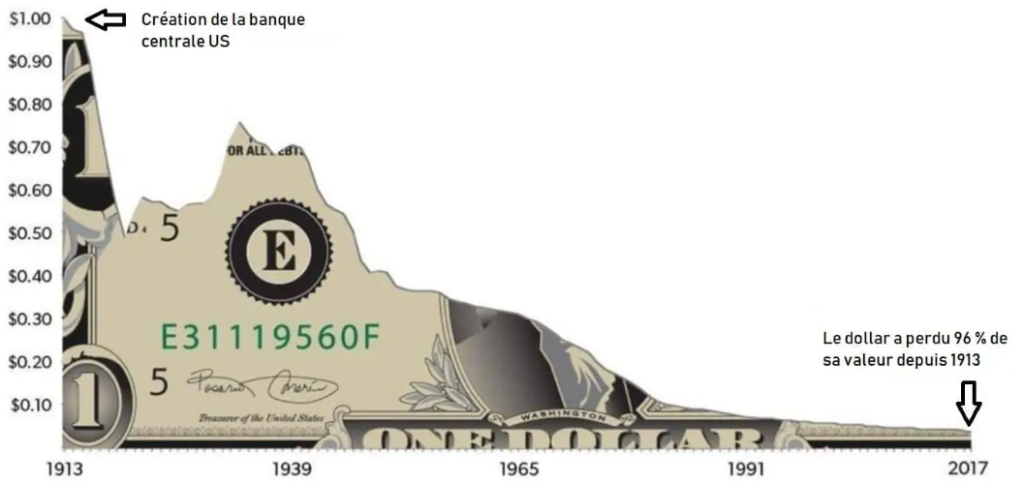

FIAT currencies (euros, dollars...) are non-volatile in the short term, but lose value over the long term. Digital assets such as Bitcoin (BTC) and others (ETH, BNB...) are highly volatile in the short term, but retain and sometimes even increase in value over the long term.

The two images below make it easy to visualize what I'm trying to explain about the purchasing power of FIAT currencies (dollars, euros). Of course, digital assets are more recent, and they still have many «tests» and periods to go through to validate these assertions over time. And that's what makes it an investment: if it were a certainty, there would be very little volatility, as with gold, which has already proved its worth over very long periods.

If you have any questions, comments or would like to find out more about our service, please do not hesitate to contact us: crypto.assets.manage@gmail.com

- Warning -

This is not investment advice. No one can predict the future.

You are solely responsible for your own investment decisions.

We are not responsible for any loss resulting from a decision taken on the basis of the information in this letter.