The aim of this letter on FED interest rates cut by 0.5 % is to inform you about the current state of the crypto-asset market, as well as recent news in this field. This letter is not an investment advice, but only a sharing of my personal point of view.

News

Bitcoin ETFs have fastest institutional adoption in ETF history, says Bitwise CIO. Matt Hougan, CIO of Bitwise, which manages the BITB ETF, said on social network X that «investment advisors are adopting Bitcoin ETFs faster than any other new ETF in history».

-

Switzerland: one of the country's largest banks now allows customers to invest in Bitcoin (BTC) and Ethereum (ETH). Zürcher Kantonalbank (ZKB), Switzerland's 4th largest bank, has been interested in the blockchain industry for several years. So much so, in fact, that it has now embraced cryptocurrencies: its customers can now buy Bitcoin (BTC) and Ether (ETH) through the bank.

-

«Serious slippage in public finances - Bruno Le Maire warns of France's financial situation. France was already in a very bad position in terms of public deficit, and this could worsen by 2025. This is the message sent by resigning Finance Minister Bruno Le Maire, warning the future government. What's the situation?

-

18 % of French people hold cryptocurrencies and 30 % have owned them, according to a study by Gemini. According to a recent study by exchange platform Gemini, 18 % of French people now hold cryptocurrencies, while 30 % have owned them in the past. These figures show a growing adoption of digital assets in France, despite market fluctuations and debates over their regulation.

-

1,460 billion: the volume of stablecoins on Ethereum (ETH) explodes. The year of stablecoins? The volume of «stable» cryptocurrencies, based on other assets, is rising steadily. It has doubled since 2023, particularly on Ethereum (ETH). Zoom in on the reasons for this breakthrough.

-

The giant PayPal is now integrating Ethereum Name Service (ENS) addresses. Payment giant PayPal has just integrated the ability for its US customers to send cryptos through the Ethereum Name Service (ENS) system. What does this mean?

Fundamental Analysis

Source : https://www.coingecko.com/fr

Letter N°41: FED interest rates cut by 0.5 %; 2025, the year of euphoria?

The Bitcoin price at the time of writing is 65,511 $ (on 27/09/24).

2025, the year of euphoria?

Below, you can see a graph comparing Bitcoin's performance after each Halving. The curve in black represents this cycle. We can see that we're halfway through in terms of duration and only at the beginning in terms of performance. However, we think it unlikely that we will exceed the green curve, which represents the previous cycle. The maximum performance of the green curve, measured since the start of Halving, has reached +690 %. For this cycle, we anticipate a more modest performance, probably between 100 % and 300 %.

Historically, peaks in previous cycles have occurred later in the cycle. Comparing trends, this suggests potential peaks between April and November 2025. We believe that 2025 will be the year of a euphoric bull market. Several elements support this outlook: interest rates that have peaked, inflation that has slowed, a marked market consolidation of over six months, and growing institutional interest in crypto, facilitated by products like ETFs.

Source: Glassnode

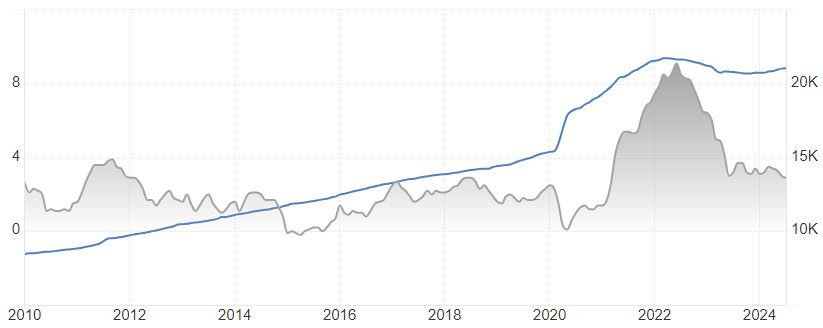

Bitcoin: Pi cycle peak indicator

The indicator Pi Cycle Top has historically proved effective in identifying the timing of market cycle peaks with an accuracy of up to three days. It is based on the 111-day moving average (111DMA) and a further multiplication of the 350-day moving average (350DMA x 2).

Over the last three market cycles, we can see that when the 111DMA (yellow) rises and crosses the 350DMA x 2 (green), this coincides with a peak in the Bitcoin price.

It's also interesting to note that 350 / 111 gives 3.153, which is very close to Pi = 3.142. This is, in fact, the closest division to Pi using whole numbers. That's why this indicator is called that.

This again illustrates the cyclical nature of Bitcoin's price movement over long periods, while showing notable accuracy during its adoption phase.

With the consolidation Bitcoin has experienced since March, the 111DMA has fallen slightly. This implies that, for this moving average to cross the 350DMA, the Bitcoin price will need to reach around 100,000 $ at the very least.

Source: Bitcoin magazine pro

FED interest rates cut by 0.5 %

The FED's current and future interest rate cuts are good for risky assets, such as crypto and equities. The US is finding it hard to keep these rates high any longer, at the risk of triggering a severe recession and a sharp rise in unemployment, which is already underway. It's crucial to understand that the FED's interest rates play a central role, as they influence all prices and asset classes, as well as the main unit of measurement: the dollar.

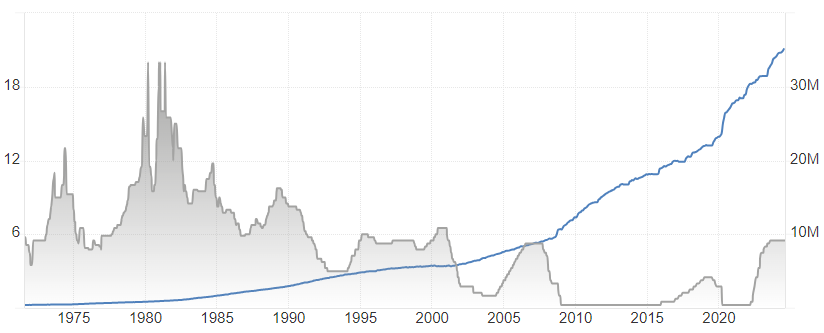

Below is a curve illustrating the history of FED interest rates in the United States since 1970. It shows Paul Volcker's great maneuver in the 1980s, when he fought inflation by raising rates to 20 %! However, the situation is very different today: back then, US debt was much lower. Now, it's a mountain of uncontrollable debt. Over the decades, the Fed has been able to keep interest rates lower and lower, and for shorter and shorter periods. The reason for this is simple: with a growing debt, it is becoming increasingly difficult to raise rates without causing the interest on this debt to explode. Interest is now the United States' second-largest budget item, along with the military.

In blue, total US debt in thousands of billions of dollars.

Source : https://tradingeconomics.com/united-states/interest-rate

Inflation in the United States has eased. Although it has not yet returned to the 2 % target, it is getting closer. The striking correlation between rising inflation and money supply expansion in 2020, during the COVID-19 crisis, is obvious. The relationship between money creation and inflation is obvious.

In blue, M2 money supply in the United States in billions of dollars.

Source : https://tradingeconomics.com/united-states/inflation-cpi

Our service

We offer a portfolio management service specializing in digital assets. We provide complete human support from A to Z in this universe. Our aim is to personalize your portfolio allocation according to your risk profile and situation.

With our turnkey management, you can take advantage of the sector's evolution without worrying about: the choice of digital assets, in-depth research, volatility, arbitrages and so on. Simply consult your monthly reports and invest regularly over the long term (4 years or more).

We don't engage in algorithmic trading on a daily basis. We only favor long-term investments in projects we know and understand. Our monthly portfolio arbitrages are accompanied by in-depth asset analysis, with a particular focus on tokenomics.

Discover our website: https://crypto-assets-management.com/

If you have any questions, or would like to find out more about our services, please do not hesitate to contact us: tristan.g@crypto-assets-management.com. You can also schedule a phone call lasting a few minutes by following these steps this link.

Discovery Pack

Investment of less than €20,000

- Entry fee: 1.5 %

- Management fee: 2.5 % / year

- Performance fees: 20 % excl. tax on capital gains (High Water Mark method)

- Exit fee: 3 %

- Minimum subscription: €5,000

- Commitment period : None

Premium Pack

Investment over €20,000

- Entry fee: 1.5 %

- Management fee: 2.5 % / year

- Performance fees: 20 % of performance above the benchmark index*.

- Exit fee: 1.5 if withdrawn before 3 years

- Minimum subscription: €20,000

- Commitment period : None

We are registered registered with the AMF for the business of buying/selling digital assets for legal tender and exchanging digital assets for other digital assets under number : E2023-084.

- Warning -

This is not investment advice. No one can predict the future.

You alone are responsible for your investment decisions.

We are not liable for any loss resulting from a decision taken on the basis of information provided by a third party.ions in this letter.